Common readers of this weblog received’t want reminding that the UK is in a stagnant bind, with financial measures like productiveness and GDP per particular person flatlining because the international monetary disaster (or earlier). The implications are felt effectively past these arid financial aggregates; wage progress has slowed down, successive governments discover it onerous to fund acceptable public companies, and there’s a palpable bitter sense of malaise in our politics.

One attention-grabbing response to this has been the emergence of a unfastened constellation of commentators, activists and stress teams, a techno-optimist motion calling for extra homes to be constructed, for the obstacles apparently stopping the nation constructing infrastructure to be swept away, for cheaper and extra ample vitality.

Britain Remade needs to “reform the planning course of to ship extra clear vitality initiatives, transport infrastructure, and new good high quality housing at velocity”, whereas the yimby Alliance , as eager subscribers to the “Housing idea of every little thing”, give attention to the necessity to construct extra homes. A really broadly talked about paper, Foundations: Why Britain has stagnated focuses on housing, infrastructure, and the price of vitality. Rian Chad Whitton likewise focuses on excessive vitality costs, connecting this with the decline of the UK’s manufacturing base.UKDayOne give attention to science, innovation and know-how because the motor for UK progress and prosperity, notably emphasising AI and nuclear energy.

I’m going to observe Tom Ough and Calum Drysdale in gathering these strands collectively underneath the banner “Anglofuturism”. Their eponymous, and attention-grabbing, podcast embraces a cheerful and optimistic model of this imaginative and prescient, with its whimsical AI generated illustrations of flying pubs and thatched area stations.

However I imagine the time period (in its present manifestation, a minimum of) was coined by the journalist Aris Roussinos, in slightly darker hues. This was a name for rebuilt state capability in a definitively post-liberal world, a imaginative and prescient that owed much less to Adam Smith, and extra to Thomas Hobbes, which some readers may suppose extra applicable to deteriorating geopolitical state of affairs we face.

I don’t suppose there may be a wholly constant underlying political ideology right here, however I feel it’s honest to say that there’s a typical centre of gravity on the centre proper. This isn’t the place to analyse political antecedents or implications, and I’m not the appropriate particular person to try this, however I do wish to make some remarks about this rising motion.

There’s a lot on this agenda that I applaud and agree with. The UK must get again to productiveness progress, and there’s no elementary purpose why that shouldn’t occur. We haven’t reached some closing technological barrier – removed from it. And I feel there’s a profoundly humanistic perspective at work right here – folks ought to have the ability to benefit from the fruits of prosperity.

In fact, there may be an opposing argument that believes that continued financial progress is inconsistent with planetary limits. It’s clear that we have to transfer to a brand new mannequin of financial progress that doesn’t impose externalities on the worldwide atmosphere, and specifically we have to shift our vitality financial system to at least one that doesn’t rely upon fossil fuels. However to embrace “degrowth” is for my part each politically infeasible and, if adequate will and sources are utilized, technologically pointless. To place it one other means, the final 15 years within the UK have been an experiment in degrowth, and the outcomes have been ugly.

There’s an undercurrent of generational justice right here too. The notion that younger folks within the UK can’t look ahead to the identical life-style as their mother and father is profoundly miserable. Nowhere is that this extra apparent than within the unaffordability of housing.

The place I feel these analyses are much less convincing is in figuring out the origins of our present issues. Particularly, I feel a proof of our present productiveness stagnation must account for its timing. It’s definitely convincing to argue, as these authors do, that we’d be higher off if the UK had constructed extra infrastructure over the previous couple of many years, however I don’t suppose they actually persuade in speaking about what situations would have produced that end result. Anglofuturism, in all its varieties, might be accused of prepared worthy ends, with out actually specifying the means.

