Join every day information updates from CleanTechnica on e-mail. Or observe us on Google Information!

Any of our readers who’ve been following my studies know that Latin America’s EV gross sales are rising. In some international locations, they is probably not rising as quick as we would want; in others, they’re quicker than we ever anticipated; however the development stays clear regardless.

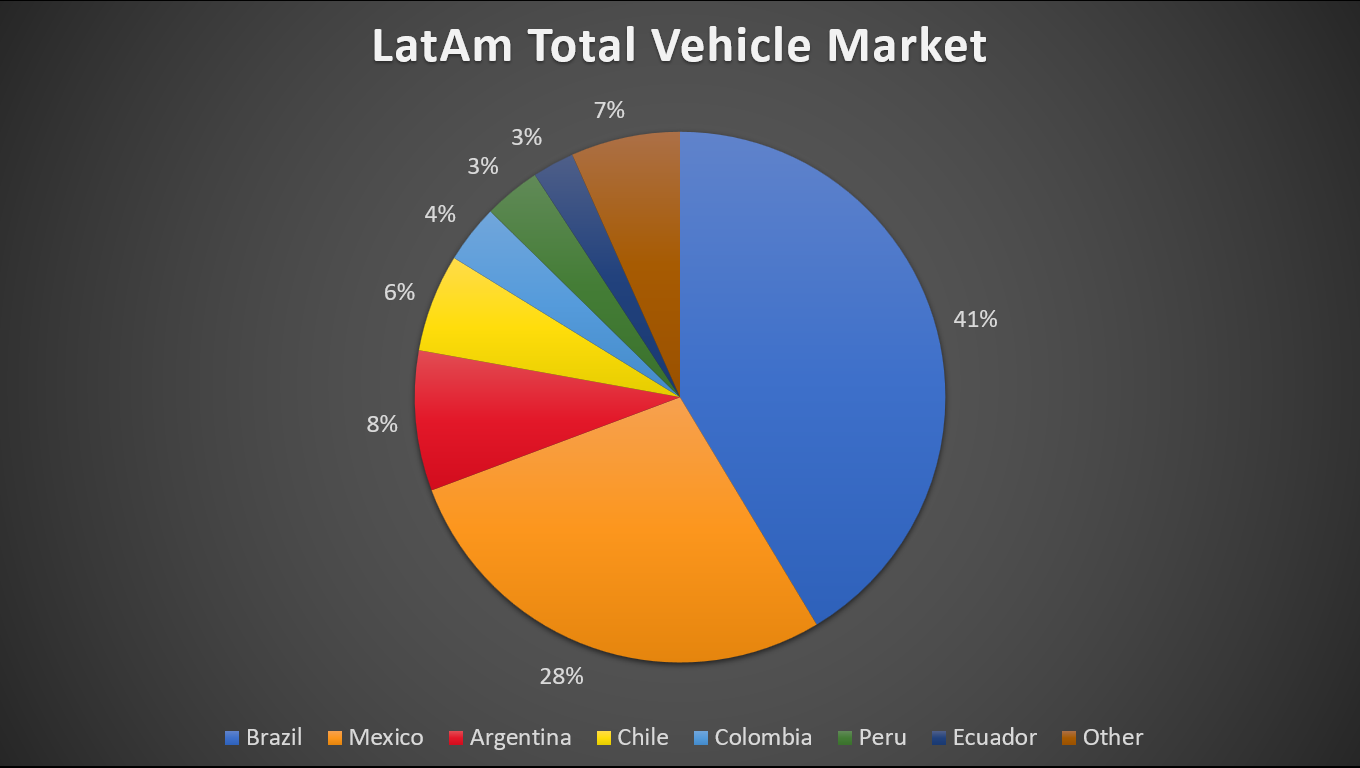

Latin America’s* market quantities to some 5 million autos a 12 months, 70% of which corresponds to solely two international locations (Brazil and Mexico), with one other 20% belonging to 4 international locations (Argentina, Chile, Colombia, and Peru). The remaining 10% is left to a different dozen international locations or so. (*Minus the Caribbean, which isn’t a giant market in any case.)

The area can also be recognized for being extremely protectionist, with tariffs to advertise native trade, be it by stress from the US (as is the case of Mexico) or due to a regional curiosity (as is the case in Brazil, Argentina, Uruguay, Ecuador, Colombia, and Peru). Which means that native manufacturing is crucial if the EV revolution is to succeed. So, how are issues occurring that entrance?

It ought to come as no shock that the 2 largest markets, and two largest producers, are additionally the 2 pioneers in EV manufacturing in Latin America: Mexico and Brazil. Collectively, these two international locations account for at the least 5 vegetation already producing EVs, and at the least six arising with manufacturing deliberate previous to 2027.

Their tales, nevertheless, are very completely different.

