The large image: If Trump had been to implement his proposed tariffs upon changing into president once more, it will considerably reshape the panorama of client electronics within the US. Financial coverage discussions can usually appear summary, but it surely’s necessary to know the real-world penalties these tariffs might deliver.

In June, sixteen Nobel Prize-winning economists signed a letter expressing concern that Donald Trump’s proposals might reignite inflation, which is at present nearing the Federal Reserve’s 2 p.c goal after surging to 9.1 p.c in 2022.

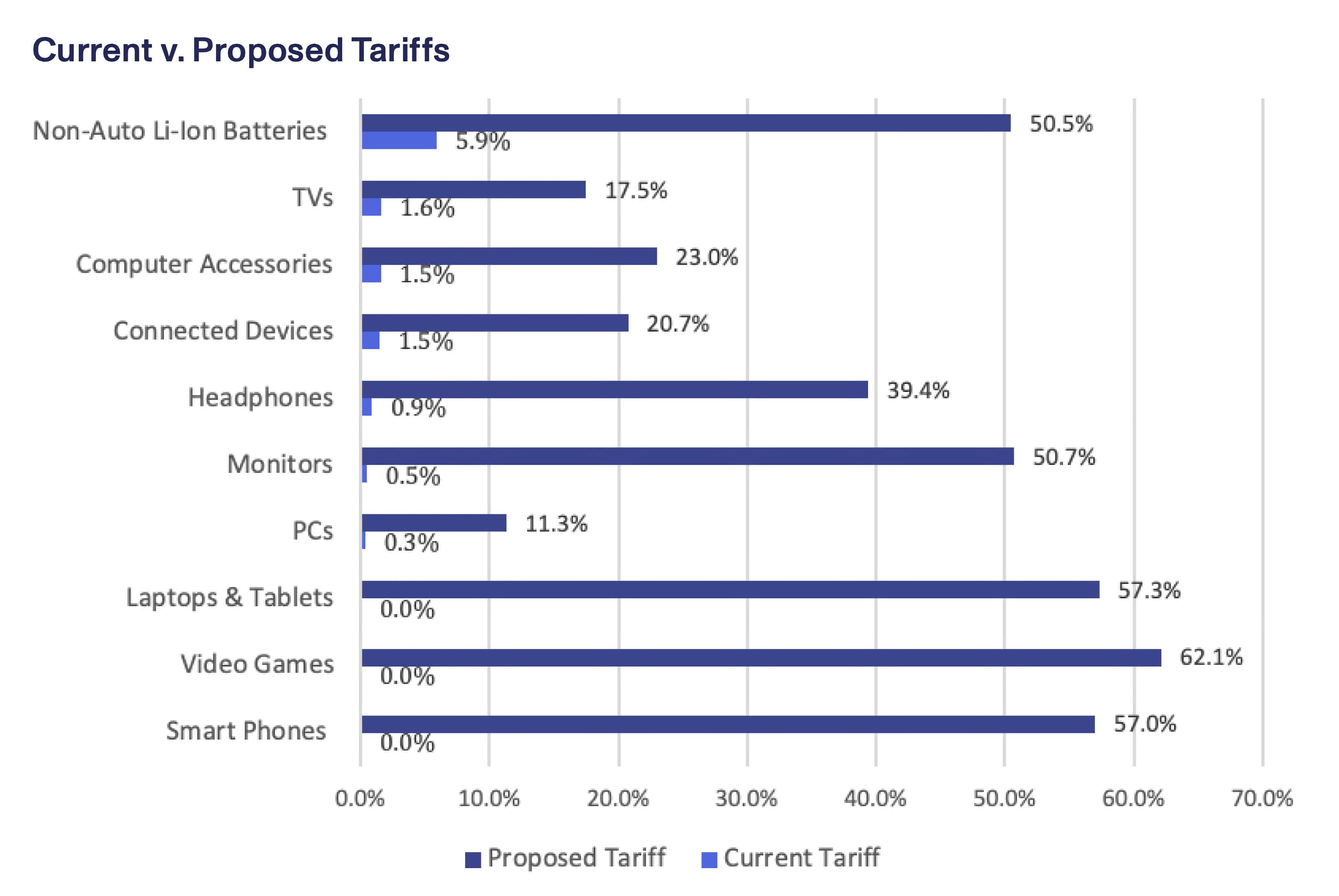

They had been primarily referring to his plans to impose tariffs of 10 to twenty p.c on imported items, together with a particular 60 p.c tariff on imports from China, aimed toward encouraging the return of producing to the US.

It’s unclear whether or not producers would pull up stakes and transfer again to the US in response, however what is definite is that these tariffs will result in larger costs on imports, and that features digital merchandise resembling laptops, smartphones, screens, desktop computer systems and TVs, most of that are primarily manufactured in China.