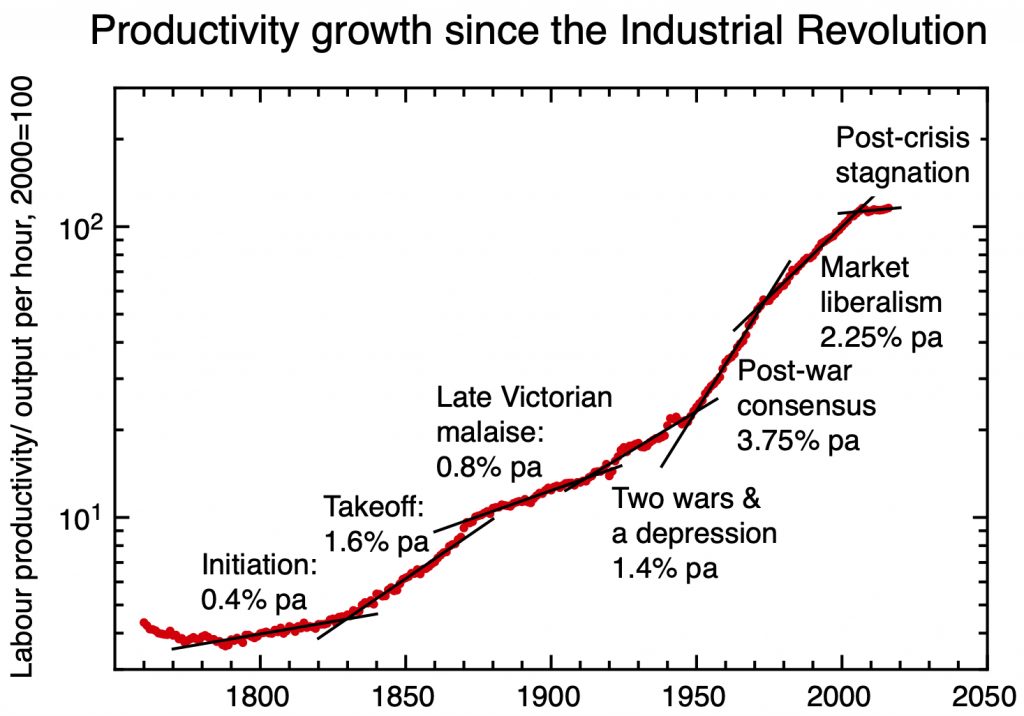

Labour productiveness within the UK because the Industrial Revolution. Information from the Financial institution of England A millennium of macroeconomic knowledge dataset, plot & matches by the writer.

The Foundations paper places loads of blame on the 1947 City and Nation Planning Act – and the broader Attlee settlement. However I don’t suppose this is sensible when it comes to the timing. As my determine exhibits, the interval of quickest productiveness progress in your complete historical past of the UK occurred between 1948 and 1972. The truth is, Roussinos harks again to this era, referring to “the optimism and excessive modernism of the post-war period, a vanished world of frenetic housebuilding and technological innovation the place British scientific analysis could lead on the world, and produce larger residing requirements via its fusion with well-paid, high-skilled labour.”

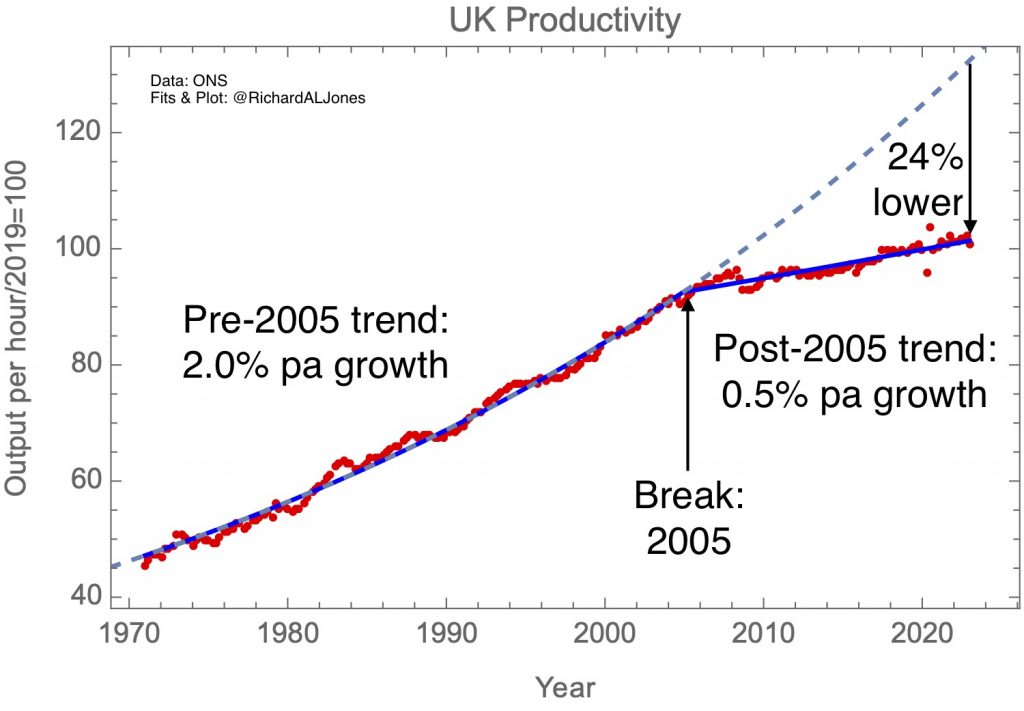

Labour productiveness within the UK since 1970. ONS knowledge, match by the writer. For the rationale for placing the break round 2005, see When did the UK’s productiveness slowdown start?

