Scams

What are a few of the commonest giveaway indicators that the individual behind the display or on the opposite finish of the road isn’t who they declare to be?

18 Apr 2024

•

,

5 min. learn

Our world is changing into extra impersonal because it turns into extra digital-centric. And since we are able to’t see the individual or group on the different finish of an e mail, social media message or textual content, it’s simpler for scammers to fake to be one thing or somebody they’re not. That is impersonation fraud, and it’s quick changing into one of many highest earners for cybercriminals. Based on the FTC, scammers impersonating companies and governments made $1.1 billion from their victims in 2023.

Impersonation fraud can take many kinds, however along with your eyes on the tell-tale indicators of a rip-off, your private info and hard-earned cash will stay beneath lock and key.

What does impersonation fraud appear like?

Like most fraud, impersonation scams are designed to get you to ship the unhealthy guys cash, or private/monetary particulars which they will both promote on the darkish net or use themselves to commit id fraud. Phishing is maybe the obvious taste of impersonation fraud: a scammer contacting you pretending to be a trusted entity requesting cash or info.

However there are different varieties. Pretend social media accounts are a rising problem; used to unfold rip-off hyperlinks and too-good-to-be-true presents. And pretend cellular apps may impersonate respectable apps to reap private data, flood your display with advertisements or enroll you in premium-rate providers.

Impersonation scams are additionally evolving. Based on the FTC, they more and more blur channels and methods, in order that “a faux Amazon worker may switch you to a faux financial institution or perhaps a faux FBI or FTC worker for faux assist.”

How one can spot the scammers

Opposite to fashionable perception, it’s not simply the aged who’re in danger from impersonation scams. Analysis within the UK discovered that folks beneath 35 usually tend to have been focused by and fallen for any such fraud. With that in thoughts, look out for these warning indicators:

- Requests for cash: A message on e mail, textual content or DM from somebody purporting to be an in depth member of the family or contact. They’ll request pressing monetary help attributable to some excuse resembling they’re stranded abroad or wanted medical assist. Fraudsters can hijack respectable social media and e mail accounts to make it appear as if it’s actually your good friend/member of the family contacting you.

- Distant entry: In tech assist fraud, an official from a tech firm, telco or different legitimate-seeming group requires entry to your pc for some made-up motive resembling it’s compromised with malware.

- Entry to your account: A police officer or authorities official contacts you out of the blue claiming cash in your account must be analyzed as a part of an investigation into cash laundering, drug smuggling or another critical crime. They provide to ‘preserve it protected’ by shifting it elsewhere.

- Stress: The individual on the opposite finish of the telephone, e mail, textual content or social media channel pressures you to behave instantly. They’ll attempt to panic you into making a call with out considering – resembling sending cash to a good friend at risk, or transferring urgently to a authorities official. It’s a traditional social engineering approach – generally even performed in individual or with a doubtlessly horrifying twist courtesy of AI instruments that may be co-opted to perpetrate digital kidnapping scams.

- Pretend couriers retrieving cash: An official presents to ship a courier to return to your own home deal with to choose up money, playing cards, priceless gadgets or PINs beneath all kinds of faux pretexts, resembling serving to your relative get out of bother or to resolve a dodgy cost in your financial institution card.

