What are your financial institution statements telling you about your corporation?

They are not simply lists of numbers — they’re filled with priceless details about your organization’s monetary well being.

Financial institution assertion evaluation helps you uncover this hidden information. It offers you a transparent image of your money movement, spending patterns, and total monetary well being. With this information, you can also make higher budgeting choices, spot potential issues early, and preserve your corporation on monitor financially.

On this weblog, we’ll discover financial institution assertion evaluation, why it issues for your corporation, and the way new expertise is making it simpler and more practical than ever.

What’s financial institution assertion evaluation?

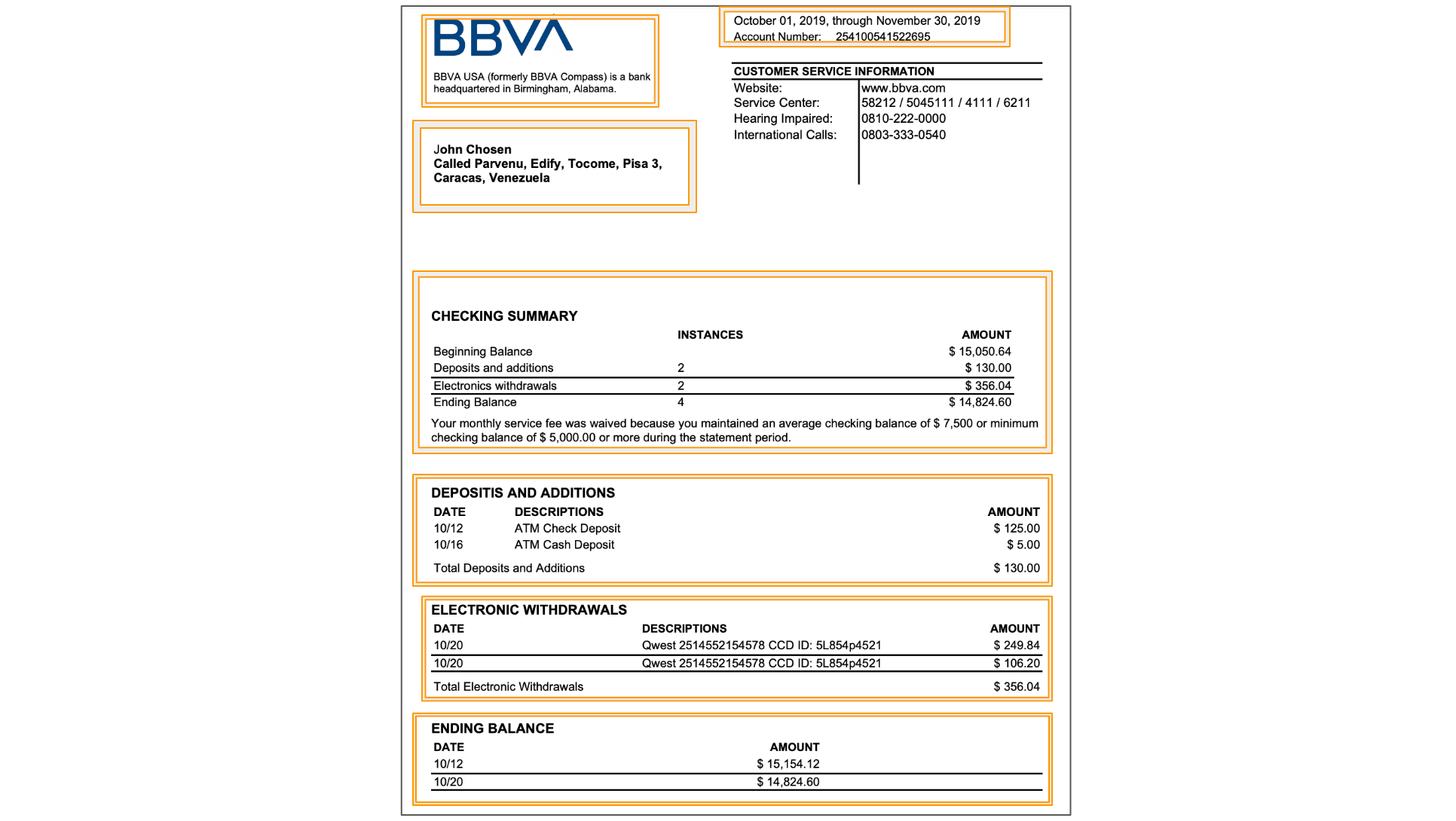

Financial institution assertion evaluation is the method of systematically reviewing and decoding all entries in a financial institution assertion over a selected interval.

