With {hardware} gross sales slowing, Apple shifted to increasing its digital providers choices to generate billions every quarter. One service stands out because the clear chief.

Apple has been aggressively increasing its Companies phase, together with Apple Music, Apple TV+, AppleCare, and the App Retailer, to create a gradual income stream that balances {hardware} gross sales. Whereas all providers should not equally standard, paid iCloud storage is essentially the most extensively adopted regardless of its low price in comparison with different providers.

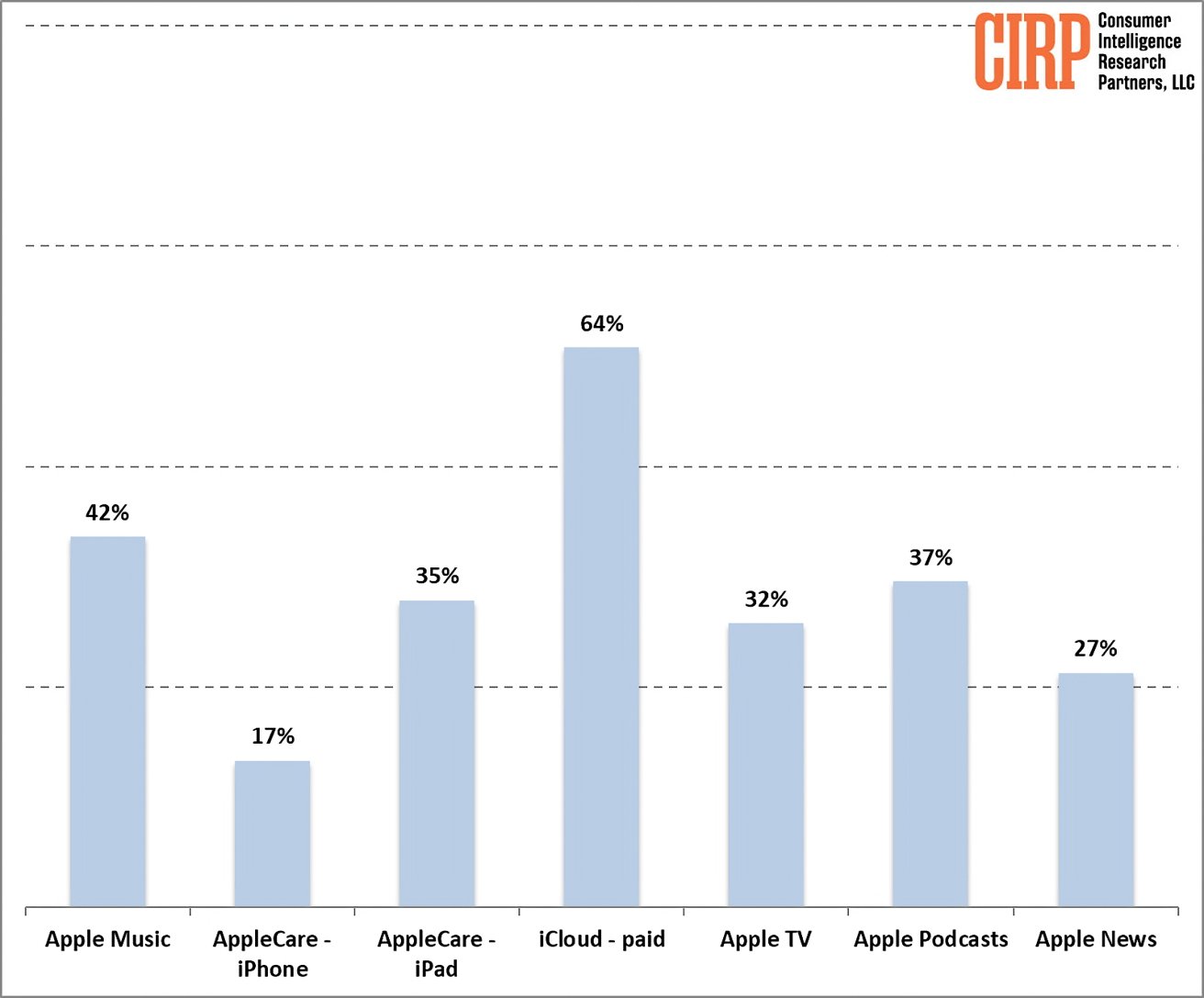

Almost two-thirds of US Apple prospects subscribe to paid iCloud storage, in accordance to new information from Client Intelligence Analysis Companions (CIRP). The seamless integration throughout Apple gadgets and the paltry 5GB free storage restrict encourage customers to improve to paid tiers as soon as they exceed it.

The deep integration of iCloud storage into Apple’s ecosystem and its lack of direct competitors make it the default selection for many Apple customers. As a person’s digital footprint grows, system prompts encourage customers to improve their storage, making certain a easy transition from free to paid tiers.

Though competing cloud storage providers like Microsoft’s OneDrive, Google Drive, and Dropbox exist, they lack the power to seamlessly combine into macOS or iOS. Consequently, customers are required to manually add their information, which can end in particular information sorts, comparable to Apple Notes, eBooks, and well being information, getting left behind.

The competitors: streaming providers & AppleCare

Apple’s streaming providers face more durable competitors. Apple Music competes with Spotify, whereas Apple TV+ faces Netflix. Nonetheless, Apple Music and Apple TV+ have important market shares, with 42% and 32% of Apple prospects subscribing, respectively.

The corporate’s different media providers, like Podcasts and Information, have a considerable person base, however these numbers might embrace free customers. The fierce competitors, with many options, makes it tougher for Apple to dominate these areas, in contrast to with iCloud storage.

AppleCare, the corporate’s prolonged guarantee service, has decrease adoption charges than its digital providers. Because of competitors from carriers and retailers, solely 17% of iPhone consumers go for AppleCare. Not like iCloud storage, AppleCare faces direct competitors in a market with a number of choices on the level of sale.

Apple faces the twin problem of sustaining present service development and innovating new choices to seize buyer curiosity. Paid iCloud storage’s success demonstrates how tightly built-in providers drive person adoption and regular income.

Nonetheless, replicating this success throughout providers requires navigating a extra advanced aggressive panorama. Apple’s ecosystem leverage is essential for sustaining the expansion of the providers phase.