Conventional (handbook) underwriting processes typically battle to maintain tempo with the rising complexity of contemporary threat evaluation, information assortment, and coverage administration.

🧐

Scaling conventional underwriting operations turns into more and more difficult as underwriters spend a big period of time gathering and verifying information from a number of sources.

These embody buyer purposes, monetary information, medical studies, and exterior threat assessments equivalent to geographic or weather-related information. These numerous information units require cautious aggregation and verification, making the method sluggish and error-prone.

🧐

Underwriting automation can assist alleviate these points to an incredible extent. It leverages AI and machine studying to shortly and precisely accumulate, assess, and course of underwriting information. This not solely accelerates decision-making but in addition ensures extra correct and constant threat assessments. This additionally leads to streamlined workflows, sooner choices, and vital price reductions—by as a lot as 50% in operational bills, in accordance with some trade studies!

This text focuses on what particular features of the underwriting course of will be automated, the applied sciences driving this alteration, and why this shift is so essential for contemporary insurance coverage corporations.

Key underwriting processes that may be automated

Automating key steps within the insurance coverage underwriting course of permits insurers to streamline operations, enhance accuracy, and cut back the time spent on handbook duties. Automation can rework how underwriters work, enabling sooner and extra constant decision-making whereas minimizing human error.

Listed below are particular underwriting processes that may profit from automation:

1. Information assortment and aggregation

Underwriters manually collect and enter information from varied sources (e.g. buyer purposes, monetary information, and threat assessments).