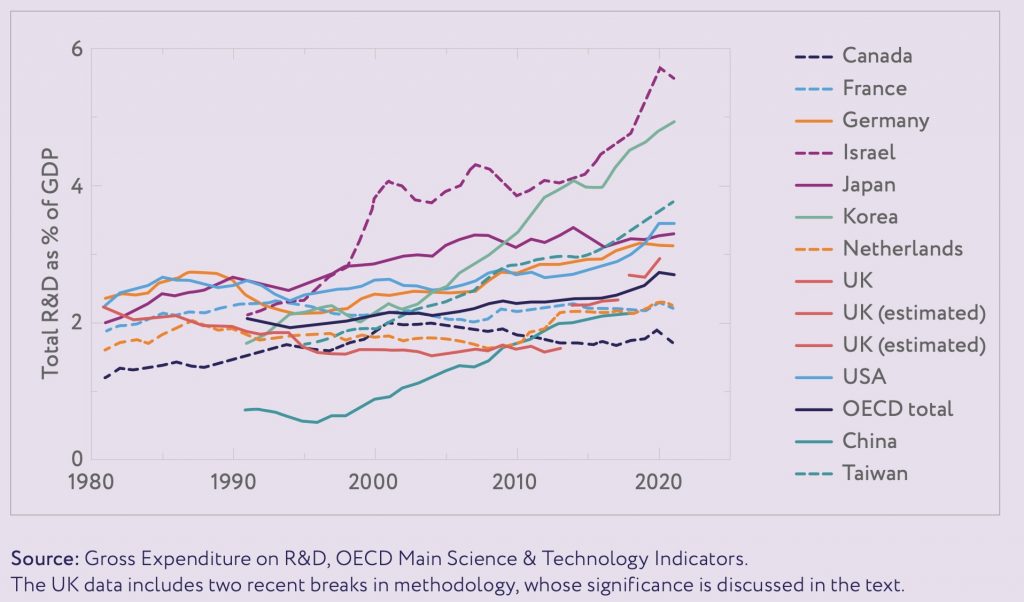

What must be defined is that the present slowdown started within the mid-2000s. There’s some overlap with a growing consensus view from mainstream economics that the speedy drawback has been a scarcity of funding within the UK financial system (see e.g. The Productiveness Agenda). This consists of public funding in onerous infrastructure, personal funding in capital items, and funding in intangibles like R&D. In my very own work I’ve emphasised the numerous discount within the R&D depth of the UK financial system between 1980 and 2005, and given the commonly technocentric flavour of the Anglofuturists, I’m stunned that this facet isn’t extra distinguished of their arguments.

From Analysis, innovation and the R&D panorama, by R.A.L. Jones, in The Productiveness Agenda.

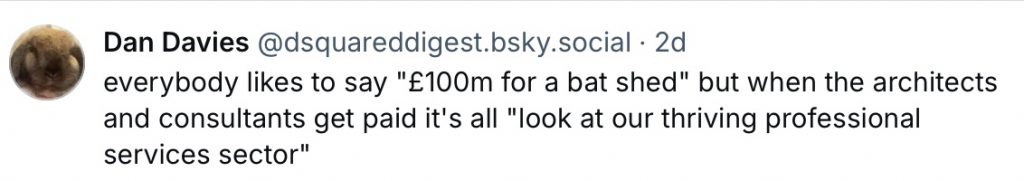

Even when one agrees that funding ranges have been too low, there isn’t actually a consensus in regards to the final reason for the dearth of funding. One frequent thread is a way that constructing infrastructure within the UK has turn into too costly due to extreme regulation. In a single sense, this can be a reflection of the truth that the comparative benefit of the UK is to be present in skilled companies. One can have fun that undeniable fact that the UK has turn into a “companies superpower”, however the draw back was caustically expressed on this remark from Dan Davies

Giles Wilkes has mentioned what he phrases the “crud financial system” at a bit extra size. Financial actors reply to incentives, and this doesn’t all the time direct exercise in direction of the place we want it. As Giles places it: “We’d like vastly extra clear vitality, precise onerous defence tools for dealing with nasty rogue nations, the troopers to make use of it, and rather more quite a few and productive care and well being staff for the ageing inhabitants. Mitigating the damaging results of local weather change goes to take actual bodily capital and energy. These are precise onerous issues – and with the ability to produce extra streaming movies, clever AI-related chat, or good authorized ‘options’ to monetary market issues will not be exchangeable for the property we want for the true issues. Simply because the lawyer’s charge is expressed in {dollars}, and so is the price of reworking the US electrical energy system, doesn’t imply the 2 can get traded collectively.”

