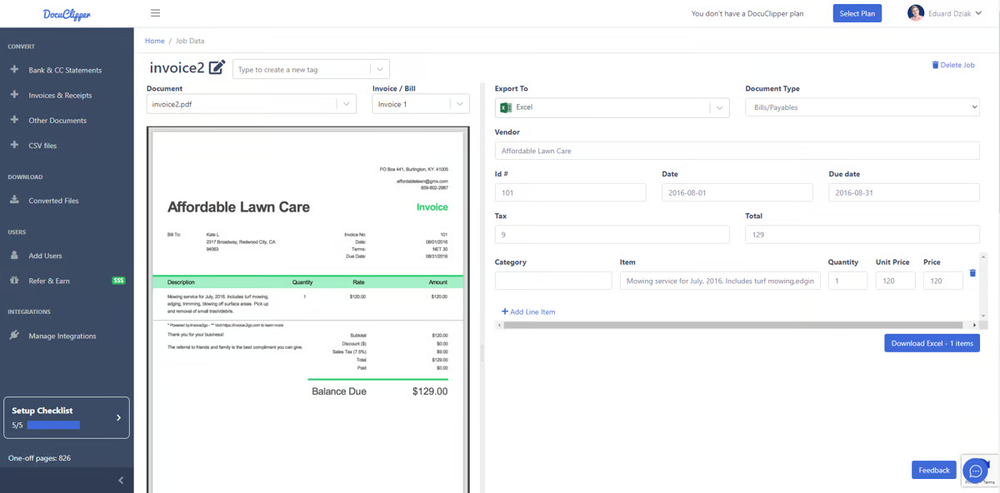

DocuClipper is an OCR-powered monetary doc processing software that converts financial institution statements, bank card statements, invoices, receipts, and brokerage statements into Excel, CSV, or accounting software-ready codecs. The software program stands out for its skill to deal with even poor-quality paperwork whereas sustaining excessive accuracy in information extraction.

DocuClipper helps you:

- Match and examine financial institution transactions

- Manage your transactions into classes

- Makes information entry fast and painless

- Handles poor-quality paperwork properly

- Converts a number of statements in seconds

- Offers correct information extraction

- Works with most financial institution codecs

- Ship information to your accounting software program

Present pricing begins at $39/month for 200 pages, with skilled plans at $74/month for 500 pages and enterprise plans at $159/month for 2000 pages.

Whereas DocuClipper serves its core goal, companies typically search for options resulting from:

- You want higher connections with ERP programs

- You need to scan paperwork together with your telephone

- You are processing advanced paperwork

- You want less complicated doc administration

- You want extra workflow automation options

- Your trade wants particular options

This comparability examines ten DocuClipper options that may higher fit your doc processing wants.

DocuClipper opponents: A fast comparability

| Instrument | Major use case | AI-powered studying | Customized doc varieties | Key benefit | Finest for | G2 score (Max 5) |

|---|---|---|---|---|---|---|

| DocuClipper | Monetary doc conversion for accounting | No | No | Accuracy, velocity | SMBs, accountants | 4.8 |

| MoneyThumb | Financial institution assertion conversion & fraud detection | No | No | Fraud detection, reconciliation | Lenders, accountants | NA |

| ProperSoft | Offline transaction file conversion | No | No | Offline use, one-time buy | People, small companies | 4.4 |

| AutoEntry | Automated information entry for accounting | No | Sure | Ease of use, accounting integration | SMBs, accounting companies | 3.8 |

| Hubdoc | Automated doc fetching & archiving | No | Sure | Automated fetching, Xero integration | Xero/QBO customers | 4.3 |

| Nanonets | Automating advanced doc workflows | Sure | Sure | Automation, versatility, multi-language | Enterprises, high-volume processing | 4.8 |

| Docparser | Customized information extraction from paperwork | No | Sure | Customizability, flexibility | Tech-savvy customers, customized wants | 4.6 |

| Dext Put together | Receipt & bill processing | No | Sure | A number of seize strategies, expense administration | Companies, accountants | 4.5 |

| FineReader PDF | Digitizing, OCR, and PDF enhancing | Sure | Sure | Excessive OCR accuracy, PDF enhancing | Basic doc wants, multi-language | 4.5 |

| ScanWriter | Forensic accounting & investigations | No | No | Audit trails, safety, native storage | Investigators, companies | NA |

Now, let’s discover every various intimately.