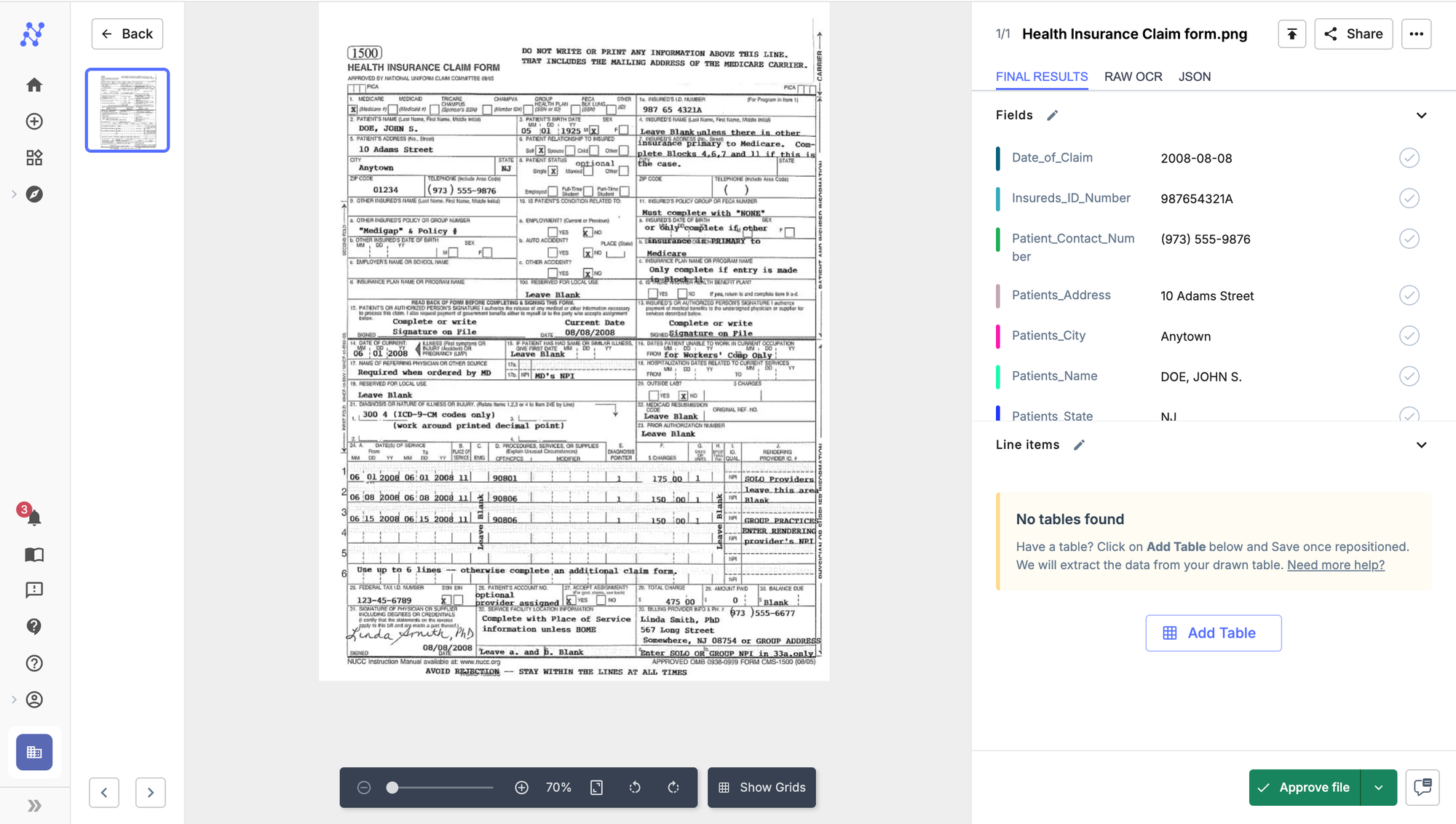

This course of shouldn’t be solely time-consuming however liable to human error. Furthermore, many paperwork arrive in several codecs, equivalent to scanned PDFs, emails, or handwritten kinds, making it tough to course of them shortly and precisely.

Automation utilizing AI-based OCR or clever doc processing (IDP) modifications this totally. OCR know-how can digitize information from quite a lot of paperwork—whether or not they’re in picture, PDF, or textual content codecs, whereas AI-driven extraction methods pull out related particulars contextually, with out counting on pre-set templates. This not solely reduces handbook information entry errors but in addition accelerates the decision-making course of.

Insurers utilizing IDP software program have reported as much as a 90% discount in processing time, permitting underwriters to focus extra on analyzing threat as a substitute of administrative duties.

2. Activity administration and workflow automation

Underwriting entails managing a number of duties equivalent to evaluating purposes, gathering extra paperwork, conducting compliance checks, and updating coverage phrases. With out automation, underwriters should manually prioritize and handle their workload, typically leading to bottlenecks.

Automation can assist streamline activity assignments and workflows through the use of AI to triage duties and assign them primarily based on precedence, complexity, and workload distribution. As an illustration:

- AI can route easier purposes, equivalent to easy auto insurance coverage renewals or low-risk residence insurance coverage insurance policies, to junior underwriters or have them straight by means of processed by the system itself.

- Extra complicated circumstances, like life insurance coverage for people with pre-existing circumstances or high-value properties in flood-prone areas, are routed to senior underwriters.

- Automated methods may also ship reminders for pending duties or compliance evaluations.

By automating activity triaging, insurers cut back turnaround occasions and enhance activity accuracy. This frees up underwriters to give attention to high-value choices equivalent to evaluating non-standard dangers or customizing coverage phrases for distinctive shopper wants.

3. Danger evaluation and pricing

Danger evaluation has historically relied on historic information, equivalent to previous claims, demographic developments, and financial indicators, to guage the probability of future claims. This information is analyzed by underwriters to set acceptable premiums.

Nevertheless, this handbook course of is subjective, inconsistent, and sluggish, typically resulting in suboptimal pricing choices.

AI and machine studying fashions enable for extra exact threat evaluation by analyzing huge datasets, figuring out patterns, and predicting potential dangers extra precisely. These methods can robotically modify premiums primarily based on dynamic threat components, equivalent to geographical location, climate patterns, or a person’s well being profile.

As an illustration, AI-supported threat pricing fashions can immediately modify a house owner’s insurance coverage premiums in the event that they transfer from a low-risk to a high-risk flood zone with out ready for handbook assessment.

This results in higher threat choice and lowered loss ratios. Actually, insurers that use AI for threat evaluation report a 10-15% improve in income resulting from improved threat profiling.

4. Compliance

Underwriting additionally entails adhering to regulatory necessities, which might range primarily based on the kind of insurance coverage and the area. Making certain compliance with requirements equivalent to AML/KYC, GDPR, or OFAC is important!

- AI options, like IDP or RPA software program, can automate compliance checks by cross-referencing utility information with related laws. For instance, an RPA bot can robotically examine a shopper’s KYC particulars in opposition to international sanction lists (OFAC) earlier than coverage approval.

- Equally, AI methods can monitor ongoing compliance by flagging any discrepancies between coverage phrases and up to date regulatory necessities.

This automated method ensures that each coverage meets the mandatory authorized requirements with out handbook intervention, lowering the danger of non-compliance and the related fines.

