Join day by day information updates from CleanTechnica on e-mail. Or observe us on Google Information!

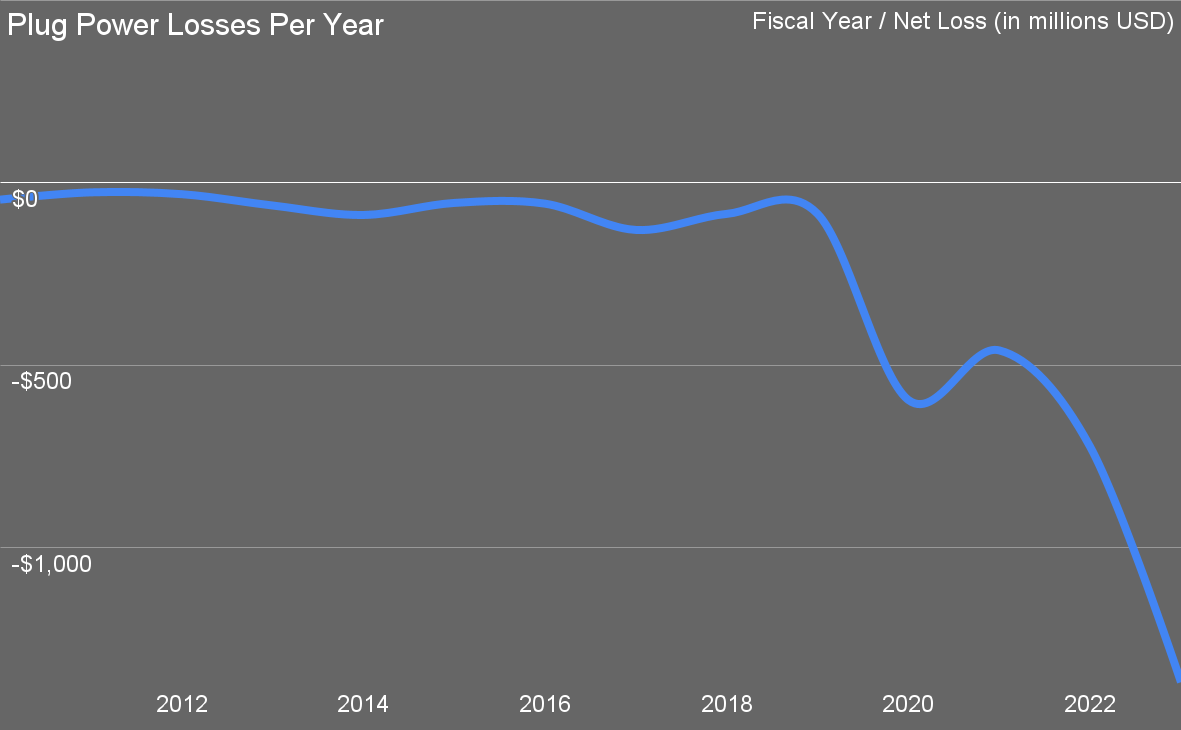

That is the yr that the hydrogen bubble pops, particularly for transportation, however more and more for all hydrogen for vitality performs. One of many corporations on my hydrogen dying watch is Plug Energy, which has managed to lose $3.12 billion of different folks’s cash since 2010, about $200 million a yr on common, and has by no means turned a revenue in its 28 years of existence.

Plug Energy Inc. was based in 1997 as a three way partnership between DTE Vitality and Mechanical Expertise Inc. (MTI), with a give attention to creating proton alternate membrane (PEM) gas cell expertise. Initially focusing on stationary energy functions, the corporate later shifted its emphasis to hydrogen gas cell programs for materials dealing with and industrial autos. Through the years, Plug Energy expanded its operations, securing key partnerships and contracts, together with supplying gas cell options for main warehouse operators like Amazon and Walmart. The corporate additionally invested in inexperienced hydrogen manufacturing, aiming to construct a complete hydrogen ecosystem.

I pulled this chart collectively quickly this morning to point out how a lot greater its losses have turn out to be. In 2023 its losses had been had been virtually $1.4 billion, and it’s on monitor to exceed a billion in losses for 2024 as properly. That’s not the form of information traders love to listen to.

As a be aware concerning the Amazon and Walmart warehouses, there are solely about 70,000 hydrogen forklifts in operation globally, and the overwhelming majority are in US distribution facilities the place the US DOE paid for the hydrogen refueling system and the hydrogen is sort of completely grey. The primary hydrogen forklift was manufactured and put into operation within the Sixties. As a distinction, in simply 2023 ~1.52 million electrical forklifts had been bought globally. In different phrases, hydrogen forklifts are a rounding error on the thorax of a gnat that’s been on a starvation strike for a very long time.

What triggered this dive into Plug Energy’s perpetually abysmal fiscals was a press launch promoted by somebody who I actually want knew higher by now. Plug Energy introduced that its 15-ton-per-day hydrogen plant in St. Gabriel, Louisiana stays on monitor to start operations in Q1 2025. The ability, operated by means of Hidrogenii, a 50/50 three way partnership with Olin Company, will use by-product hydrogen from Olin’s chlor-alkali manufacturing, integrating it into Plug Energy’s North American hydrogen community. A dry-out course of is underway to take away moisture and impurities together with chlorine, making certain the manufacturing of high-purity hydrogen.

In different phrases, zero information, simply an announcement that they had been nonetheless going to do one thing they began engaged on in October of 2022. That’s a very long time to get to fifteen tons of hydrogen a day.