Mexico

Mexico is a globalized participant, a particularly aggressive producer, key to the huge North American market due to the defunct NAFTA and the USMEC that changed it. Mexico has free-trade agreements with half the world and it has turn into a hub for manufacturing and innovation. As such, the nation began its journey as an EV producer when legacy auto began pivoting to EVs, beginning in 2019 when Ford began to provide the Mustang Mach-E.

Again then, China was simply one other participant so far as EVs went. BYD had not but introduced its Blade Battery, Chinese language EV adoption was struggling the blues from a sudden discount on incentives, and the technique of a number of legacy manufacturers nonetheless appeared affordable. China, although already the most important EV market on this planet, was not but the behemoth posed to overcome the globe and destroy legacy auto and their ICEVs.

Which means that Mexico’s early begin was not influenced by the (now) omnipresent presence of Chinese language EV manufacturers, as an alternative being led by legacy auto aiming to get a bigger reduce on this rising market. These days, Mexico’s EV manufacturing is closely skewed in the direction of legacy auto, with Ford, GM, and Stellantis main in manufacturing, and JAC standing far behind them.

JAC’s case is kind of specific. Mexico’s richest man, Carlos Slim, needed to get in on the enterprise of automotive manufacturing and determined to decide on JAC as his companion. Preliminary operations again in 2017 targeted primarily on ICEV fashions. Even at this time, EVs correspond to only one/6 of JAC’s complete meeting in Mexico.

Which means that the Chinese language are literally latecomers in Mexico so far as EV manufacturing goes: Dongfeng (by way of its ally SEV), BYD and Jetour are solely beginning manufacturing within the subsequent two or three years. MG can also be all for turning Mexico into a neighborhood growth and manufacturing middle, however the announcement was made in August and there’s no info on timing but.

Now, this doesn’t imply that legacy auto is protected, nor that the Chinese language gained’t reach Mexican lands, in fact. However it does imply that alongside these Chinese language manufacturers, some legacy manufacturers have additionally made Mexico a cornerstone of their EV plans: Kia is anticipated to begin the manufacturing of its Kia EV3 in some unspecified time in the future sooner or later, and BMW has made Mexico one of many major epicenters of its Neue Klasse platform, which needs to be up and working by 2026.

Total, nevertheless, the indeniable leaders so far as EV manufacturing goes in Mexico are GM and Ford, as the information for August clearly reveals (with an undetermined variety of RAM Promaster EVs, which sadly isn’t listed individually from the ICEV model):

Apart from these, 7 Worldwide and 10 Kenworth EV Vans have been constructed final month.

One final line of thought: with the Ultium siblings roughly cruising at 10,000 models produced a month, plus the Lyriq and the Honda Prologue within the US, and the upcoming Optiq, I really feel GM is probably not too distant from the magic quantity so far as EV profitability goes (which is 300,000 a 12 months in response to Hyundai, 500,000 in response to BYD).

Brazil

Not like Mexico, Brazil is a much less globalized market, with manufacturing targeted on South America. Although, it’s additionally closely protected, on this case being the most important member of Mercosur. Brazil didn’t have early curiosity in EVs, and due to this fact its progress on this path has been solely influenced by the arrival of Chinese language manufacturers.

Like in Mexico, a few of these manufacturers already arrived up to now decade with ICEV choices and are actually pivoting to EVs (Nice Wall Motors and Chery), whereas BYD arrived in 2023 and targeted solely on EVs. Some legacy auto corporations have claimed curiosity in constructing EVs in Brazil, however for now, these three Chinese language corporations are the one ones set on doing it within the subsequent three years.

Brazil can also be a vital marketplace for flexi-fuel autos (maybe a very powerful one on this planet), so there’s an enormous ethanol foyer all for making biofuel the way forward for zero-emissions transportation, as an alternative of electrical energy.

Apart from Mexico and Brazil, EV manufacturing is proscribed to the meeting of two-wheelers, three-wheelers, and some native manufacturers of quadricycles (together with Quantum in Bolivia, Tito in Argentina, and Eolo in Colombia) that solely promote a couple of hundred models a month at most, and a dozen at worst. The absence of aggressive EVs in these segments (one thing evident of their small gross sales numbers) is frankly worrying, and notably so within the case of two-wheelers, which haven’t improved their value-for-money within the area in six years. Electrical vehicles maintain getting cheaper and higher, however electrical bikes are utterly stagnant … and the latter are way more necessary to bringing EV manufacturing to smaller international locations.

Ultimately, I did give attention to BEVs for this evaluation, as I discovered it a lot more durable to get numbers for PHEVs, lots of that are additionally constructed as HEVs and ICEVs.

Have a tip for CleanTechnica? Wish to promote? Wish to counsel a visitor for our CleanTech Speak podcast? Contact us right here.

Newest CleanTechnica.TV Movies

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.

CleanTechnica’s Remark Coverage