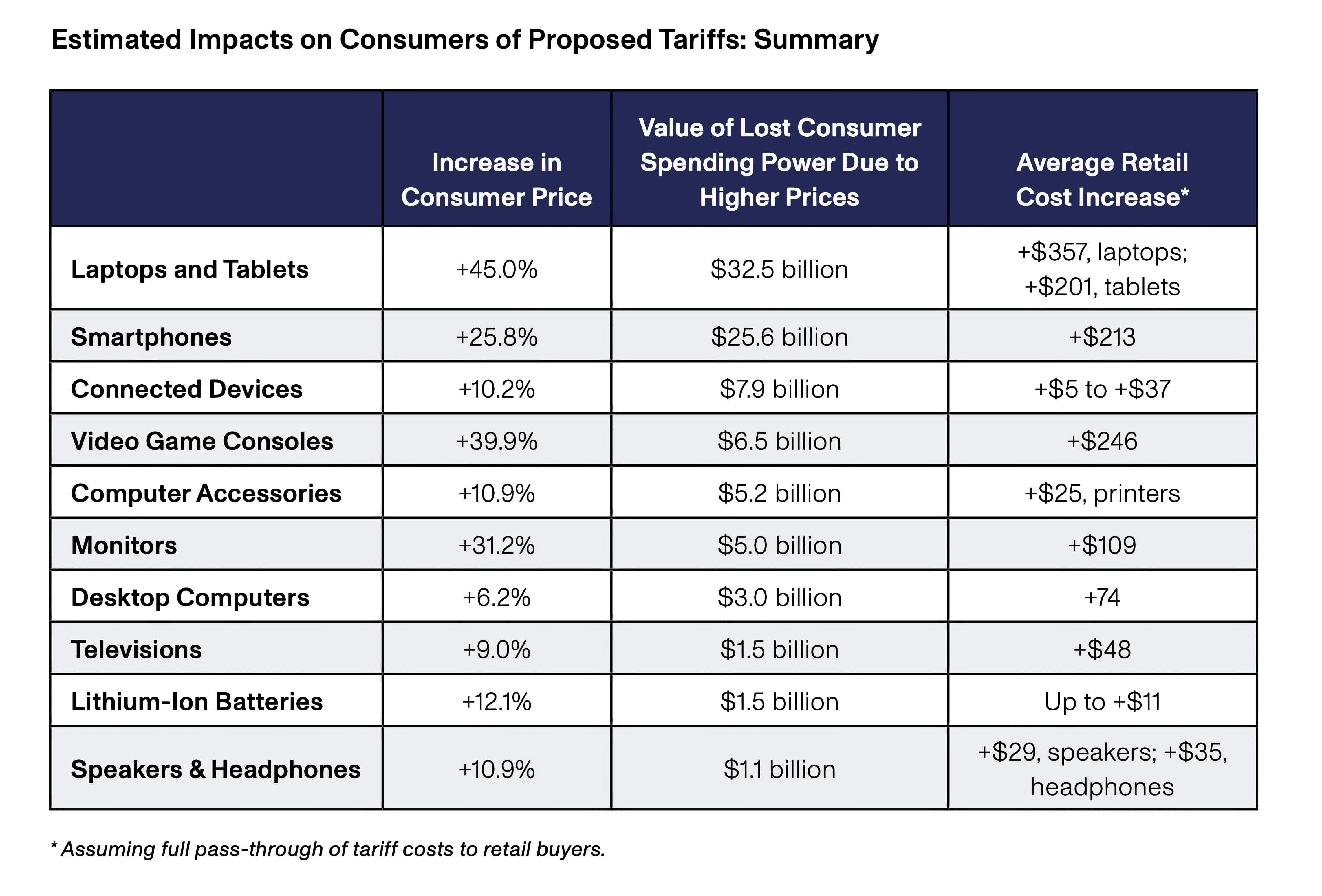

In line with a current Shopper Know-how Affiliation (CTA) report, a ten p.c international tariff mixed with a 60 p.c China-specific tariff might improve laptop computer costs by 45 p.c. As an example, a laptop computer at present priced at $793 would price customers a further $357. Premium fashions might see even better will increase, including $450 for each $1,000 of present pricing.

The CTA, in partnership with Commerce Partnership Worldwide (TPW), has projected vital worth hikes throughout a variety of merchandise. Smartphone prices are anticipated to rise by 25.8 p.c, whereas screens are anticipated to see a 31.2 p.c improve.

Recreation consoles, that are primarily made in China, might expertise a considerable 39.9 p.c bounce. In distinction, desktop PCs, which rely much less on Chinese language manufacturing, are projected to have a extra modest rise of 6 p.c. The general price of electronics might improve by $90 billion yearly, inflicting gross sales to fall undoubtedly.

The proposed tariffs might have far-reaching results past larger client costs. The Tax Basis estimates {that a} 10 p.c common tariff, plus a 60 p.c China tariff, might decrease GDP by 0.8% and doubtlessly price 1.4 million full-time jobs over time.

As is usually the case when tariffs are imposed, different international locations might introduce retaliatory measures, which might additional impression the US financial system.

In the meantime, it’s unsure whether or not Trump’s said aim of bringing manufacturing again to US shores will likely be completed by means of tariffs. Most specialists will inform you that shifting manufacturing away from China is neither easy nor fast for producers. It might take years for firms to determine new amenities and provide chains in various international locations like India, Vietnam, or Mexico.

It is necessary to notice that Trump might impose these tariffs with little resistance, even when Congress objected. Not like many different financial insurance policies, a US president can implement tariffs with out requiring congressional approval.

There’s, after all, the chance that the tariff proposals are a part of a broader negotiating technique – a option to create leverage in worldwide discussions. The specter of tariffs can be utilized as a bargaining chip, giving the US a stronger preliminary place in negotiations. Throughout his first time period, Trump usually used the specter of tariffs as a negotiating software with numerous international locations, with blended outcomes.

Trump’s stance on tariffs might also be a political tactic. Robust commerce discuss resonates with sure voter teams who really feel that present commerce insurance policies have damage American employees.

It is also potential that Trump intends to impose tariffs however at decrease charges than at present proposed. By citing excessive measures like 50 p.c tariffs, smaller tariffs could appear extra affordable by comparability.