The necessity for automation within the insurance coverage trade is extra urgent than ever. In line with a latest research by Datos Insights, the insurance coverage trade lags when it comes to digitisation, with solely 20% automation in underwriting and fewer than 3% automation in claims processing throughout sectors. This hole represents a major alternative for enchancment and value financial savings.

Insurance coverage trade has two major processes: underwriting and claims, each of which have excessive handbook dependency. This leads to elevated turnaround occasions and unsightly buyer experiences. Not simply that, it is also a number one trigger for claims leakage.

Probably the most promising options to those challenges is Straight By way of Processing (STP). However what precisely is STP within the insurance coverage context, and why is it turning into more and more essential?

STP refers back to the automation of end-to-end processing of transactions or processes with out handbook intervention. Within the insurance coverage trade, this interprets to automating varied processes corresponding to monetary credibility evaluation, KYC/Id verification, underwriting, and claims processing.

On this weblog publish, we’ll dive deep into the world of Straight By way of Processing in Insurance coverage. We’ll discover what STP means within the context of the Insurance coverage sector, the ache factors inside the trade and the advantages of STP. We can even perceive how we will leverage AI-based Clever Doc Processing (IDPs) instruments to automate STP and cut back human dependency on this sector. So, let’s get began.

What’s Straight By way of Processing in Insurance coverage?

Straight By way of Processing in insurance coverage refers back to the end-to-end automation of insurance coverage processes, from preliminary buyer interplay to ultimate decision, with out the necessity for handbook intervention. This automation could be utilized to varied elements of the insurance coverage worth chain, together with coverage purposes, underwriting, and claims processing.

Let’s discover some particular use instances the place STP could make a major affect:

1. Claims Processing

Claims processing is probably essentially the most seen and impactful space the place STP could be applied. Conventional claims processing entails a number of handbook steps, from declare submission (First-notice-of-loss or FNOL in sure sectors like automobile insurance coverage and so forth.) to evaluation, verification, and settlement. With STP, this course of could be considerably streamlined.

For instance, think about a medical health insurance declare. A policyholder will get a minor process carried out over the course of a day whereas being hospitalized. As a substitute of calling an agent or filling out prolonged types, they may:

- Use a cell app to take photographs of the hospital admission paperwork and the payments

- Submit these photographs alongside by means of a cell software

- Have an AI system extract related particulars together with authenticity verification

- Get quick approval and payout if it falls inside sure predefined parameters

This complete course of might occur in minutes, with minimal human intervention from the insurer’s finish.

2. Underwriting for Insurance coverage

Underwriting is a posh course of that historically requires important human experience. It assesses the monetary credibility of a person making use of for an insurance coverage coverage to assist resolve whether or not that particular person ought to be insured. It entails a number of sub-processes, which we are going to cowl within the following sections. Nevertheless, with STP and AI, a lot of this course of could be automated:

- The system collects all related information concerning the applicant (from the appliance kind, uploaded ID and monetary paperwork, and exterior databases)

- AI algorithms analyse this information to evaluate the chance

- For easy instances that fall inside predefined parameters, the system could make an computerized determination on whether or not the coverage ought to be issued or denied

- For extra complicated instances, the system can flag them for human evaluate, offering an in depth danger evaluation to assist the underwriter’s determination

a. KYC/Id Verification

Know Your Buyer (KYC) and identification verification are vital sub-processes in insurance coverage underwriting, particularly for fraud prevention. It’s particularly important with new-age insurers who’ve automated buyer onboarding. STP could make these processes extra environment friendly and correct:

- The shopper uploads their ID doc (driver’s license, passport, and so forth.)

