Waste was already baked into attire enterprise fashions lengthy earlier than social media influencers made kinds lose their coolness on a weekly fairly than a seasonal foundation. However whilst quick style drives unprecedented waste, many manufacturers, retailers and startups are slowly advancing round enterprise fashions that hold clothes in use.

New software program startups are rescuing less-than-perfect objects, revealing particulars by synthetic intelligence about how manufacturers, retailers and customers behave. These rising companies are pitching new efficiencies that assist to revive or customise garments, footwear and equipment that in any other case go stale in warehouses, closets or landfills.

In New York, Alternew seeks to streamline client repairs and alterations, whereas Revive is flipping returned items into new gross sales for manufacturers. Different restore and refurbishment ventures: Suay Sew Store fashioned in 2017 in Los Angeles; Mendit opened in 2019 in Houston; Sojo fashioned in London in 2020, as did ReCircled in Denver; and Circulo got here to life within the U.Ok. in 2024. And this previous February, the Loom app debuted to attach individuals with designers to “upcycle” their garments. Tersus Options spiffs up used garments and footwear for scores of branded resale portals.

After all, Nordstrom and Bloomingdale’s way back set the bar in retail by providing prospects alterations at most shops. And beginning 20 years in the past, manufacturers corresponding to Levi’s, Patagonia and The North Face launched free or low-cost restore packages, whereas extra just lately Ralph Lauren, Arc’teryx, Dr. Martens, Timberland and Reformation have adopted. In the meantime, along with its no-cost client repairs, Eileen Fisher gives particular Mended collections that concoct new clothes out of spare elements from outdated ones.

Low-hanging alternatives

All of those corporations are pursuing a share of restore as a enterprise alternative, one that’s attracting much more curiosity these days as tariffs deliver turmoil to provide chains and laws right here and overseas round end-of-life textile administration provides stress on manufacturers.

- The marketplace for style repairs, which has been rising by 2.5 % yearly, will increase from $3.6 billion in 2024 to $4.5 billion by 2033, based on Enterprise Analysis Insights.

- Round enterprise fashions, together with repairs and reuse, might attain $700 billion by 2030, the Ellen MacArthur Basis projected in 2021. That’s greater than 20 % of the worldwide style market.

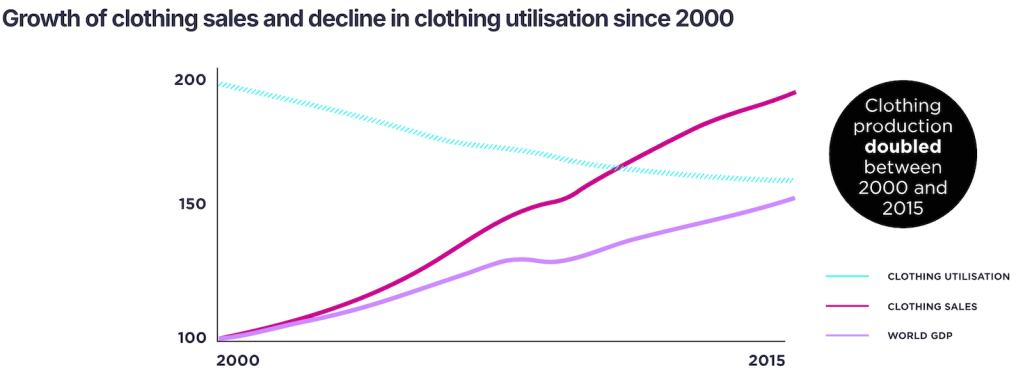

- As clothes manufacturing has doubled within the first 15 years of this century, the common variety of occasions that somebody wears a garment has dropped by 36 %.

“Even with manufacturing separated from consumption, the destructive impacts of style’s environmental footprint have gotten more durable to disregard,” mentioned former Timberland govt Ken Pucker, a enterprise teacher at Tufts and Dartmouth universities. “Pictures of trashed clothes, penalties of microfiber launch and accelerating carbon emissions compromise the planet and, in the end, the viability of the trade.”

Current analysis has quantified that repairs have extra energy than secondhand gross sales to stop or delay new purchases. Eighty-two % of restore companies displace the acquisition of a factory-fresh garment, in contrast with 60 % for resale companies, based on the nonprofit Waste and Assets Motion Programme (WRAP). It saves 16 kilos of CO2, roughly equal to driving a gasoline automotive for 20 miles, to restore a cotton T-shirt as a substitute of shopping for a brand new one, the report discovered.