It is like placing your monetary transactions underneath a microscope to higher perceive your corporation’s monetary well being and actions.

Key points of financial institution assertion evaluation

- Transaction categorization: Classify entries as deposits, withdrawals, transfers, funds, and many others.

- Expense evaluation: Evaluation outgoing funds similar to vendor funds, payroll, and operational prices.

- Income monitoring: Monitor earnings sources, together with buyer funds and curiosity earnings.

- Asset and legal responsibility modifications: Observe fluctuations within the firm’s belongings (money, investments) and liabilities (loans, credit).

- Stability verification: Verify the accuracy of the ultimate stability on the finish of the assertion interval.

- Sample recognition: Establish recurring transactions or uncommon fraud actions.

This detailed assessment helps companies get a transparent image of their monetary standing and spot any irregularities early on.

Why is financial institution assertion evaluation vital?

Money movement evaluation

- Establish common bills (e.g., payroll, utilities) and flags surprising prices

- Observe regular earnings streams and spotlight irregular earnings

- Spot uncommon actions which will point out errors or financial institution assertion fraud

- Predict future money flows and plan for potential overdrafts

Financial institution reconciliation

- Evaluate financial institution assertion information with inner information to make sure each transaction is accounted for correctly

- Detect errors or fraud by catching discrepancies between the financial institution’s information and your monetary documentation

- Catch and proper errors earlier than they trigger important monetary injury

Managing future liabilities

- Financial institution assertion evaluation helps assessment the stability to make sure ample funds can be found for upcoming obligations

- The insights from financial institution assertion evaluation will help keep away from pointless spending and enhance operational effectivity

Mortgage and shopper evaluation

- To know the monetary reliability and creditworthiness of mortgage candidates and shoppers and to guage mortgage compensation skill

- The evaluation offers you a greater image of the applicant’s liabilities and earnings streams

Audit and compliance

- Help the audit course of with detailed transaction histories

- Guarantee correct tax filings

- Preserve adherence to monetary laws

Spreadsheet-based financial institution assertion evaluation

Spreadsheet instruments like Microsoft Excel, Google Sheets, or LibreOffice Calc have lengthy been the go-to instruments for financial institution assertion evaluation. They provide a well-known interface and options that can be utilized for efficient monetary administration.

The info from the financial institution assertion is imported or manually copy pasted into the spreadsheet templates. Formulae are prebuilt into the spreadsheet to carry out calculations, which may then be manually analyzed.

Professionals of utilizing spreadsheets for financial institution assertion evaluation

- Utilizing spreadsheet templates is a low-cost resolution for financial institution assertion evaluation.

- It may be discovered utilizing free on-line sources and YouTube tutorials – which makes it widespread amongst particular person professionals.

- Spreadsheets can be utilized offline and be simply custom-made to suit particular enterprise wants or accounting practices.

- Superior customers can create complicated calculations and leverage built-in charting instruments for higher visualization.

Cons of utilizing spreadsheets for financial institution assertion evaluation

Whereas spreadsheets provide flexibility, they’ve many drawbacks for financial institution assertion evaluation.

- Guide information entry is time-consuming and vulnerable to errors, particularly as transaction volumes develop.

- Spreadsheets wrestle with scalability, typically changing into sluggish with giant datasets.

- Additionally they lack sturdy safety features, doubtlessly exposing delicate monetary information.

- Model management might be difficult, notably in collaborative environments, and spreadsheets provide restricted audit trails for monitoring modifications.

- Whereas doable, complicated monetary modeling and superior evaluation are difficult in spreadsheets.

💡

Whereas spreadsheet-based templates have limitations in comparison with specialised software program or AI-powered instruments, they continue to be viable for people simply beginning with financial institution assertion evaluation. Their flexibility and familiarity make them an excellent stepping stone earlier than investing in additional superior options.

Let’s face it – going via financial institution statements line by line is time-consuming and tedious.

Historically, solely educated accountants and auditors carried out financial institution assertion evaluation, which concerned analyzing and analyzing every entry within the financial institution assertion. That is virtually unattainable with at the moment’s scaled-up operations and a number of codecs of financial institution statements.

That is the place trendy AI-powered instruments are available in. They will shortly analyze your statements, supplying you with priceless insights with out the headache of guide number-crunching.

Let’s study how that is carried out and discover some superior financial institution assertion analysers.

AI-powered financial institution assertion evaluation

AI-powered instruments are paving the way in which for monetary evaluation throughout all industries.

