Although funding for cybersecurity startups started slowing globally in late 2022, Israeli startups proceed to win vital cybersecurity investments, even with the nation’s ongoing navy operation in Gaza and escalating regional tensions.

The continued funding exhibits that Israel continues to be one of many strongest hubs for tech innovation within the US exterior of Silicon Valley, says Or Shoshani, CEO and co-founder of Tel Aviv-based Stream.Safety. His firm, a cloud detection and response agency, garnered its first spherical of funding — a $26 million Sequence A — in March 2022 on the tail finish of the increase. Earlier this month, the corporate was awarded a Sequence B spherical for $30 million.

“I have been touring greater than I have been doing within the final 4 years. Why? Simply to indicate that we’re right here to help our prospects, and we have now constructed a enterprise that’s actually resilient, no matter the place we’re and whatever the state [of affairs] Israel is experiencing.”

Following a two-year drought, cybersecurity startup firms are seeing an uptick in funding internationally, with the worth of offers anticipated to develop by 45% in 2024 — a reversal of fortunes in comparison with the 40% lower in 2022 and 49% drop in 2023, based on information from cybersecurity investment-advisory agency Altitude Cyber.

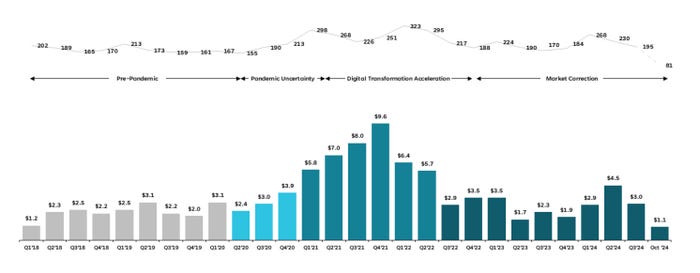

Following a peak in This fall 2021, funding in cybersecurity corporations tapered off for 2 years. It is beginning to return. Prime: Variety of offers. Backside: Worth of offers in billions of US$. Supply: Altitude Cyber

The funding focus of Altitude Cyber’s shoppers, for instance, stays the US, Israel, and Europe, adopted by the remainder of the world, says Dino Boukouris, founder and managing accomplice on the agency.

“We do not anticipate that pattern will change any time quickly,” he says. “Even with the geopolitical local weather we’re in, Israel has continued to ship, the US cyber market stays as robust as ever, and Europe [and the] UK proceed to innovate and produce actually nice cyber firms.”

Cybersecurity Springs Again

Israel’s analysis and improvement facilities took off throughout the US regulatory assault on encryption within the Nineteen Nineties and the migration of chip design to most of the expertise parks round Tel Aviv and Haifa throughout the previous 20 years. On the cybersecurity aspect, the nation has developed “outsized” capabilities, based on a current historical past of Israel’s evolution in cybersecurity.

Just like Silicon Valley, going out for a cup of espresso usually means operating into two or three entrepreneurs which can be going to let you know about their newest concept, says Jacques Benkoski, basic accomplice at US Enterprise Companions, an investor in Stream.Safety.

With the nation’s deal with cybersecurity and the density of expertise and training out there in a small space, innovation naturally follows, he says.

“If you take a look at the historical past of enterprise capital, you may have nodes of innovation which can be characterised by a catalytic density of expertise — you take a look at locations like Silicon Valley, you take a look at locations like Tel Aviv, and also you simply have lots of people which can be targeted on the identical factor,” he says. “And from the acceleration by dialogues and the collisions [of ideas] between these individuals comes extra innovation” than different components of the world.

But, one facet of Israel’s venture-capital scene is that buyers don’t wish to fund firms fixing native issues. As an alternative, the main target is on creating applied sciences and companies that handle points within the US, Europe, and worldwide, Benkoski say.

“We sometimes put money into firms that see the US as their major market — it is really an funding situation,” he says. Second rounds of enterprise capital for firms like Stream.Safety are sometimes to develop a stronger presence of their major market, he provides.

Broadening Out Cybersecurity Funding

Whereas the nation’s cybersecurity ecosystem definitely has its adherents, different buyers see a deal with native ecosystems to be fascinating. Ukraine has traditionally had a powerful cybersecurity group — albeit blended with its share of cybercriminal teams — and that might see a resurgence if Russia ends its conflict, says Ron Gula, president of Gula Tech Adventures, an funding agency.

“I am hopeful that the Ukraine conflict will finish quickly, and imagine the tech ecosystem there’ll emerge as a rival to the Israeli ecosystem,” he says.

Different areas of the world additionally provide substantial advantages for funding. Along with increasing its funding into Israel, Forgepoint Capital plans to deal with Latin America and the Asia-Pacific areas, the place the mobile-first ecosystem requires a tailor-made strategy to cybersecurity, managing director J. Alberto Yépez says.

“Different geographies have extra of a built-in enterprise business infrastructure to help native innovation, with established establishments taking an lively position to drive collaboration and higher anticipate and handle their prospects’ wants,” he says, including that the agency has partnered with world monetary establishments to assist innovate. “We purpose to deal with a vital hole in progress funding for startups in Europe whereas increasing our purview into Latin America and Israel,” he says.

One overhyped expertise for buyers? AI. Whereas synthetic intelligence has expertise giants spending closely — and practically each cybersecurity agency boasts of AI options — the impression of AI startups on cybersecurity stays modest, says Altitude’s Boukouris. However there have been some vital financing offers for AI-cybersecurity firms in previous few years, together with Shield AI ($60 million in Sequence B funding, HiddenLayer ($50 million, Sequence A), Witness AI ($28 million, Sequence A), and Skull ($25 million, Sequence A), he says.

“Distributors particularly targeted on safety for AI/ML are nonetheless primarily within the early levels by way of funding,” he says. “We have solely seen one vital M&A occasion thus far, with Sturdy Intelligence being acquired by Cisco for round $300 million, which signifies that we’re nonetheless within the early levels of safety for AI.”