Alternew: connecting manufacturers, customers and tailors

“There’s a landfill on the market with my identify on it that I’m personally liable for,” jokes Nancy Rhodes, cofounder and CEO of Alternew. The previous footwear designer’s creations, together with for Beyoncé’s Home of Dereon and Kenneth Cole, bought at Bloomingdale’s, Nordstrom, Marshall’s and Costco.

Now she’s constructing a matchmaking service for manufacturers, customers and tailors. Alternew, which captured $2 million in pre-seed funding in September, is engaged on a pilot with New York womenswear label Faherty. Manufacturers Everlane and Moose Knuckles are fascinated about partnering, too.

Retailers spend lots of of billions of {dollars} on “returns and churns,” and types spend billions to lure prospects to the register solely to lose them after the sale, she famous. “Seventy % of all attire returns are as a consequence of poor match,” Rhodes mentioned. “The style trade has a 26 % retention fee when utilizing care and restore companies as a model. There’s knowledge from the market that claims a buyer is 73 % extra possible to return to the shop throughout the yr based mostly on the companies.”

Rhodes described a buying expertise that Alternew would stop: You strive on a pair of pants in a retailer, however they’re too lengthy, so that you stroll out empty handed. “As a substitute of shedding the sale, the shop affiliate logs an alteration request instantly [on Alternew], matching you with a neighborhood, vetted tailor on our platform, you get a textual content notification with appointment particulars, pricing, after which real-time updates.”

That’s a gap for manufacturers to distinguish themselves, based on Rhodes: “Care and restore are an intrinsic core resolution to creating an genuine, holistic and round expertise for the patron.”

Alternew can even present corporations new insights into their merchandise. As an illustration, perhaps 20 zippers on a denim jacket broke throughout the nation, or a excessive share of New England consumers hemmed wide-legged linen pants by 4 inches.

And Rhodes bets that by making it simpler for customers to hem pants or seal busted seams, extra individuals will proceed carrying their favourite manufacturers.

“We began by making a enterprise in a field for tailors, and that enables us to get proprietary knowledge that doesn’t exist as we speak, so we are able to match the proper tailor with the proper product,” she mentioned. “As a result of the tailor that hems a pair of denims isn’t essentially the identical tailor that’s going to soak up a Gucci blazer. Clients get an ideal match, and tailors get new shoppers.”

Revive: Making repairs at scale

Revive originated out of Hemster, a restore and alterations startup based in 2017 that has serviced Zara, Diane von Furstenberg and Reformation. But Co-founder and CEO Allison Lee swerved in a special route in 2022, when she seen model warehouse managers utilizing the service’s business-to-consumer restore portal to course of useless inventory and broken items.

Stated Lee: “That’s actually how we by chance found this enormous drawback that manufacturers appear to have round their stock and debt, the damages and returns and such.”

After elevating $3.5 million in seed funding final June, Revive turned worthwhile on the finish of 2024. Lee mentioned it processed 500,000 models final yr, which might triple in 2025. “There’s a whole lot of tailwind we’re feeling proper now,” she mentioned, as manufacturers reevaluate their provide chains as a consequence of tariffs.

Manufacturers create $740 billion of unproductive stock yearly, “the equal of each single unit bought on Amazon going on to landfill,” Lee mentioned. But corporations solely write off one-tenth of their stock.

Manufacturers typically categorize returned objects as “broken” regardless of what are sometimes trivial points, together with cat hair, wrinkles, a tear within the plastic wrap or a dent within the shoebox. As a substitute of recycling or donating these items, Revive cleans, sews, re-tags and repacks them. Revive can assist manufacturers promote 95 out of 100 objects it processes, based on Lee. The corporate re-routes the rest for recycling or donations.

Revive, which takes a charge for the logistics and a fee for every sale, sits between manufacturers and a number of other third-party logistics corporations throughout the U.S. It strikes merchandise in just a few weeks that may in any other case rot in a warehouse for a complete season. The service combines its stock data with pricing knowledge from 30 gross sales channels, together with Macy’s, Nordstrom, eBay and Poshmark, along with influencers who livestream gross sales.

“We mainly take a look at this clear system on report and we’re like, oh, Michael Kors purses promote rather well on Whatnot, however the footwear promote higher on Poshmark,” Lee mentioned of patterns Revive’s synthetic intelligence reveals.

“The sustainability narrative places an excessive amount of stress on customers to purchase higher and throw out much less,” Lee mentioned, however the greater influence is in decreasing enterprise waste. “The objects that I’m getting from the model equal 1,000,000 individuals reselling their items, and that’s coming from like 4 manufacturers.”

[Connect with the circular fashion community and gain insights to accelerate the shift to a circular economy at Circularity, April 29-May 1, Denver, CO.]