DeFi, or Decentralized Finance, is a broad notion that refers to monetary providers made on and supplied by a blockchain.

They sometimes make the most of cryptocurrencies to course of operations and are available beneath ideas of eliminating the intermediary, i.e., monetary establishments or governments.

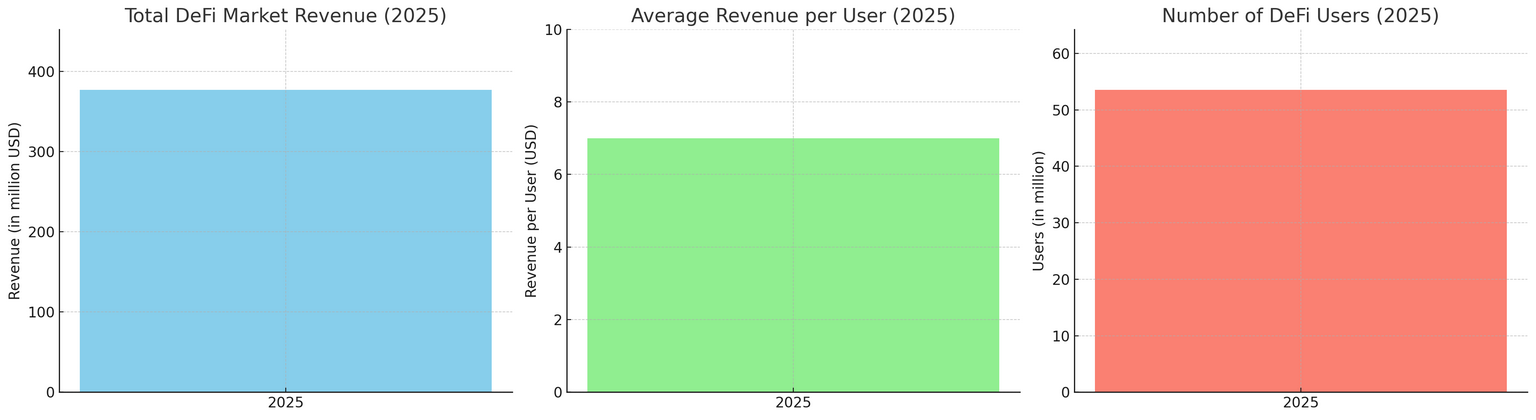

Decentralized finance is a fairly huge area (53.56m customers; $376.9m whole value). It has a big concentrate on totally different monetary providers, similar to lending and borrowing, funds, cash alternate, and plenty of extra.

However probably the most sought-after service on this ecosystem is staking, a mannequin that enables customers to earn passive earnings whereas supporting the safety and operation of blockchain networks.

How Does DeFi Staking Work?

Staking is the method of locking up cryptocurrency inside a blockchain community to safe its operation in return for being rewarded.

It’s primarily useful on Proof of Stake (PoS) blockchains, the place folks “stake” their cash in good contracts and receives a commission out in intervals primarily based upon how a lot and the way lengthy they stake.

For instance, an individual can stake 10 ETH on Ethereum 2.0 and earn about 4–6% yearly, or stake SOL on Solana via a validator and earn staking rewards every single day. Usually talking, the longer and bigger the stake, the higher the potential return.

Staking will be performed fairly otherwise, relying on the “dose” of management and participation stakers would need to have:

- Essentially the most sensible strategy is direct staking, by which customers tie up their crypto on the blockchain to help with its maintenance after which obtain rewards for it. It normally calls for a big quantity of crypto and a few tech setup. For instance, staking on Ethereum 2.0 requires having your individual validator and a minimal of 32 ETH.

- Delegated staking is much less technical. You merely select a trusted validator and allow them to stake your tokens for you. You obtain your portion of the rewards, however you don’t run something your self. An instance that’s broadly used is staking SOL on Solana utilizing the Phantom pockets.

- Pool staking is a kind the place folks come collectively and unite their tokens into one pool. This mannequin offers an opportunity of getting rewards distributed to all of the members.

- Staking primarily based on alternate is when massive cryptocurrency exchanges supply customers the power to stake their tokens via their providers. All they should do is press a button to start out accumulating rewards, however they need to belief the alternate with their holdings.

Advantages of Crypto Staking for Customers and Companies

On the floor, the plain usefulness of staking is just for the top customers of decentralized platforms as a result of, in any case, it provides a solution to earn passive earnings simply by holding tokens.

Certainly, staking will be equally helpful for each DeFi members and companies in some ways.

For instance, are you aware that over 58,000 Bitcoins are presently staked, representing a staking market cap of round $6 billion? That’s a really telling signal that hundreds of customers assume the rewards are greater than ample to cowl the dangers.

If staking have been such a loss-making exercise, it’s unlikely that so many members would conform to expertise it.