Core applied sciences driving underwriting automation

Because the insurance coverage trade shifts towards automation, a number of key applied sciences play a pivotal function in reworking the underwriting course of. These applied sciences not solely streamline workflows but in addition improve the accuracy and velocity of decision-making, permitting insurers to handle extra insurance policies with fewer assets.

1. AI, Machine Studying (ML), and Clever Doc Processing (IDP)

Synthetic intelligence (AI) and machine studying (ML) are the spine of underwriting automation. When mixed with Clever Doc Processing (IDP), they supply an end-to-end answer for automating document-intensive workflows, equivalent to these present in underwriting.

In underwriting, AI and ML are used to:

- Predict dangers: AI fashions can assess components like a shopper’s credit score rating, geographic threat (e.g., flood zones), or way of life patterns (e.g., smoking or high-risk occupations) to find out the probability of a declare.

- Automate threat scoring: AI-driven methods can robotically assign threat scores primarily based on predefined standards, eradicating the necessity for handbook analysis.

- Enhance threat pricing: ML algorithms repeatedly be taught from new information, enhancing their potential to suggest aggressive premiums. This enables insurers to regulate pricing dynamically primarily based on real-time components, equivalent to market developments or modifications in buyer threat profiles.

- Extract information from complicated unstructured paperwork: IDP powered by AI and ML can extract structured information from complicated paperwork equivalent to claims kinds, coverage purposes, medical information, and monetary statements.

- For instance, Nanonets’ IDP system can extract related fields like policyholder particulars, declare quantities, or accident descriptions, lowering handbook information entry by as much as 90% and dealing with doc processing at speeds far larger than human operators.

The mixture of AI-based OCR and ML helps insurers obtain a big discount in doc dealing with prices whereas making certain information accuracy and consistency.

💡

2. Robotic Course of Automation (RPA)

Robotic Course of Automation (RPA) is one other key know-how that automates repetitive, rule-based duties in underwriting, equivalent to information entry, validation, and coverage issuance. RPA is particularly helpful for automating the submission consumption course of, the place insurance coverage corporations typically obtain massive volumes of submissions that should be triaged and reviewed.

RPA methods can:

- Automate information transfers: RPA bots can seamlessly switch information between methods, equivalent to from legacy methods like AS/400 or IBM iSeries to fashionable cloud-based underwriting platforms, making certain all essential data is available for underwriters. That is particularly precious when integrating with older methods not optimized for contemporary workflows.

- Flag inconsistencies: RPA bots can robotically flag purposes with lacking or inconsistent data, routing them for handbook assessment, whereas easy circumstances are processed with out human intervention.

- Deal with compliance checks: RPA methods can automate compliance checks, making certain that insurance policies adhere to native regulatory requirements like Solvency II in Europe or the NAIC Mannequin Act within the U.S

💡

By implementing RPA, insurers can course of as much as 10 occasions extra submissions in the identical period of time, releasing up underwriters to give attention to extra strategic duties.

Advantages of automating insurance coverage underwriting

Automation delivers tangible advantages to insurers, starting from operational efficiencies to improved buyer satisfaction. Let’s discover these advantages with real-world information and particular examples:

1. Effectivity beneficial properties

Automation permits insurers to course of purposes sooner. For instance, insurers who implement AI-driven underwriting have reported processing occasions lowered by as a lot as 70%, with some insurance policies being issued in minutes slightly than days.

Based on a report by McKinsey, AI-driven underwriting can cut back the processing time of complicated purposes from days to lower than 24 hours.

2. Improved accuracy

Automation ensures constant, close to error-free information processing, lowering errors by as much as 75% in areas like information entry and threat calculations.

Through the use of predefined guidelines and AI fashions, insurers can consider each utility persistently, lowering the probability of biased or inconsistent choices.

3. Price financial savings

With automated underwriting, insurers can considerably cut back their reliance on handbook labor and bodily infrastructure for information processing, resulting in decrease operational bills.

Corporations that implement AI and RPA in underwriting processes report operational price financial savings of 30-50%, particularly in high-volume durations the place scaling handbook operations would in any other case require extra workers.

4. Enhanced buyer expertise

With automation, prospects profit from sooner processing occasions, extra correct quotes, and a extra personalised expertise.

AI methods can tailor premiums primarily based on particular person threat profiles, making certain that prospects get the absolute best protection at aggressive charges.

- Automated underwriting methods can cut back the time to difficulty a coverage by as much as 60%.

- AI fashions can assess every buyer’s distinctive threat components to supply personalised quotes, making prospects really feel that their wants are being met extra exactly.