- An AI system verifies the authenticity of the doc

- The system extracts related info from the doc

- This info is cross-checked towards different databases for verification

- If all checks move, the client is mechanically verified

b. Processing tax types and financial institution statements for evaluation

Insurance coverage corporations take care of a mess of tax types, each for their very own operations and on behalf of their purchasers and as a sub-process in underwriting. STP can considerably simplify this course of:

- Tax types are scanned or uploaded (relying upon geographic location, for instance, Earnings Tax Returns for India and 1099 and W2 types for the US amongst others)

- An AI system extracts related information from these types

- The extracted information is mechanically populated into the corporate’s tax software program

- The system checks for any discrepancies or pink flags

- If all the pieces checks out, the types are processed and filed mechanically

Ache Factors Addressed by STP

The insurance coverage trade faces quite a few challenges that hinder its effectivity and buyer satisfaction. These ache factors span throughout varied elements of insurance coverage operations, from buyer expertise and fraud prevention to operational effectivity and regulatory compliance. Because the trade evolves within the digital age, addressing these challenges has change into more and more pressing. Let us take a look at among the most urgent points troubling the insurance coverage sector in the present day:

- Sluggish Processing Occasions and Inconsistent Buyer Expertise:

Conventional handbook processes within the insurance coverage sector can take days and even weeks for attaining easy duties. This results in inconsistencies in how prospects are handled for related points. In line with this report by Accenture, US$ 170 Bn. in international premiums is susceptible to churning by 2027, largely as a consequence of poor buyer expertise.

- Fraudulent Claims:

In line with this report by McKinsey, about 5-10% of claims within the property and casualty insurance coverage sector within the Americas and Europe are fraudulent. By simplifying this course of with the assistance of AI, there’s a potential for discount in fraudulent claims.

- Human Error and Scalability Challenges:

Guide information entry inside any insurance coverage course of, be it underwriting or claims, is vulnerable to errors. A easy mistake in assessing the monetary credibility of a person can result in coverage rejections or exponential payouts hurting the insurance coverage businesses. When a course of is handbook, it turns into more and more troublesome to scale it with out scaling the error price.

- Excessive Operational Prices:

Furthermore, scaling handbook processes can result in excessive payroll prices inside insurers. Since most of those organizations are large-scale enterprises, processing a whole lot of hundreds of paperwork per day, a handbook workforce supporting essential processes will not be optimum.

- Compliance Dangers:

Insurance coverage trade is very regulated with a number of compliances to stick to. Not simply that, that is an trade that’s consistently evolving with coverage adjustments each few months. Guide processes improve the chance of non-compliance with rules dramatically. This could trigger points with audit and credibility certifications.

Advantages of Automation and Affect on STP

In line with a McKinsey International Institute report, there’s a 43% potential for automation within the insurance coverage and finance sectors. As of 2023, this report by Statista says that 14% of insurance coverage companies surveyed had been starting the method of automation of their claims and processing division. However why? Just because, there may be immense financial savings of sources, an exponential improve in STP of easier instances and a dramatic improve in effectivity to be realized by leveraging modern-day instruments.

1. Elevated Effectivity

Automation in insurance coverage reduces handbook workflows, dashing up processes corresponding to claims dealing with and underwriting. For instance, automated claims processing can cut back the common cycle time from days to minutes. By eliminating repetitive duties, staff can deal with higher-value actions, enhancing general productiveness.

2. Price Discount

Automation slashes operational prices by minimising the necessity for handbook intervention and paper-based processes. McKinsey estimates that 30-40% of conventional insurance coverage processes could be automated, resulting in potential value financial savings of 20-30% in administrative bills. This additionally reduces the associated fee per declare, contributing on to the corporate’s backside line.

3. Enhanced Buyer Expertise

Automated programs allow insurers to supply sooner and extra correct companies, corresponding to on the spot coverage issuance and fast claims approval, which improves buyer satisfaction. In line with a PwC research, 41% of insurance coverage prospects would change suppliers as a consequence of poor digital experiences, whereas automation can improve responsiveness and cut back grievance charges. Actual-time updates and seamless interactions drive larger retention and model loyalty.

4. Fraud Detection

Automation aids in figuring out and flagging suspicious patterns by means of information analytics and real-time monitoring. Fraud detection programs can cut back fraud-related losses by as much as 40%. Insurers utilizing automated fraud detection report an enchancment in accuracy and velocity, as they’ll course of huge quantities of information far past human capability.

The affect of those advantages on STP is important. As extra processes change into automated, the proportion of transactions that may be processed straight by means of will increase. This creates a virtuous cycle: extra automation results in extra information, which ends up in higher AI fashions, which in flip permits much more automation.