For Customers

To start with, staking permits people to make passive earnings simply by holding and immobilizing their cryptocurrency. As an alternative of getting their cash sit idle in a crypto pockets, they’ll stake them and obtain advantages in the long term (as they’d in a financial institution incomes curiosity).

Secondly, staking permits customers to put money into these initiatives they’re considering. Nearly all of staking platforms supply governance functionality, thus folks can forged their votes on essential choices and set the course of the challenge.

Moreover that, most staking options are non-custodial, so clients retain full management of their possessions whereas gathering rewards.

For Companies

From a enterprise standpoint, staking is an effective way to contain and retain customers. If customers are rewarded commonly for possessing a token, then they’re more likely to stick round on the platform.

Moreover, staking has the impact of decreasing the circulating provide of tokens, therefore making costs extra steady and market situations extra wholesome.

Along with that, companies may achieve additional earnings from staking charges with smaller sums or via getting into into reward-sharing preparations. Particularly with DeFi, staking can be utilized to lure additional liquidity and encourage person interplay on the location.

What Is a DeFi Staking Platform?

A DeFi staking platform is a decentralized utility/hub/software program that lets customers lock up their crypto acquisitions to assist help the community or liquidity pool, in alternate for incomes dividends (normally curiosity, governance tokens, or a portion of transaction charges).

Key Options of a DeFi Staking Platform

Because the title suggests, the important thing characteristic of the staking platform is the power to stake for a reward. However is that this sufficient to achieve the crypto market?

Not likely. Sure, typically much less is extra. Nevertheless, to face out and achieve success with customers, it’s essential to develop the vary of performance.

A very powerful characteristic of any platform is good contract improvement. Good contracts autonomously direct each a part of staking, from locking tokens and giving out rewards to imposing the situations and limitations.

Subsequent, it’s good to have help for a lot of totally different cryptocurrencies. Customers can stake totally different cash similar to ETH, SOL, or BNB, plus particular tokens from liquidity swimming pools or companions. The extra choices accessible, the extra customers the platform can entice.

Moreover, the platform ought to have instruments that present customers how a lot they’ll earn. These calculators estimate rewards primarily based on how a lot crypto is staked and for the way lengthy, and so they replace in actual time so customers can see their earnings develop.

To make the platform higher with out making it too overloaded, it’s good so as to add reminders and alerts about staking, referral bonuses for inviting mates, and a easy dashboard that reveals earnings. These small extras can preserve customers and assist them perceive their progress.

Methods to Construct a DeFi Staking Platform – Step-by-Step

As with every software program, creating a Defi platform requires a prudent strategy. However as with all comparable endeavor, breaking the complete course of down into smaller phases will assist make the complete journey extra painless.

1. Market Analysis & Enterprise Planning

Earlier than coding a single line, begin by fulfilling market evaluation. Analysis the competitors, observe what the customers require (e.g., vary of APY, token sorts, pockets preferences), and level out what your platform does uniquely.

Subsequent, develop a marketing strategy together with your income mannequin, tokenomics, roadmap, and regulatory scheme.

2. Selecting the Blockchain (Ethereum, BSC, Solana, and so forth.)

After that, choose the blockchain community that greatest serves your situations. Ethereum, as an example, has the richest ecosystem, whereas BNB Good Chain provides quicker and extra reasonably priced transactions.

Solana, in flip, has excessive speeds and scalability. By and huge, this choice will affect good contract improvement, person expertise, in addition to total expense.

3. UI/UX and Frontend Design

The following step is to determine on the design to make staking easy for all person ranges. The platform ought to present stay information (like APY, rewards, and token balances), supply staking calculators, and help pockets connections from each desktop and cell.

4. Accomplice With a DeFi Staking Platform Improvement Firm

With a purpose to have a good staking platform, it’s advisable to outsource the method to an organization specialised in DeFi improvement providers.

They won’t solely perform the technical half but in addition create a wholly custom-made product that goes consistent with model identification, tokenomics, and person expectations.

Partnering with a DeFi staking improvement firm additionally means quicker time-to-market as a result of blockchain builders usually use ready-made parts.

Moreover, you obtain safety and compliance embedded from the start, which diminishes dangers and complies with laws. Lastly, the corporate will proceed to help you so your platform operates properly and expands as extra people join.

5. Testing, Safety Audits, and Deployment

After improvement and earlier than launch, it’s mandatory to check the software program inside and outdoors, in addition to audit good contracts by a trusted third-party agency. When all the pieces is prepared, the platform will be deployed to the mainnet.

6. Submit-launch Assist & Token Administration

Launching the platform doesn’t imply the top of improvement. You’ll want to observe efficiency, reply to person ideas, roll out upgrades, and management token provide and staking rewards.