Financial institution assertion evaluation can carried out by leveraging machine studying (ML) and synthetic intelligence (AI) to automate and improve the extraction and interpretation of economic information. AI-powered instruments use superior OCR to extract information with greater than 98% accuracy and include self-learning and adaptive capabilities.

Professionals of utilizing AI-powered financial institution assertion evaluation

- These instruments automate information extraction and categorization and might dramatically cut back guide effort and human error by growing pace and accuracy.

- They excel in dealing with giant volumes of knowledge throughout a number of accounts, making them extremely scalable for rising companies.

- AI’s clever categorization capabilities enhance over time, offering more and more correct insights.

- May be simply built-in with all different monetary programs utilizing API to behave as financial institution assertion analyzers.

- By automating time-consuming duties, AI instruments unencumber priceless sources, permitting workers to concentrate on strategic decision-making quite than information processing.

Cons of utilizing AI-powered financial institution assertion evaluation

Whereas AI-powered automation instruments provide important benefits, they are not with out drawbacks.

- The preliminary setup and coaching interval for some AI instruments might be time-consuming, and employees might expertise a studying curve, particularly for superior complicated integrations.

- Require a considerable preliminary funding and won’t be appropriate for actually small companies or low-volume financial institution assertion customers.

- Whereas they’re extremely correct (as much as 99% accuracy), AI instruments are usually not excellent and will sometimes misread uncommon transactions and require human oversight.

Find out how to arrange financial institution assertion extraction and evaluation workflow

Financial institution assertion evaluation must be spot-on, with no room for errors.

Let’s examine how you should use Nanonets, an AI-powered OCR information extraction software, to make the method simpler and extra environment friendly. Observe that this may be carried out without spending a dime for as much as 500 financial institution statements:

- Open the online utility at app.nanonets.com. When you don’t have an account but, join free and log in.

- Navigate to “New workflow” and choose “Pre-built financial institution assertion extractor.” If this feature isn’t accessible, you should use the Zero-training extractor as an alternative.

- Add/Import all of your financial institution statements —whether or not they’re PDFs, scanned pictures, or spreadsheets. Nanonets can deal with all file varieties.

- Evaluation the extracted information and extract extra fields if any missed.

- It’s also possible to customise and add extra financial institution assertion areas by modifying completely different labels.

- Obtain/export the information as completely different file codecs (CSV, Excel, Google Sheet, XML).

- Whereas the above steps coated the essential steps to arrange a financial institution assertion extraction workflow, for extra evaluation you can too export it to your accounting or ERP software program for additional processing. All you want to do is setup an integration workflow.

Nanonets comes with 30+ built-in integrations, you’ll be able to arrange any new integration workflow utilizing a financial institution assertion API.

- It’s also possible to used superior analytics to get insights into your workflows.

Overcoming challenges in financial institution assertion evaluation

Difficulties come up in financial institution assertion evaluation primarily because of the inconsistencies within the supply information.

Excessive quantity and velocity of knowledge

Conventional strategies like guide information entry, spreadsheet-based evaluation, and periodic batch processing wrestle with the growing quantity and pace of economic transactions and sometimes result in delays. To handle this, implement real-time information processing options and use massive information analytics instruments able to dealing with giant volumes of transaction information repeatedly.

AI-powered information extraction instruments can considerably enhance this course of by robotically processing and categorizing excessive volumes of transactions in real-time, whatever the information supply or format.

Various assertion codecs

Banks use completely different types and codecs for his or her statements, making standardized information extraction troublesome. A library of templates for generally used financial institution assertion codecs will help streamline the method in case you are presently utilizing or planning to undertake a template-based information extraction software.

Within the case of superior clever doc processing (IDP) instruments similar to Nanonets, the AI fashions robotically adapt to numerous templates and will help overcome this problem.

Poor supply high quality

Poor-quality scans can result in low accuracy in information extraction. Put money into high-quality scanning tools for bodily statements and use picture preprocessing methods to reinforce doc high quality earlier than extraction. AI algorithms able to dealing with low-quality inputs can considerably enhance accuracy.

A number of currencies and worldwide requirements

For corporations working throughout completely different nations, dealing with a number of currencies and ranging financial institution varieties provides one other layer of complexity. Monetary requirements and terminologies can differ from one nation to a different, making information extraction and harmonization a little bit of a problem.

Use superior instruments that include built-in forex conversion capabilities and implement a standardized chart of accounts to accommodate worldwide variations. Leverage AI instruments that may acknowledge and categorize transactions throughout completely different languages and currencies.

