Govt Abstract

On this weblog submit we discover how personal fairness (PE) corporations can leverage information intelligence to reinforce portfolio returns. We spotlight the challenges PE corporations face when buying new corporations, equivalent to information visibility, integration, and standardization points. The Databricks Information Intelligence Platform is introduced as an answer to those challenges, providing a unified and open cloud information platform, a knowledge lakehouse structure, AI and machine studying capabilities, and safe information sharing. By adopting Databricks, PE corporations can streamline operations, scale back prices, acquire deeper insights, and drive sustainable development throughout their portfolio corporations.

Introduction

Non-public fairness corporations are like elite private trainers for companies. They determine corporations that want a significant exercise, design custom-made train and diet plans, and remodel them into lean, high-performing powerhouses. By injecting capital, providing strategic teaching, and making use of operational self-discipline, PE corporations assist these portfolio corporations (PortCos) shed inefficiencies, bulk up on development methods, and finally attain peak monetary health. This transformation course of is important to a wholesome economic system, because it fuels innovation, drives development, and revitalizes underperforming companies.

Nonetheless, simply as trendy health coaching has developed from fundamental exercise routines to data-driven regimens, personal fairness should additionally step up its sport in right this moment’s fast-paced, data-driven world. To stay aggressive, PE corporations want greater than conventional approaches. They have to leverage the info they already maintain, mixed with superior know-how to streamline operations, optimize efficiency, and maximize returns. On this context, a strong information resolution like Databricks Information Intelligence Platform serves because the state-of-the-art health facility geared up with superior private coaching instruments, offering real-time insights, AI-driven suggestions, and seamless collaboration to assist PE corporations whip their portfolio corporations into prime form.

Not too long ago, we now have been collaborating with our associate Collibri Digital on delivering a number of profitable initiatives for personal fairness corporations and their portfolio corporations. Based mostly on this expertise, on this weblog submit we are going to present how the Databricks Information Intelligence Platform can act as a high-tech coaching facility to standardize information, increase productiveness, enhance insights, and drive sustainable development throughout a complete portfolio.

Challenges with Buying Portfolio Firms and the Want for Open Requirements, Interoperability and Standardization

When a non-public fairness agency acquires a brand new firm, it’s like a coach taking over a brand new consumer who’s been doing inconsistent exercises, consuming a haphazard food regimen, and logging health information on a bit of paper, or a number of, incompatible apps, and even, dare we are saying in an Excel spreadsheet. The primary hurdle is getting a transparent image of the consumer’s present health stage, habits, and targets, and for PE corporations, which means coping with information visibility, integration, and standardization challenges. Let’s discover a few of these challenges in additional element:

- Poor Information Visibility, Inconsistent Monetary Reporting and Integration Points: A standard challenge is the dearth of visibility right into a portfolio firm’s current information. Many corporations use disparate methods, starting from outdated on-premise platforms to trendy cloud-based options, creating fragmented and inconsistent information landscapes. This fragmentation makes it tough for personal fairness corporations to realize a holistic view of the corporate’s operations, funds, and buyer habits. With out built-in information, making knowledgeable, data-driven selections turns into time-consuming and inefficient. Figuring out key efficiency indicators (KPIs) throughout the portfolio and uncovering areas for enchancment is hampered by siloed, unstructured, or incomplete information.

- Siloed Information Throughout Departments and Places: Many portfolio corporations function in silos, with information unfold throughout totally different departments, methods, and even geographic places. This separation not solely creates inefficiencies when it comes to collaboration but additionally results in inconsistent reporting and information duplication, additional complicating efforts to streamline operations throughout the portfolio.

- Operational Incompatibilities: Each portfolio firm has its personal distinctive operational processes, usually utilizing totally different software program and cloud infrastructures (equivalent to AWS, Azure, or Google Cloud). Usually information is locked into some proprietary format hindering interoperability, portability, and environment friendly information sharing. These variations create friction when trying to ascertain a constant information administration strategy throughout the portfolio.