Implementing Straight By way of Processing in Insurance coverage

We have now mentioned the optimistic affect that STP can have on the insurance coverage trade, however the query stays implement it? There are two common strategies Insurance coverage corporations go about this:

- Utilizing AI-based Clever Doc Processing (IDP) platforms

- Utilizing Conversational Course of Automation (CPA) platforms

Technique 1: Workflow automation utilizing AI-based IDPs

Workflow automation utilizing AI-based Clever Doc Processing (IDP) is a cornerstone of STP in insurance coverage. This technique leverages synthetic intelligence to mechanically extract, classify, and course of info from varied doc varieties, corresponding to declare types, coverage purposes, and supporting paperwork.

AI-based IDPs can deal with each structured and unstructured information, considerably decreasing handbook information entry and related errors. By automating document-heavy processes, insurers can dramatically velocity up processing occasions, enhance accuracy, and improve general operational effectivity.

This know-how permits insurers to course of the next quantity of transactions with fewer sources, resulting in value financial savings and improved scalability. Furthermore, AI-based IDPs constantly be taught and enhance over time, adapting to new doc codecs and turning into extra correct with every processed doc.

Technique 2: Conversational Course of Automation

Conversational Course of Automation (CPA) in insurance coverage STP focuses on utilizing AI-powered chatbots and digital assistants to information prospects by means of varied processes, with a selected emphasis on claims processing and triaging.

This technique combines pure language processing with robotic course of automation to create an intuitive, conversational interface for patrons. In claims processing, CPA can information claimants by means of the complete course of, from preliminary notification to ultimate settlement, asking related questions and offering real-time updates. For claims triaging, the system can mechanically categorise and prioritise claims primarily based on the data supplied, routing easy claims for quick processing whereas escalating complicated ones to human adjusters.

This method not solely hastens the claims course of but additionally improves buyer satisfaction by offering 24/7 service and on the spot responses. Moreover, CPA can deal with coverage inquiries, quote requests, and easy coverage changes, additional streamlining insurance coverage operations and enabling true STP throughout a number of touch-points.