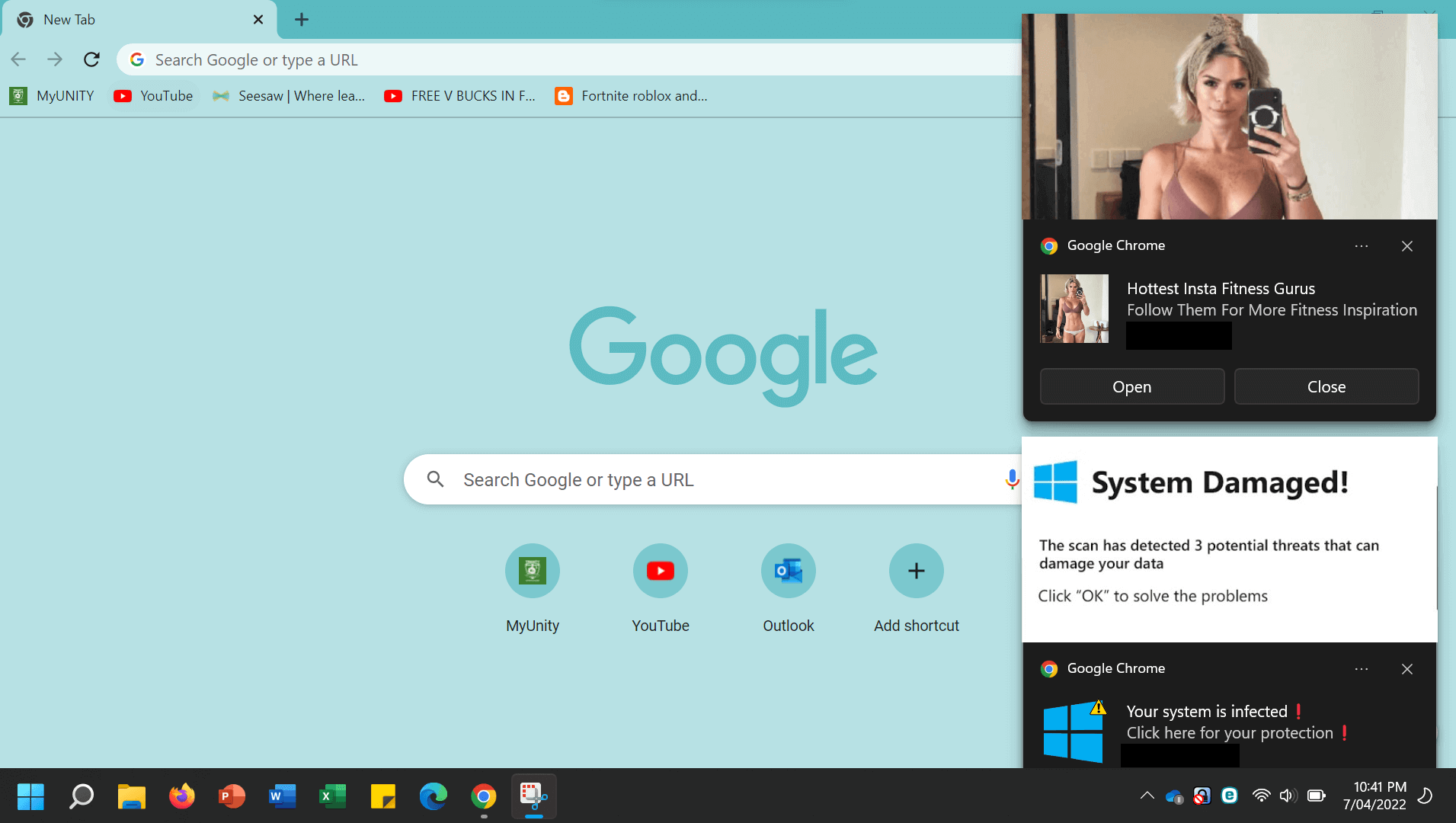

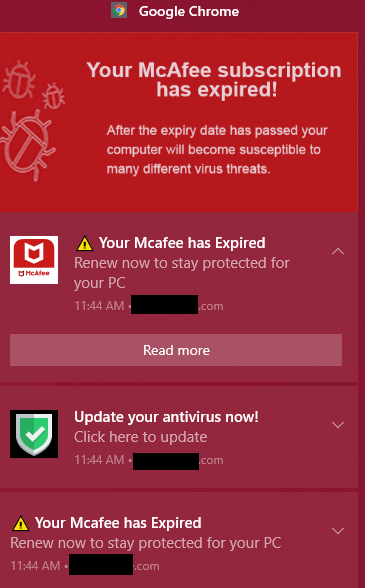

- Account safety alerts: These faux notifications typically require you to ‘verify’ your particulars first – one other method for scammers to pay money for your private and monetary info.

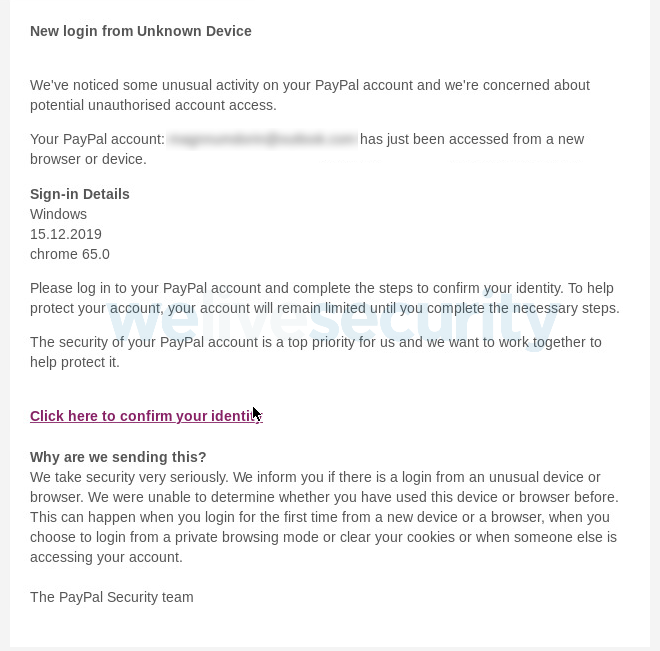

- Uncommon messages: Phishing emails typically comprise inconsistencies which mark them out as impersonation fraud. Scammers will attempt to spoof the show title to impersonate the sender. However by hovering over the title, you may see the masked e mail deal with beneath, which can be an unofficial-looking one. Remember, nevertheless, that scammers can even hijack respectable e mail accounts and use caller ID spoofing to make it tougher to inform the actual from the faux.