One factor all branches of Anglofuturism agree on is the necessity for ample, low cost vitality, and on the dangerous financial results that present excessive industrial vitality costs are inflicting. This clearly causes robust emotions, to guage by the violent on-line response to Tom Forth’s completely affordable, from a classical market liberal perspective, feedback about this, arguing that, whereas this case was not good, it was “a smaller drawback and of a decrease precedence than many different restrictions on progress in Britain.”

I agree that it could be higher if vitality costs within the UK had been decrease, however I feel you will need to perceive how this case has arisen. Excessive industrial vitality costs now are inflicting severe issues for what trade stays within the UK, however I don’t suppose they are often blamed for the UK’s better diploma of deindustrialisation that its neighbours. This occurred at a time when vitality costs had been low and falling.

The choice the UK authorities made within the Nineteen Eighties was that vitality was simply one other commodity whose provide might be left to the market. Because it occurred, this coincided with a second in time when the UK switched from being a internet importer of vitality, to being a internet exporter, having discovered ample provides of pure gasoline and oil within the North Sea. North Sea oil and gasoline manufacturing peaked round 2000, and the nation switched to being an vitality importer once more in 2004. The UK’s relative success in decarbonising its electrical energy provide initially relied on an early change from coal to gasoline; even after the newer enlargement of offshore wind the value of electrical energy is ready by the internationally traded worth of gasoline. This was fantastic till it wasn’t – in the 2022 gasoline worth spike.

If our drawback is that we depend on imported gasoline, whose fluctuating worth is past our management, along with offshore wind, which is essentially intermittent (in addition to being generated a great distance from the place it’s wanted, related by an insufficient grid), would it not not be higher if a a lot larger proportion of our vitality was generated by nuclear fission?

An enthusiasm for nuclear energy is a typical thread working via all strands of Anglofuturism, and it’s one with which I’ve a lot sympathy. For all of the progress there’s been in renewable vitality, in 2022, 77.8% of our vitality nonetheless got here from oil, gasoline and coal, and I feel it’s going to be tough to have a fossil-fuel free vitality financial system which doesn’t rely upon some nuclear energy to supply agency vitality . I deeply remorse the failure of the nuclear new construct programme of current governments – of the 18 GW of recent producing capability deliberate in 2014, solely 3.2 GW is even underneath building.

However I feel it is crucial, and salutary, to grasp why this failure has occurred. My current weblog posts go into the story of the UK’s civil nuclear energy programme in some element . There are methods wherein the regulatory and planning framework for civil nuclear might be streamlined, however the elementary drawback with Hinkley C wasn’t the fish disco. It was the truth that the UK authorities needed the Chinese language state to pay for it, and the French state to construct it, because the UK state not had the desire or capability to do both.

The UK’s personal civil nuclear trade was killed within the Nineties; in an atmosphere of excessive rates of interest and low pure gasoline costs, and an ideological dedication to depart vitality provide to the market, there was no place for it. I do suppose the UK ought to recreate its capability to construct nuclear energy stations, together with the small modular reactors which might be at the moment attracting a lot consideration, however I don’t suppose this can occur with out substantial state intervention.

I agree with the Anglofuturists that we shouldn’t resign ourselves to our present financial failures. I feel we have to ask ourselves what has gone flawed with the number of capitalism that now we have, that has led us to this stagnation. It’s an issue that’s not distinctive to the UK, however which appears to have affected the UK extra significantly than most different developed nations. The slowdown appears to have begun within the 2000s, crystallising in full on the World Monetary Disaster.

This timing factors to modifications within the nature of capitalism and political financial system that took maintain within the many years after 1980, with the ascendancy of

market liberalism, the doctrine of shareholder worth in company administration, and an enthusiasm for outsourcing authorities features to non-public contractors, irrespective of how central to the core functions of the state they could seem like. Within the UK, even the Atom Weapons Institution has been run by personal contractors since 1989, with the federal government solely taking possession and management again from SERCO in 2020.

We’ve a brand new type of globalisation that adopted from abolishing capital controls, along with a conviction that one doesn’t want to fret in regards to the steadiness of funds, although the persistent commerce deficits the UK has run since then has meant possession and management of nationwide property has moved abroad. We’ve a monetary system that appears unable to direct sources to these actions that result in long-term progress. We’ve a hollowed out state, that now lacks the capability even to be an knowledgeable and efficient contractor for companies.

I agree with the Anglofuturists that our present stagnation isn’t inevitable, and I applaud their lack of defeatism. It doesn’t must be this fashion – however to get past our present malaise, I feel we have to ask some deeper questions on how our financial system is run.