So with a purpose to unlock worth throughout a various portfolio, personal fairness corporations may need to standardize their information platforms and operations on a platform that’s constructed on open requirements, open protocols and extremely interoperable. This strategy brings a number of vital benefits. By consolidating information right into a unified platform, corporations can implement constant information governance insurance policies and acquire real-time visibility into all portfolio corporations. Standardization additionally facilitates extra environment friendly cross-portfolio analytics, permitting for simpler comparability of efficiency metrics throughout totally different corporations, which helps determine synergies and alternatives extra shortly. Moreover, a constant information platform minimizes redundant methods, streamlines reporting, and enhances operational effectivity throughout your complete portfolio.

That’s the place Databricks Information Intelligence Platform, which is constructed on open requirements and protocols, that’s extremely modular and extensible, presents an incredible resolution to those challenges. Subsequent, let’s talk about intimately how Databricks addresses these challenges.

The Information Intelligence Platform for Non-public Fairness

Within the face of those challenges, the Information Intelligence Platform presents a perfect resolution for personal fairness corporations trying to streamline their information platforms and operations. Databricks is a unified information intelligence platform that enables PE corporations to consolidate, handle, and analyze information throughout their portfolio corporations affordably, delivering deeper insights and driving higher enterprise outcomes

Right here’s how Databricks will help personal fairness corporations overcome information challenges:

- Unified and Open Cloud Information Platform: Databricks integrates with all main cloud suppliers (AWS, Azure, Google Cloud), permitting personal fairness corporations to standardize their information platforms whatever the current infrastructure utilized by every portfolio firm. This eliminates the necessity to handle a number of cloud-native information platforms with an identical interface and merchandise that simplifies the method of onboarding new corporations to a centralized information system. Databricks platform can also be constructed on open supply and open requirements making certain interoperability and portability of all information and AI fashions.

- Lakehouse Structure with Information Intelligence: Databricks’ information lakehouse structure combines the perfect of knowledge lakes and information warehouses, offering the pliability to deal with each structured and unstructured information within the type of paperwork like monetary statements, corporations home information or funding stories, whereas enabling quick and correct analytics. This structure ensures that every one portfolio information is saved in a single place, accessible to all key stakeholders. By centralizing information from disparate methods right into a single platform, personal fairness corporations can break down information silos, acquire a holistic view of portfolio operations, and shortly generate actionable insights. Powered by DatabricksIQ, the platform’s Information Intelligence Engine understands the distinctive semantics of your information. This engine optimizes efficiency, manages infrastructure, and simplifies the consumer expertise by pure language help, making it simpler for customers to look, uncover, and develop new information purposes

- Gaining Significant Enterprise Insights with AI and Machine Studying: Databricks comes geared up with superior machine studying (ML) and synthetic intelligence (AI) capabilities that assist automate advanced information workflows. For instance, portfolio corporations can use Databricks’ ML fashions to forecast demand, optimize pricing methods, or detect anomalies in operational information. These automated insights assist drive development and scale back prices throughout the portfolio. Non-public fairness corporations profit from the most recent developments in GenAI with safe entry to each frontier and open supply Giant Language Fashions (LLMs) like Llama 3.2, to allow them to construct high quality and correct GenAI purposes utilizing their very own information.

- Seamless and Safe Information Sharing with Delta Sharing: Databricks Delta Sharing and Market allows safe, real-time information sharing between portfolio corporations, personal fairness corporations, and exterior stakeholders (equivalent to consultants or strategic companions). This functionality is important for personal fairness corporations trying to collaborate throughout their portfolio, share greatest practices, or contain exterior advisors in efficiency enchancment initiatives. Delta Sharing offers a safe setting for sharing delicate information, making certain compliance with regulatory necessities (equivalent to GDPR, HIPAA, SOC 2) and mitigating the danger of knowledge breaches.