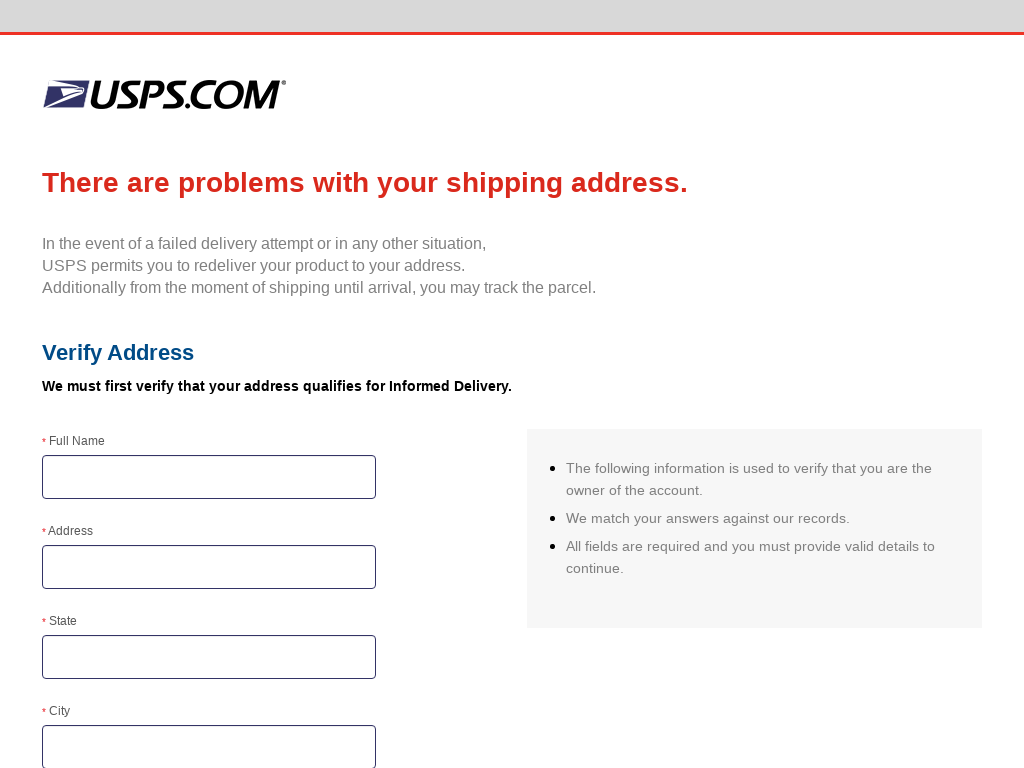

- Pretend supply points: Official-looking postal/logistics corporations demand that you just pay a small price or hand over financial institution particulars to allow protected supply of your non-existent parcel. In different eventualities, fraudsters will pose as a well known supply service and provide you with a warning of ‘issues’ along with your bundle.

- Present playing cards: You’re requested to pay fines or one-off charges by shopping for high-value gadgets or present playing cards. The scammer needs you to do that slightly than a financial institution switch, because it’s far tougher to hint.

- Pretend subscription renewals: These could require you to attach the scammer to your pc to resume your subscription or course of a non-existent refund.

- Fictitious giveaways or reductions: These require you to pay a small ‘price’ in an effort to declare them. Evidently, there isn’t a reward or low cost as that is merely a variation on the advance price fraud.

- Uncommon language: One other tell-tale signal of phishing makes an attempt may very well be poor grammar and spelling or imprecise language in messages – though with fraudsters utilizing generative AI to create their faux messages, that is changing into much less frequent.

Keep alert

Bear in mind, impersonation scams are always evolving, so the above is actually not an exhaustive record. The following evolution in such scams is coming due to AI-powered deepfakes, which might mimic the voice and even look of a trusted particular person. These are already tricking workplace employees into making big-money company fund transfers to accounts beneath the management of cybercriminals. And the know-how is getting used to impersonate trusted people on social media in an effort to trick followers into making rash investments. As deepfakes change into cheaper and extra accessible, they may be utilized in smaller scale fraud.

With any impersonation fraud, the bottom line is: be skeptical, decelerate, and independently confirm they’re who they are saying they’re. Do that by reaching out to the group or particular person immediately, don’t reply to an e mail or telephone quantity listed on the preliminary message. And by no means hand over cash or private info except you’ve confirmed the contact is respectable.