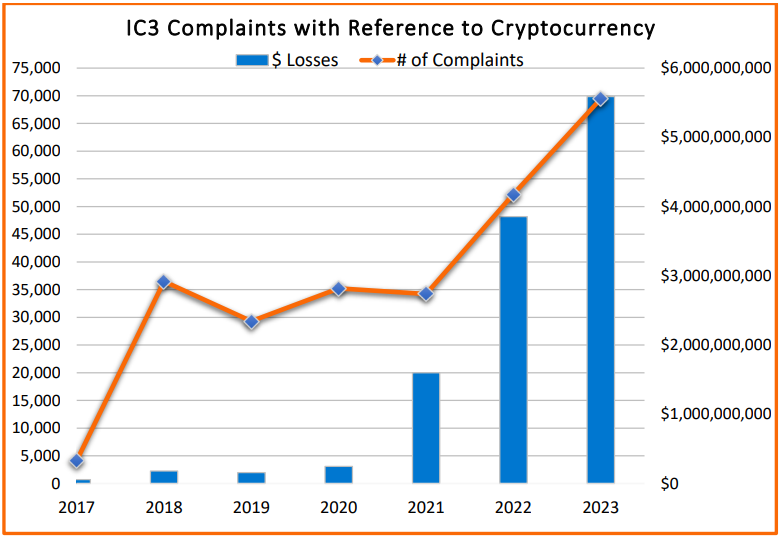

The FBI says that 2023 was a file yr for cryptocurrency fraud, with whole losses exceeding $5.6 billion, primarily based on almost 70,000 experiences acquired by way of the Web Crime Grievance Heart (IC3).

This marks a forty five% enhance in losses in comparison with the earlier yr, pushed primarily by funding fraud, which accounted for 71% of the overall cryptocurrency losses. Different kinds of fraud contributing to the statistics embody tech assist scams, name heart fraud, and authorities impersonation.

The overwhelming majority of the reported losses ($4.8 billion) have been incurred by U.S. residents, adopted by Cayman Islands ($196M), Mexico ($127M), Canada ($72M), the UK ($59M), India ($44M), and Australia ($25M).

Within the U.S., California is the state that suffered the best damages, recording losses of $1,155,000,000 adopted by Texas ($412M), Florida ($390M), and the New York ($317M).

Supply: FBI

FBI’s report highlights varied fraud developments that dominated 2023. In what issues funding fraud, the primary developments revolved round variations of courting apps {and professional} networking platforms resulting in “pig butchering” websites.

There are additionally liquidity mining scams the place victims are promised excessive returns for staking their property in a liquidity pool.

Criminals in 2023 additionally created pretend gaming functions claiming to be primarily based on blockchain applied sciences. They promised gamers cryptocurrency rewards to trick them into connecting their wallets.

Fraudsters additionally used cryptocurrency restoration scams the place they aim victims of earlier scams, providing pretend restoration providers for stolen cryptocurrency. These schemes usually require upfront funds for retrieving misplaced funds.

How one can defend from cryptocurrency fraud

The IC3 report explains that cybercriminals goal cryptocurrency due to its decentralized nature, the existence of mechanisms that may assist obscure the cash hint, and the sufferer’s lack of ability to revert fraudulent transactions.

Cryptocurrency holders can defend themselves from fraud by following these suggestions:

- Be skeptical when met with “too good to be true” funding guarantees

- Confirm the legitimacy of funding platforms earlier than committing any funds.

- Ask your funding advisor to fulfill in particular person, and deal with refusal as a crimson flag.

- Use separate cryptocurrency wallets for gaming and investments.

- Periodically test pockets permissions utilizing a trusted third-party token allowance checker software, and revoke entry the place obligatory.

- Keep away from liquidity mining swimming pools that don’t comply with cryptocurrency market fluctuations.

- Be cautious of personal restoration corporations claiming capability to grab stolen cryptocurrency and requiring upfront funds.

- Independently confirm caller identities by calling corporations again utilizing publicly out there contact info.