Key takeaways

- Provide chain shifts from tariffs may have an effect on an organization’s capacity to gather information on the influence of worth chains and shift carbon disclosure purpose timeframes.

- Compliance on human-rights initiatives and moral enterprise practices may fluctuate if provide chains transfer location.

- Corporations dedicated to ESG efficiency seemingly will let political points shake out earlier than figuring out subsequent steps.

The U.S. administration’s introduction (and delay) of sweeping tariffs already is displaying indicators of disrupting international commerce. In fact, addressing the basic financial challenges the tariffs symbolize shall be high of thoughts for all firms, however it’s vital to notice that the redrawn commerce patterns and alliances can even seemingly change how firms method their efforts to make sure provide chains meet their requirements for environmental, social, and governance-related efficiency.

Along with the usual enterprise imperatives of price, high quality, and timeliness, most international companies have already invested vital sources into mapping their worth chains. Ahead-looking firms have additionally engaged with suppliers on a variety of points together with local weather reporting and efficiency, human rights-related points and moral enterprise practices.

However as prospects and suppliers come to grips with a brand new financial panorama, it could require them to vary suppliers to make sure they’ll stay economically aggressive.

A provide chain reshuffle

Based on our conversations with a number of international firms within the prescription drugs, software program and manufacturing sectors, it’s nonetheless too early to foretell the precise impacts of tariffs. Nonetheless, all see the next three situations as potential, if not going, if tariffs stay in place for any vital interval.

- Provide chain shifts may have an effect on information assortment: World companies have invested considerably in constructing relationships with suppliers who share or at the very least conform to assist efforts to acquire related information concerning the impacts of their worth chains. The brand new financial calculus that the tariffs symbolize will virtually actually end in substantial parts of world provide chains being restructured and new relationships being put in place. This may have an effect on mutual agreements on what info is offered by suppliers to prospects – corresponding to carbon metrics, well being and security info, human rights-related information and different sustainability measurements. Many of those ESG information assortment processes will must be rebuilt to some extent and will end in a disruption of information availability for a while.

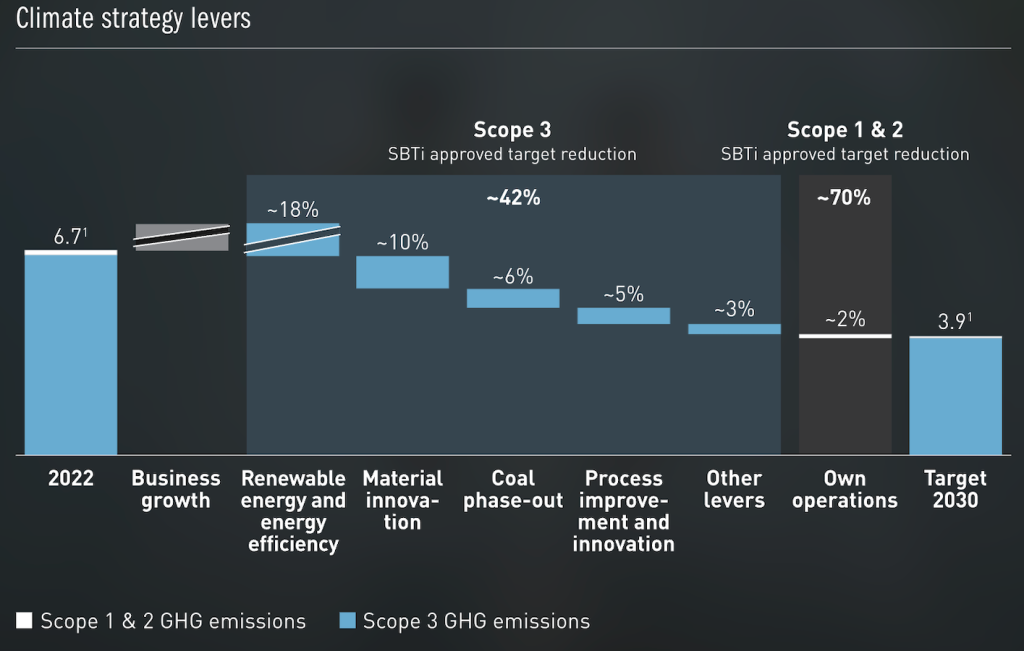

- Altering carbon disclosures and purpose timeframes: Varied goal-setting regimes, together with these administered by the Science Based mostly Targets Initiative (SBTi), usually have a requirement for firms to set targets associated to the emissions that originate of their provide chain. To fulfill these targets, firms usually will encourage their suppliers to set their very own targets. Nonetheless, if firms should establish new suppliers to mitigate the influence of tariffs, most of those agreements will must be renegotiated, placing these firms who’ve set such targets liable to not with the ability to accomplish them in the timeframe anticipated. This will likely end in reputational injury to these not in a position to meet their unique commitments.

- Compliance unknowns for suppliers and producers alike: The onshoring of provide chains in response to tariffs could end in simpler compliance with varied human rights and anti-corruption necessities. That’s as a result of many firms have constructed refined operations to guard working circumstances and uphold moral enterprise practices. If provide chains are moved geographically nearer — presumably to the place the regulatory setting is much like the purchaser — then there’s the possibility we may see a web profit from such tariffs. On the flip aspect, if an organization requires sure uncooked supplies that solely originate from particular international locations as an integral part to their manufacturing course of, it’s additionally potential there might be a “race to the underside” — the place firms are tempted to supply supplies from wherever, whatever the provider’s dedication to human rights and moral enterprise practices.

Doubling down on values

It’s clear we’re in a extremely disruptive interval for companies, notably for these dedicated to sustainable enterprise practices. Should you couple tariffs with an administration that’s clearly inclined to decontrol sustainability-relevant points, then progress in direction of a extra sustainable future could also be harder for the following few years.

That’s why firms ought to prioritize their most vital “non-negotiables” — be it human rights, fundamental carbon information and/or anti-corruption efforts — and stick with their values on these. Then let the political points shake out earlier than figuring out the following finest steps.

Regardless, the enterprise case for sustainable practices stays clear. Ahead-looking firms which have already dedicated to visibility and traceability of their provide chain shall be higher positioned to navigate these disruptions and shortly adapt to the brand new international provide chain panorama.