Editor’s take: What would occur if Ubisoft had been truly acquired, as present rumors counsel? Hypothesis is {that a} new proprietor would redirect it to supply fewer, however extra commercially viable video games and scrap a few of its area of interest initiatives in favor of established franchises. There is no such thing as a method to know for certain, however the market actually favors the prospect of a buyout.

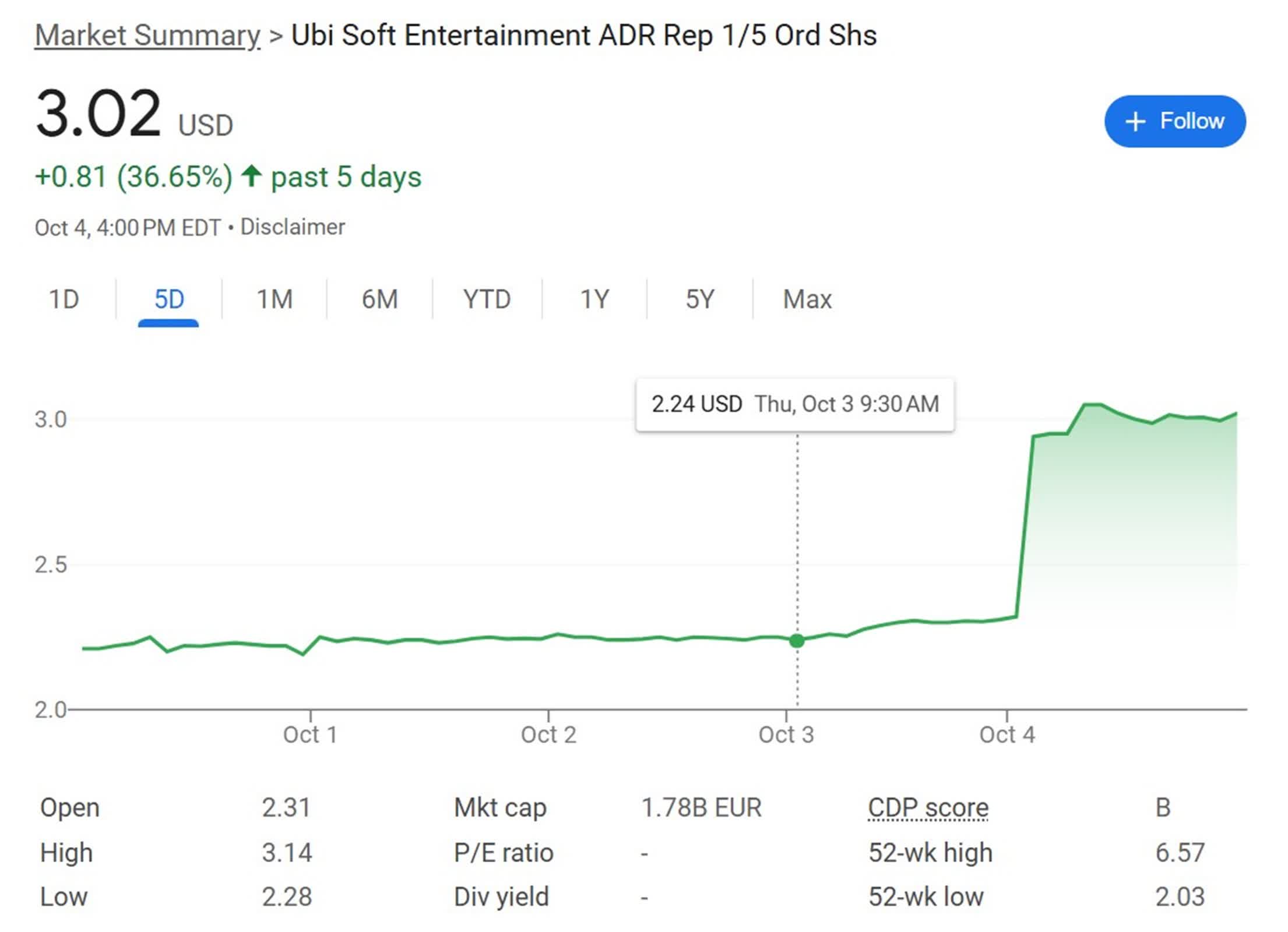

Final week Bloomberg reported that, in line with individuals accustomed to the matter, Tencent Holdings and the Guillemot household are exploring choices for Ubisoft, together with a possible buyout. The events doubtless weren’t pleased with the leak, but it surely in the end offered a much-needed increase for the French online game developer, which has misplaced over half its market worth this 12 months. Following the story, Ubisoft’s shares surged by 33 p.c in Paris, marking the steepest achieve for the reason that firm’s preliminary public providing in 1996.

Ubisoft, identified for its Murderer’s Creed franchise, has seen its shares fall by about 40 p.c this 12 months, reaching their lowest level in over a decade final month. The corporate’s market capitalization now stands at roughly €1.8 billion ($2 billion).

Tencent and the Guillemot Brothers have been consulting with advisers to seek out methods to stabilize Ubisoft and improve its worth. One chance into account is taking the corporate non-public.

Presently, Tencent owns 9.2 p.c of Ubisoft’s internet voting rights, whereas the Guillemot household holds about 20.5 p.c. Some minority shareholders, together with AJ Investments, have been pushing for both privatization or a sale to a strategic investor.

The discussions are nonetheless in early levels, and there isn’t any assure they are going to end in a transaction. Each Tencent and the Guillemot household are additionally contemplating different alternate options, Bloomberg stated.

Ubisoft has been struggling for a couple of years after dealing with intense improvement pressures through the pandemic. This led to setbacks in launching new titles and the cancellation of some initiatives in improvement.

In 2022, there was vital merger and acquisition exercise within the gaming sector, with stories that main non-public fairness corporations had been evaluating potential provides for Ubisoft. Subsequently, the corporate’s founding household entered right into a partnership settlement with Tencent, which acquired a 49.9 p.c stake in Guillemot Brothers, along with its direct stake in Ubisoft. This transfer was seen as a method to maintain potential consumers at bay whereas permitting the Guillemot household to keep up management of Ubisoft’s governance.

Ubisoft had been relying on Star Wars Outlaws to be an enormous hit, however the sport did not stay as much as these expectations. The corporate then determined to delay the discharge of the following Murderer’s Creed entry, Shadows, for additional refinement. It admitted this was a results of “the learnings from the Star Wars Outlaws launch.” It additionally confirmed that the Star Wars journey had a “softer than anticipated launch,” promoting just one million copies within the month since launch.

The corporate minimize its steering for the monetary 12 months, anticipating bookings to fall to round €1.95 billion ($2.1 billion). It additionally expects internet reserving for the fiscal second quarter to be right down to €350 million to 370 million ($387 million to $410 million) from its earlier forecast of €500 million euros ($554 million).