- Unified Information and AI Governance and Safety: For personal fairness corporations managing massive volumes of delicate monetary and operational information, safety is a prime concern. Databricks presents sturdy security measures, together with encryption, entry controls, and information lineage monitoring, making certain that information is protected and compliant with trade laws. Databricks Unity Catalog, a built-in governance instrument, additionally permits corporations to implement constant information insurance policies throughout their portfolio corporations, making certain that every one information is correctly managed and auditable.

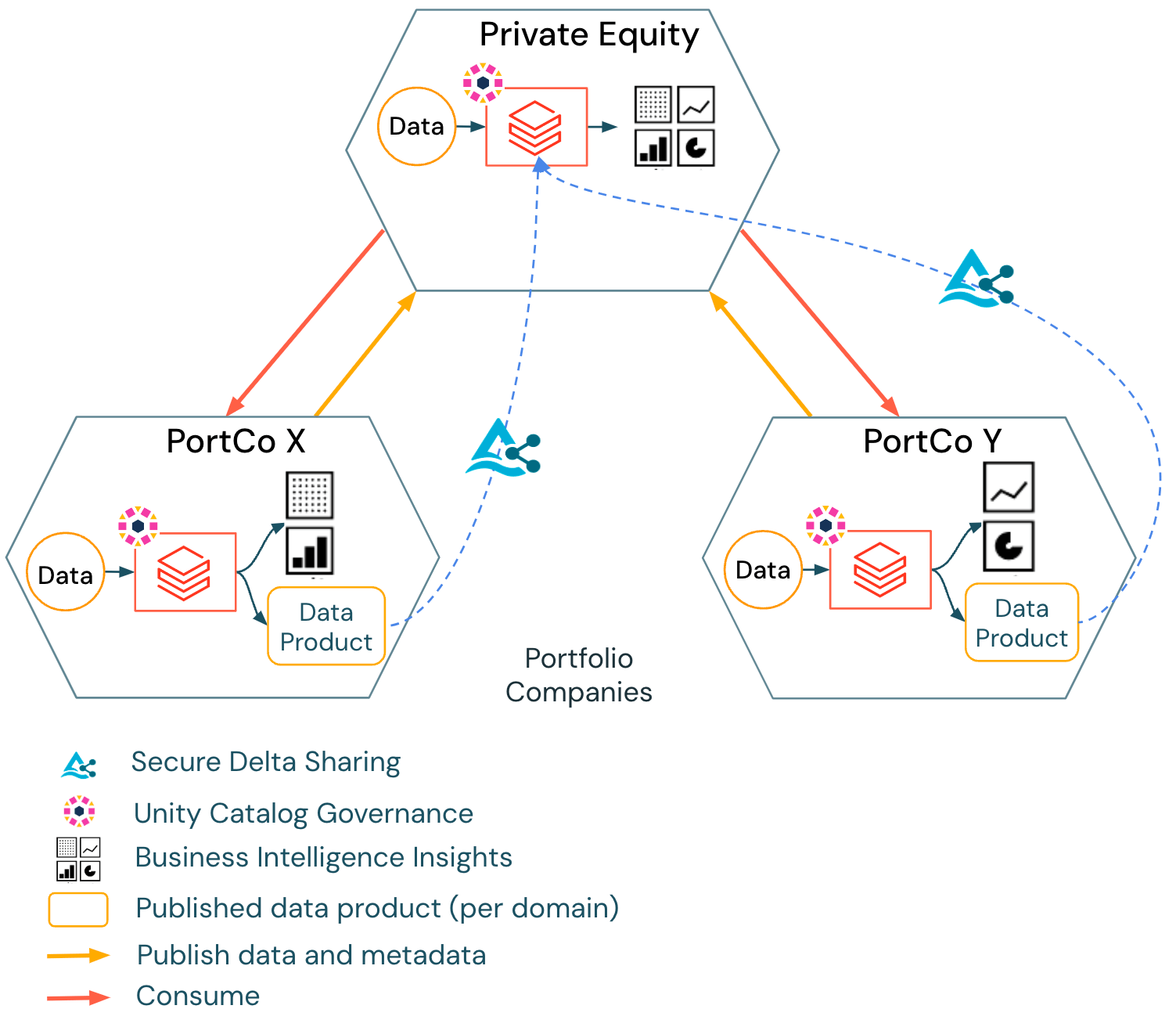

In essence, as proven within the beneath structure diagram, Non-public Fairness with its Portfolio Firms can leverage Databricks Intelligence Platform to construct high quality information merchandise and AI fashions, govern them at scale with Unity Catalog and securely share information property with open Delta Sharing to supply real-time insights into enterprise operations.

With this straightforward and streamlined design and strategy, Non-public Equities can speed up decreasing value of operations and enhance productiveness whereas additionally supercharge development of the acquired Portfolio Firm by gaining new insights into its operations and uncovering potential new alternatives.

Information Intelligence Lowers Prices and Improves Productiveness

Past enhancing visibility and standardization, Databricks brings vital benefits when it comes to value financial savings and productiveness beneficial properties for portfolio corporations. By consolidating fragmented information platforms right into a single, cloud-based setting, Databricks helps corporations lower IT infrastructure prices. The automation of knowledge administration processes additional reduces reliance on handbook labor, decreasing operational overhead. This centralized strategy eliminates the necessity for separate analytics instruments and platforms, lowering software program licensing and upkeep charges.

Moreover, Databricks boosts productiveness by enabling self-service analytics, giving enterprise customers in varied departments—equivalent to finance, HR, and operations—direct entry to real-time information insights with out relying on information engineers. This streamlines decision-making and permits sooner responses to enterprise challenges. Standardized dashboards and KPIs enable executives to simply evaluate efficiency throughout the portfolio, rushing up the identification of areas for enchancment. With built-in instruments like AI/BI Genie, which offers conversational expertise for enterprise groups to interact with their information by pure language, organizations are in a position to democratize information and acquire new insights into their enterprise.