AI-based IDPs for STP in Insurance coverage

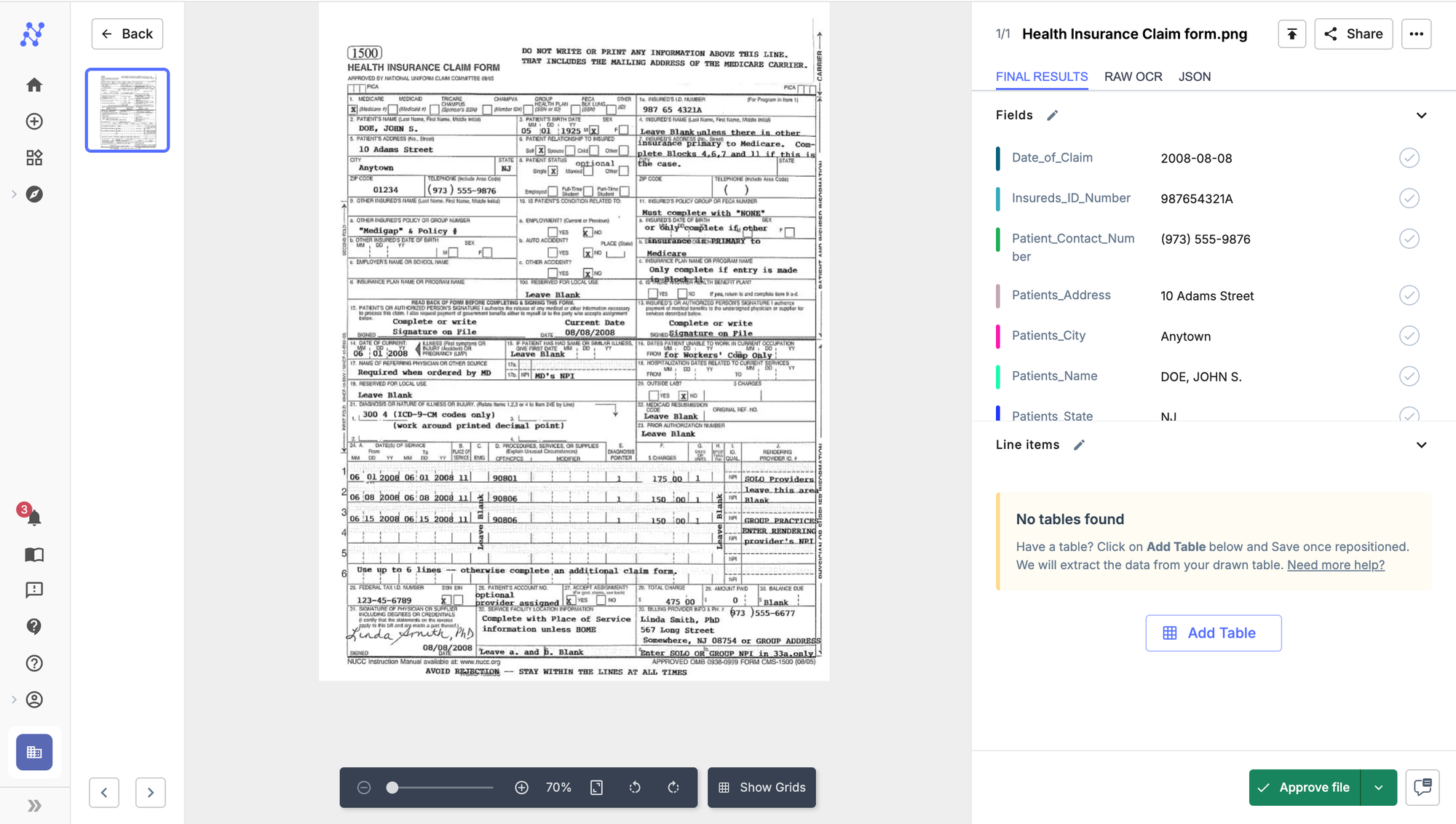

On this part, we are going to take a deeper have a look at how precisely one can implement STP for insurance coverage processes of their group by taking a particular instance. We’ll see course of a medical health insurance kind utilizing Nanonets.

So, let’s get began.

Step 1: Go to the Nanonets platform (app.nanonets.com)

Step 2: Click on on “Workflows” on the left panel > “Zero-training extractor”

✅

Zero-training extractor: Utilizing the zero-training extractor, you’ll be able to deploy an OCR mannequin for any doc, be it a Affected person ID card, Hospital invoice, declare kind, monetary statements or every other doc that’s essential to the method you need to automate.

Step 3: Now, all it is advisable to do is enter the label names. For example, on this well being kind we now have taken:

- Affected person’s identify

- Affected person’s deal with

- Affected person’s metropolis

- Affected person’s state

- Affected person’s zip code

- Insured’s ID quantity

- Date of declare

- Insurance coverage kind

In case of any tabular fields, you’ll be able to flip over to the “desk headers” part from the highest.

Step 4: That’s it. Click on on “Proceed” and add your file to manually check it out.