Is it inexperienced? Not an opportunity. Whereas a few of Olin’s chlor-alkali crops run in areas with sturdy hydroelectric and renewables powering their grids, this can be a St. Gabriel, Louisiana web site getting grid electrical energy with 438 kg of CO2e emissions per MWh.

Chlor-alkali crops produce about 35.5 occasions the mass of chlorine as of hydrogen. It’s simply electrolysis of salty water to unlock the chlorine from salt. The hydrogen is a waste byproduct, and traditionally it was principally vented to the environment, one thing thought-about simply nice till just lately when the oblique international warming potential of hydrogen was quantified as 12-37 occasions that of carbon dioxide over 100 and 20 years respectively. Corporations like Olin have been struggling to search out offtakers as a result of the volumes are so low.

Each ton of chlorine requires about 2.5 MWh to fabricate, in order that’s 1.1 tons of CO2 per ton of chlorine. The 15 tons of hydrogen per day are a byproduct of about 500 tons of chlorine, so about 550 tons of CO2. You may argue about attribution, however even the Olin CEO admits it isn’t inexperienced hydrogen.

That is par for the course for the hydrogen for vitality crowd. Plug Energy’s press launch fastidiously doesn’t name this hydrogen inexperienced and leaves out all emissions, however makes use of “inexperienced hydrogen” 4 occasions in phrasing round it, leaving the sturdy impression that it’s inexperienced hydrogen.

To be clear, it’s higher that an off take is discovered for the waste hydrogen. Venting 15 tons of hydrogen to the environment can be like venting 555 tons of CO2 per day on the GWP20 scale. Extra crops flare the byproduct than vent it for security causes, and a few have discovered methods to make it helpful economically. Nevertheless, an estimate by an individual who tracks this means that there are about 200 tons of un-utilized byproduct hydrogen produced daily in america.

These losses and the continued failure of hydrogen for transportation and vitality to do something besides contract lately have quite a bit to do with this inventory chart. The illusions and hype had been excessive in 2000, simply as they had been for different deathwatch corporations Ballard Energy — $1.3 billion in losses since 2000, no income ever — and FuelCell Vitality, each of whose inventory charts look virtually similar.

Plug Energy is buying and selling at 0.1% of its peak. Its 2021 bump with the newest resurgence of hydrogen hype was a pimple, but it surely appears traders don’t hit that max button on inventory charts to get a way of the fact. And apparently they don’t learn annual stories intently both, as a result of who precisely would spend money on an organization with accelerating losses and nil income in 28 years. That Plug Energy’s precise enterprise wasn’t notably massive — just a few tens of 1000’s of forklifts’ price of upkeep and hydrogen — didn’t appear to happen to traders.

Whose cash is Plug Energy burning? Norges Financial institution, Norway’s central financial institution, holds 88 million shares (about 8% of Plug’s excellent inventory), whereas BlackRock Inc. and Vanguard Group personal 79.3 million and 87.4 million shares, respectively. South Korea’s SK Group stays a key strategic investor after its $1.5 billion stake buy in 2021, buying about 10% of the corporate.

Norges greater than tripled its stake in Plug Energy in This fall of 2024, elevating its stake from 26 million shares it had misplaced some huge cash on to purchase one other 62 million shares which it has misplaced one other $18 million on. BlackRock purchased in just a few occasions, together with earlier than and a few occasions after the 2021 pimple. Vanguard, like BlackRock, was in for the 2021 pimple and has purchased in a few extra occasions. SK Group purchased in in February of 2021 at round $48, an funding it’s misplaced most of its $1.5 billion on. These aren’t mother and pop traders, they usually have collectively wasted billions of cash by giving it to a lifeless finish firm with a legacy upkeep and gas enterprise with no credible development mannequin. The due diligence approached zero, clearly.

Plug Energy remains to be pretending it’s a going and rising concern, staying within the European and North American markets. Nevertheless, in October 2024, it halted development of its hydrogen manufacturing facility on the Science Expertise and Superior Manufacturing Park (STAMP) in Genesee County, New York, on account of monetary constraints. Like Ballard, it’s beginning to shutter, divest and retrench, but it surely gained’t be sufficient.

Ballard and Plug Energy have been struggling arduous to remain above the $1 per share clip degree for delisting, however at their burn charges, deep losses and lack of considerable income, they’re most probably to drop into the delisting zone and go bankrupt. FuelCell Vitality’s inventory is above theirs, but it surely’s nonetheless 124 occasions decrease than in 2021, so its traders are undoubtedly simply as proud of them.

They aren’t alone. I proceed so as to add corporations to my hydrogen deathwatch checklist, which now sits at 129 after the addition of Norway’s HydrogenPro up on the information that it had reported a lack of $18 million for 2024. The simplest option to assemble an inventory of corporations concerned in hydrogen for vitality is simply to attend for headlines about monetary losses and retrenching.

Whether or not you’ve gotten solar energy or not, please full our newest solar energy survey.

Chip in just a few {dollars} a month to assist assist impartial cleantech protection that helps to speed up the cleantech revolution!

Have a tip for CleanTechnica? Need to promote? Need to recommend a visitor for our CleanTech Speak podcast? Contact us right here.

Join our day by day e-newsletter for 15 new cleantech tales a day. Or join our weekly one if day by day is just too frequent.

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.

CleanTechnica’s Remark Coverage