Interbank, one in every of Peru’s main monetary establishments, has confirmed an information breach after a risk actor who hacked into its techniques leaked stolen information on-line.

Beforehand referred to as the Worldwide Financial institution of Peru (Banco Internacional del Perú), the corporate gives monetary providers to over 2 million prospects.

“We’ve recognized that some information of a bunch of purchasers has been uncovered by a 3rd celebration with out our authorization. In mild of this example, we instantly deployed extra safety measures to guard the operations and data of our purchasers,” Interbank stated right now.

Whereas prospects have been reporting that the financial institution’s cell app and on-line platforms stopped working all through the day and through a separate outage reported two weeks in the past, Interbank says that the majority of its operations are actually again on-line and that its purchasers’ deposits are safe.

“We wish to guarantee our purchasers that Interbank ensures the safety of your deposits and all of your monetary merchandise. Most of our channels are working. As quickly as we full the exhaustive evaluate, we are going to reestablish operations in the remainder of our channels,” Interbank added.

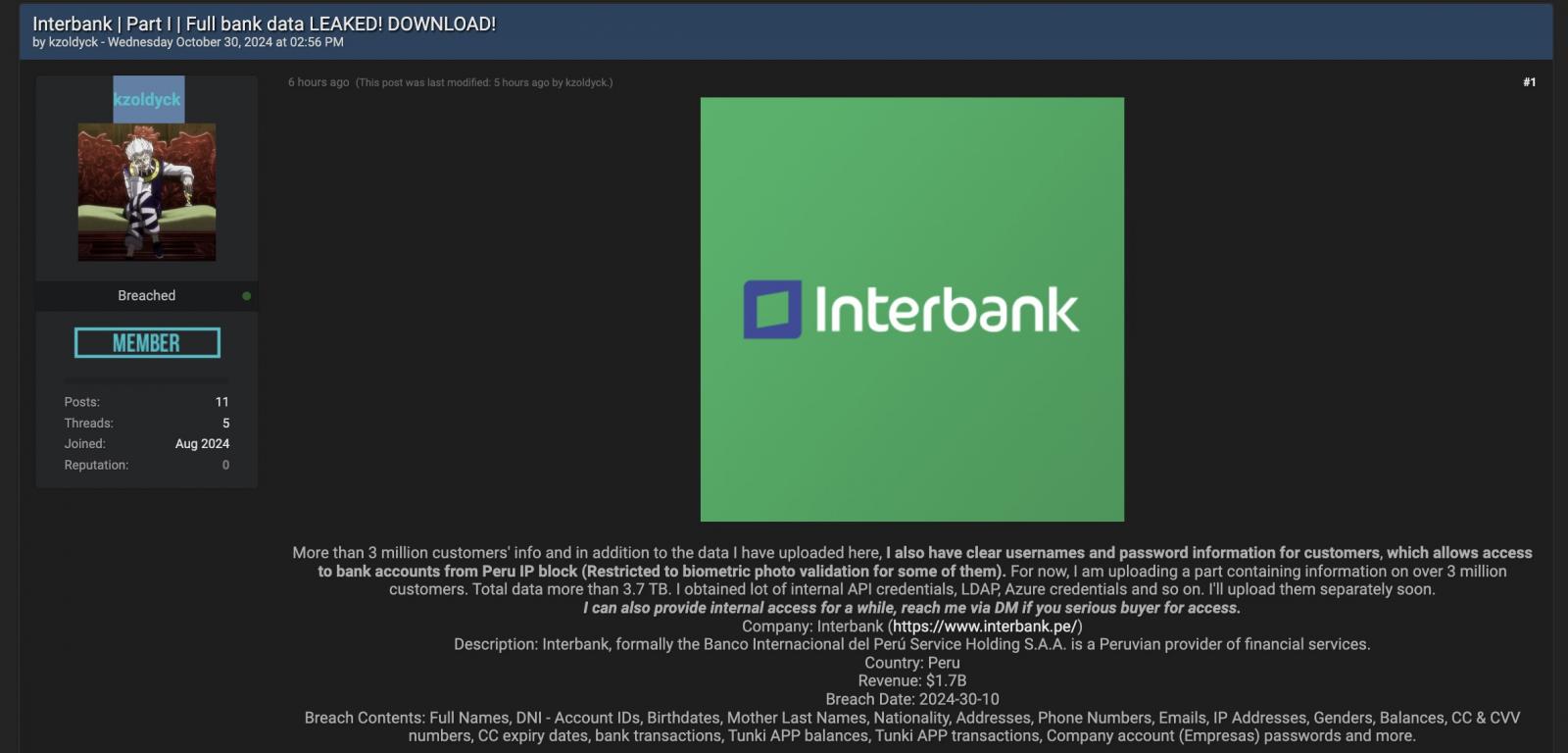

Regardless that the financial institution has but to reveal the precise variety of prospects whose information was stolen or uncovered within the breach, as first noticed by Darkish Internet Informer, a risk actor who makes use of the “kzoldyck” deal with is now promoting information allegedly stolen from Interbank techniques on a number of hacking boards.

The risk actor claims they have been capable of steal Interbank prospects’ full names, account IDs, delivery dates, addresses, telephone numbers, e-mail addresses, and IP addresses, in addition to bank card and CVV numbers, bank card expiry dates, information on financial institution transactions, and different delicate info, together with plaintext credentials.

“Greater than 3 million prospects’ information and along with the information I’ve uploaded right here, I even have clear usernames and password info for patrons, which permits entry to financial institution accounts from Peru IP block (Restricted to biometric photograph validation for a few of them),” the risk actor says.

“For now, I’m importing a component containing info on over 3 million prospects. Whole information greater than 3.7 TB. I obtained lot of inside API credentials, LDAP, Azure credentials and so forth.”

Additionally they claimed in a thread the place samples of the stolen information have been printed that negotiations with Interbank’s administration started two weeks in the past. Nonetheless, the tried extortion failed after the financial institution determined to not pay.

An Interbank spokesperson was not instantly accessible when BleepingComputer reached out earlier right now for extra particulars concerning the breach.