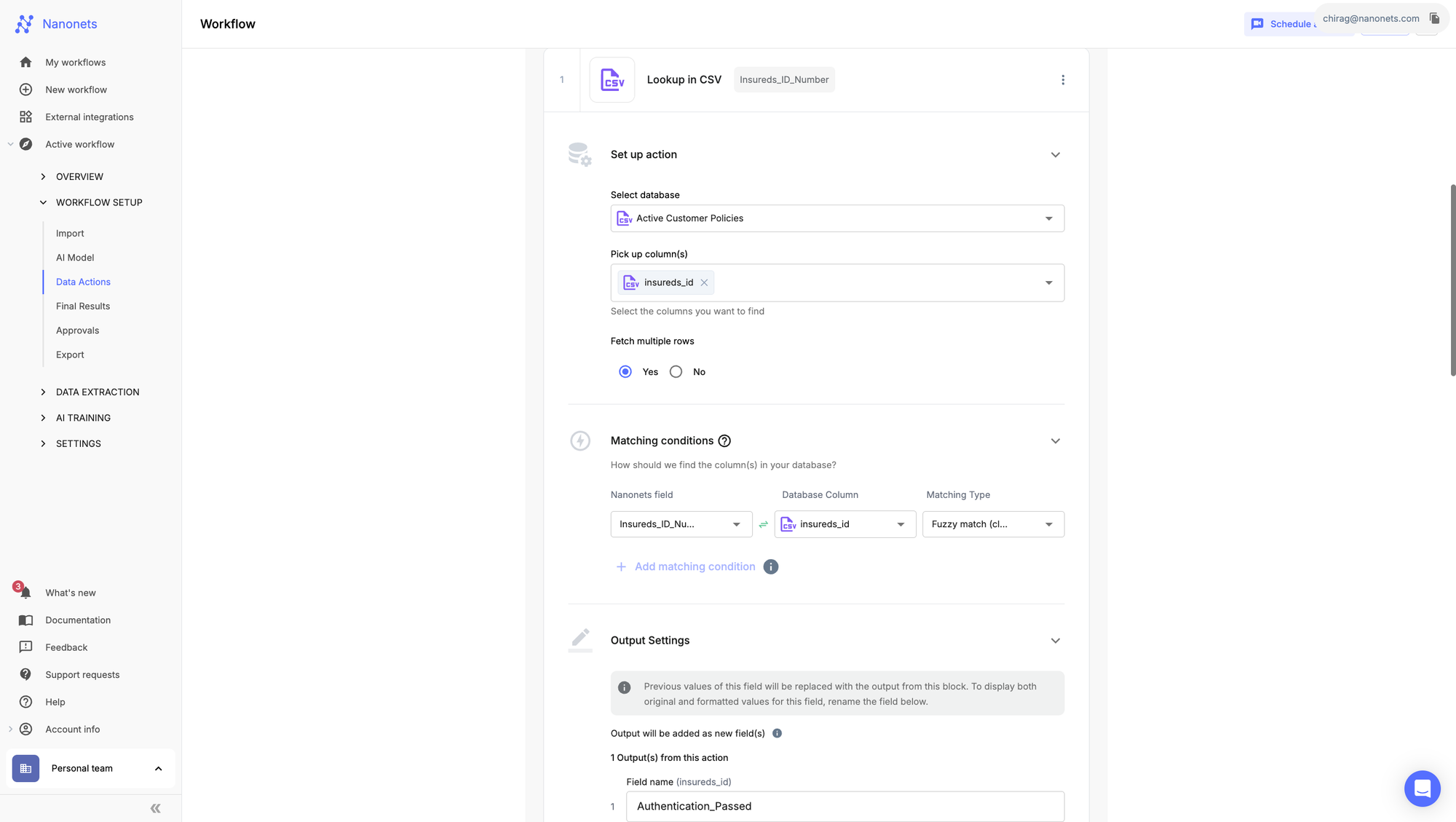

Step 5: Navigate to the “Workflow” part on the left panel > “Knowledge Actions” part.

✅

1. Utilizing the lookup functionality, we will arrange a workflow to “fuzzy match” the Insurance coverage coverage quantity towards your organisation’s information. In case of a match, we will have a brand new subject populated that claims, “authentication handed.”

2. Alternatively, let’s say you need to be sure that the coverage was energetic when the declare was made. You can “fuzzy match” the date of declare towards the coverage interval saved in an exterior database.

These are only a few examples of the “{custom} actions” Nanonets can carry out together with mathematical features, formatting actions and plenty of extra.