Guaranteeing information safety and compliance

Lastly, safeguarding information safety and making certain compliance with laws like GDPR or HIPAA (in healthcare) is essential. Monetary data is delicate, and managing compliance might be difficult.

Select a reputed software program resolution with sturdy encryption and compliance certifications. Implement strict entry controls and audit trails for all monetary information and frequently practice employees on information safety finest practices.

Trade purposes of financial institution assertion evaluation and its automation

Financial institution assertion evaluation is used throughout many industries for monetary administration and decision-making. Under are some key examples of how completely different sectors use financial institution assertion evaluation and methods during which automation will help:

Banking and monetary providers

- Confirm earnings and money movement patterns for mortgage purposes

- Detect irregular transactions or potential cash laundering actions

- Analyze spending habits to supply customized monetary merchandise

- Assess debt-to-income ratio for credit score choices

- Assess mortgage candidates’ creditworthiness

- Consider shopper corporations’ money movement for valuations

- Assess monetary stability for mergers and acquisitions

💡

Automation resolution: AI-powered instruments can analyze hundreds of thousands of financial institution statements shortly, extracting key monetary indicators and flagging potential dangers. Machine studying algorithms can predict creditworthiness primarily based on transaction patterns, considerably dashing up mortgage approval processes.

Insurance coverage

- Confirm earnings for insurance coverage premium calculations

- Detect potential insurance coverage fraud by analyzing transaction patterns

- Assess monetary stability for high-value coverage purposes

- Confirm claims by cross-referencing with financial institution assertion transactions

- Assessing shoppers’ monetary standing.

💡

Automation resolution: Automated programs can shortly establish discrepancies between claimed and precise monetary conditions by figuring out patterns between financial institution statements. AI can flag suspicious transaction patterns which will point out fraudulent claims.

Taxation and accounting

- Establish undisclosed earnings sources by analyzing deposit patterns

- Confirm reported money transactions in opposition to financial institution deposits

- Analyze the timing of earnings receipts for tax planning

- Detect potential structuring actions to keep away from reporting thresholds

- Routinely categorize earnings sources and bills

- Establish potential tax deductions from transaction information

💡

Automation resolution: Machine studying fashions can establish uncommon patterns indicating undisclosed earnings or suspicious actions whereas adapting to industry-specific expense patterns for correct categorization. NLP interprets transaction descriptions, precisely categorizing ambiguous entries.

Retail and e-commerce

- Analyze buyer refund and chargeback patterns

- Confirm service provider settlements in opposition to financial institution deposits

- Detect potential worker theft by analyzing POS information in opposition to deposits

- Analyze seasonal money movement patterns for stock planning

💡

Automation resolution: AI-driven financial institution assertion evaluation instruments can robotically reconcile gross sales information with financial institution deposits, flagging discrepancies which may point out worker theft or technical points. Machine studying algorithms analyze seasonal transaction patterns, offering priceless information for stock and money movement administration. This automation permits retailers to shortly establish and deal with monetary irregularities whereas optimizing their operations.

Actual property

- Confirm rental earnings for property traders

- Analyze emptiness influence on money movement from financial institution statements

- Detect potential tenant fraud by analyzing their financial institution statements

- Confirm property administration price deductions

💡

Healthcare

- Reconcile insurance coverage funds with affected person accounts

- Analyze cost patterns for various remedy varieties

- Detect potential insurance coverage fraud by analyzing cost histories

- Observe timing of medicare/medicaid deposits

💡

Non-profit organizations

- Observe and categorize donations by supply and objective

- Analyze the timing of grant funds for money movement administration

- Detect potential misuse of funds by analyzing expense patterns

- Reconcile fundraising occasion revenues with financial institution deposits

💡

Automation resolution: AI algorithms can categorize incoming funds by supply and objective, producing detailed experiences for donors and regulators. By analyzing expense patterns, organizations can flag potential misuse of funds and improve accountability.

Authorities businesses

- Reconcile tax funds with taxpayer accounts

- Analyze timing of federal or state fund deposits

- Detect potential embezzlement by analyzing transaction patterns

- Observe grant fund utilization via recipient financial institution statements

💡

Automation resolution: AI-powered financial institution assertion evaluation considerably enhances monetary oversight in authorities businesses. These programs can course of huge quantities of transaction information, robotically reconciling funds with taxpayer accounts and figuring out potential misuse of funds. ML fashions can detect refined patterns which may point out embezzlement or fraud.