Recurring updates, substantial help, and clear communication will assist your platform develop and make customers return.

Profitable DeFi Staking Tasks You Can Check with When Making Your Personal Software program

When creating software program, it’s usually tough to get began as a result of it’s not clear in any respect by which course to maneuver.

well-known DeFi staking initiatives can provide you a greater thought of what works, what customers count on, and how one can construct a platform that stands out from others.

1. Lido Finance (Ethereum, Solana, Polygon)

Lido is a prime liquid staking platform. It permits customers to stake ETH and different tokens with liquidity by minting stTokens (e.g., stETH). The tokens can be found throughout DeFi protocols to be lent, traded, or farmed.

- TVL (Whole worth locked): Greater than $28 billion at its peak

- Blockchain: Ethereum, Solana, Polygon, and others

- Key characteristic: Liquid staking + extensive DeFi integration

2. Rocket Pool (Ethereum)

Rocket Pool is straight centered on decentralized Ethereum staking and permits customers to stake small portions of ETH. Node operators can run their very own validators with decrease capital necessities, whereas common customers can stake ETH via a pool.

- TVL: Roughly $3 billion

- Blockchain: Ethereum

- Main characteristic: Decentralized node operation and low-stake involvement

3. PancakeSwap Staking (BSC)

As a part of its DeFi bundle, PancakeSwap provides staking by way of Syrup Swimming pools (we’ve already talked about it above). Customers can stake CAKE tokens to earn rewards in CAKE or different associate tokens.

- TVL: $1–2 billion+

- Blockchain: BNB Good Chain (BSC)

- Main attribute: Easy staking UI and cross-token reward swimming pools

Value of Constructing a DeFi Staking Platform

The cornerstone of any improvement challenge is all the time value. The price of making a DeFi staking platform can range quite a bit, relying on what parts you need, how protected it should be, and which blockchain you select.

Value Standards

There are a number of issues that have an effect on the ultimate value:

- Expertise stack – Totally different blockchains (Ethereum, Solana, and so forth.) and instruments usually have totally different improvement and fuel prices.

- Safety – Good contract auditing is a sheer requirement and could also be costly, but it surely retains customers protected and prevents them from being hacked.

- Design and person expertise – Clear, intuitive screens and dashboards add to the price but in addition to person attraction and retention.

- Customized options – Customized components similar to multi-token help, governance, or particular reward programs will be cost- and time-intensive to create, however they straight affect your individuality.

Approximate Finances Estimates

Thus, in case you are creating an MVP with easy staking, pockets integration, and a minimalist interface, it could value you between $40,000 and $70,000.

A totally featured platform with {custom} design, multi-token help, refined good contracts, audits, and governance instruments can value between $100,000 and $250,000 or extra, relying on a mixture of parts.

| Platform Kind | Included Options | Estimated Value Vary |

| Primary MVP | Easy staking, pockets integration, minimal UI | $40,000 – $70,000 |

| Normal Platform | Higher UI/UX, fundamental analytics, help for one token | $70,000 – $120,000 |

| Superior Platform | Multi-token help, good contract audit, {custom} reward logic | $120,000 – $180,000 |

| Enterprise-Grade Answer | Customized UI/UX, full governance, audits, advanced good contracts, scalability instruments | $180,000 – $250,000+ |

Why Select SCAND as a DeFi Staking Platform Improvement Firm?

If you wish to construct a DeFi staking platform, SCAND is a good associate to work with. We have now greater than 20 years of software program improvement expertise and a powerful staff of Web3 and blockchain expertise specialists.

Our builders know find out how to create protected and correct good contracts, join crypto wallets, and produce user-oriented Web3 improvement options. We work with main blockchains and use trusted instruments like Solidity and Web3.js.

Moreover, we care for each step of improvement, from planning and design to testing, launch, and help. Once you work with us, you get a devoted staff, clear communication, and an answer that’s able to develop with you.

FAQs About DeFi Staking Platform Improvement

Q: What’s the greatest blockchain for staking platforms?

A: It is dependent upon what you are attempting to do. Ethereum is well-tested and trusted, however expensive. BSC and Polygon are faster and cheaper. Solana is greatest for high-frequency apps.

Q: How a lot does it value to create a staking platform?

A: Once more, it is dependent upon many standards. MVPs begin at $40,000. A totally useful staking platform will be over $100,000 primarily based on complexity.

Q: Can I combine a number of tokens and rewards?

A: Sure, if wanted, we are able to combine multi-token staking and customizable reward logic into the good contracts.

Q: Is it attainable to run a staking platform legally?

A: That is dependent upon the world you might be in and the legal guidelines it adheres to. In sure areas, staking is a monetary service. In some territories, it may be thought to be an criminality. We suggest that you simply research the laws or contact specialised professionals for recommendation.