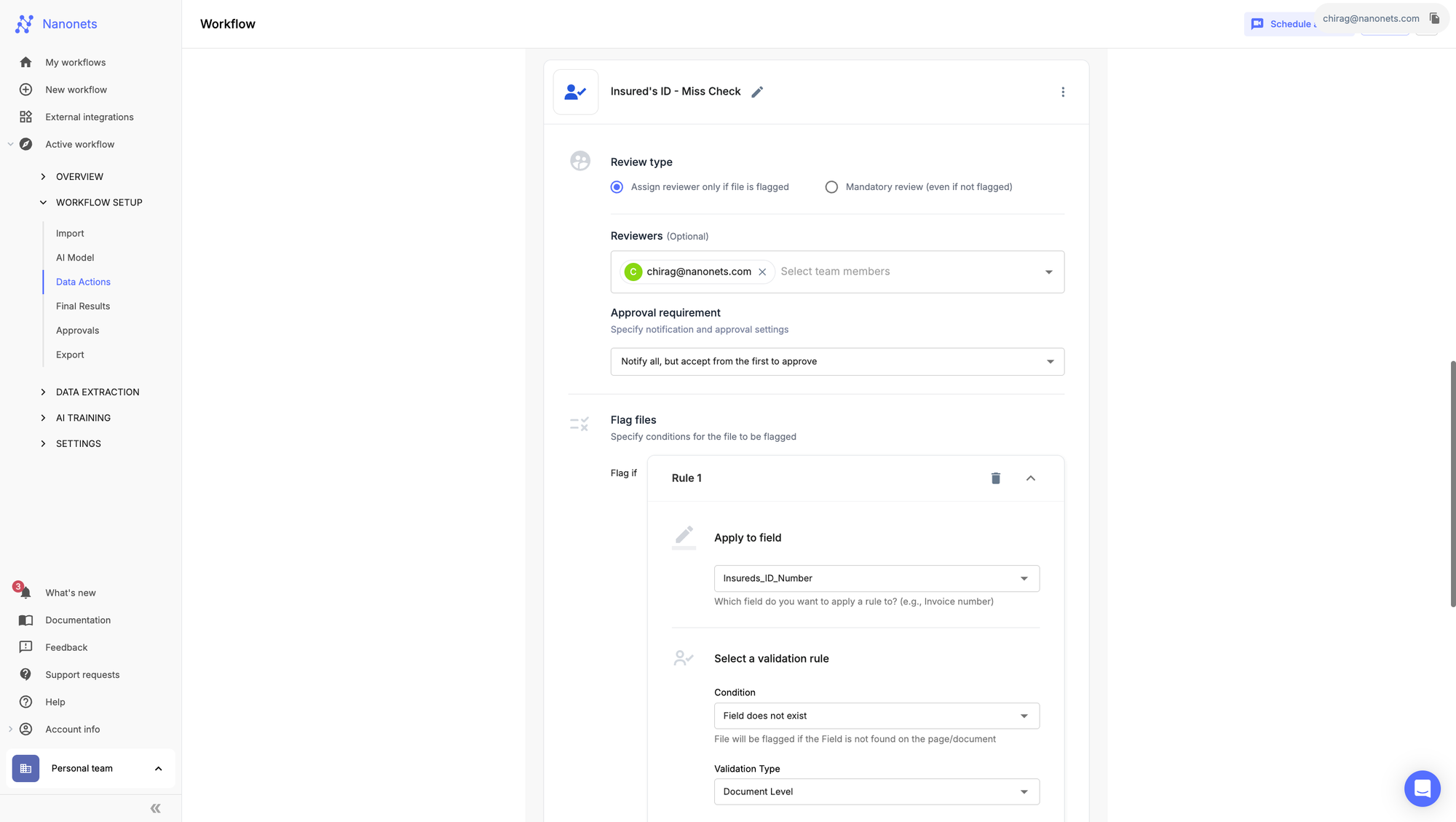

Step 6: Navigate to the “Approvals” part on the left panel beneath “Workflow setup”

✅

You possibly can outline {custom} logic actions within the “Approvals” part that flags a selected file for handbook evaluate. You possibly can create a situation that flags a file in case the Insured’s ID is lacking and notify an agent for reviewing a selected file.

Step 7: Navigate to Import and Export part beneath “Workflow setup”

✅

1. With quite a lot of automated import and export choices, this complete course of could be automated end-to-end. You possibly can import the recordsdata, on this case, declare types from e mail inboxes, cloud storages, like, G-Drive, Dropbox, One drive, and even databases, like Amazon S3. There’s all the time an choice to import recordsdata utilizing the API endpoint.

2. Equally, you’ll be able to export to third-party software program. In style choices embrace ERPs like Salesforce, Hubspot, and so forth. or databases, like, MsSQL, Amazon S3, and even cloud storages, like G-Drive. There are one-click integrations to accounting software program, like Quickbooks, Xero, Sage, and so forth. for monetary statements.

So, there we now have it! An instance of how one can leverage all of the options that Nanonets gives to efficiently implement STP in Insurance coverage processes. The most effective half is that that is utterly customisable and could be tailor-made to completely different processes and doc varieties in a safe and user-friendly method.