Information Intelligence Accelerates Development

Databricks empowers personal fairness corporations to uncover new development alternatives throughout their portfolios by leveraging superior information insights. By means of its highly effective analytics instruments, PE corporations can analyze buyer information to determine untapped market segments or uncover potential for cross-selling and up-selling. The platform additionally enhances operational effectivity by offering real-time information to optimize provide chains, handle stock, and streamline manufacturing processes.

With a clearer view of portfolio operations, Databricks allows personal fairness corporations to develop data-driven development methods, resulting in better-informed selections concerning useful resource allocation, product growth, and market enlargement. This holistic strategy finally helps corporations capitalize on rising alternatives and enhance total efficiency throughout their investments.

Conclusion

Non-public fairness corporations can unlock super worth by remodeling information administration right into a high-performance exercise routine. With Databricks Information Intelligence Platform as their equal of a contemporary and state-of-the-art coaching facility, PE corporations can acquire real-time insights, drive operational excellence, and maximize returns. By partnering with consultants like Colibri Digital, who deliver deep trade information and implementation experience, PE corporations can speed up their transformation journey and obtain superior outcomes. Simply as an athlete wants a coach to achieve peak efficiency, a non-public fairness firm requires the proper information technique, a contemporary information platform, and an skilled associate to appreciate its full potential and expedite value financial savings and development alternatives findings.

Need to be taught extra about Databricks for FinServe? Discover The Information Intelligence Platform for Monetary Providers.

If you need to be taught extra about our associate Colibri Digital, a digital engineering consultancy that helps clients navigate the quickly altering and complicated world of rising applied sciences, with deep experience in large information, information science, machine studying, and cloud computing, please go to their web site. Colibri Digital creates well-structured, safe, scalable options at pace to supply the muse for groundbreaking change, they usually have expertise working with personal fairness corporations to assist them maximize returns and operational effectivity by unlocking and harnessing the hidden potential of their information.