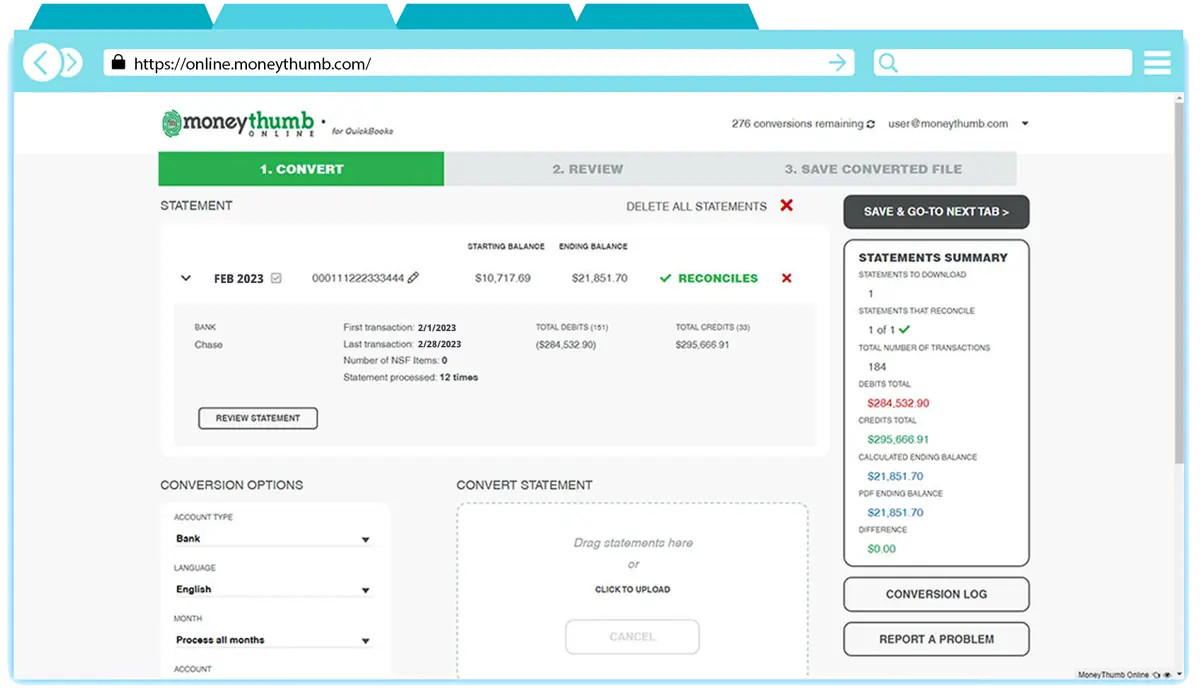

1. MoneyThumb

MoneyThumb presents specialised instruments for changing and analyzing monetary paperwork, serving each accounting professionals and monetary establishments. It presents particular options for various monetary workflows, similar to figuring out mortgage applicant creditworthiness and evaluating PDF authenticity for lending choices.

Key options:

1. Converts financial institution statements from PDF to QBO, QFX, OFX, and CSV codecs

2. Verifies doc authenticity via Thumbprint know-how

3. Cleans up and standardizes payee names routinely

4. Reconciles statements to make sure accuracy

5. Handles each textual content and image-based PDFs

6. Helps a number of monetary establishments

Pricing: Particular person plan at $24.95/month for five conversions, the Commonplace plan at $49.95/month for 20 conversions, and a Professional plan at $99.95/month for 60 conversions.

| Execs of MoneyThumb | Cons of MoneyThumb |

|---|---|

| Dramatically reduces information entry time | Desktop-based with set up limitations |

| Excessive accuracy in assertion conversion | Studying curve for brand spanking new customers |

| Constructed-in reconciliation checks | Some financial institution format compatibility points |

| Works with varied assertion codecs | Annual renewals for sure options |

| Robust fraud detection capabilities | Restricted automation choices |

| Fast processing of a number of statements |

Finest for: Accounting professionals, lenders, and small to medium-sized companies that recurrently course of financial institution statements and wish dependable format conversion with fraud detection capabilities.

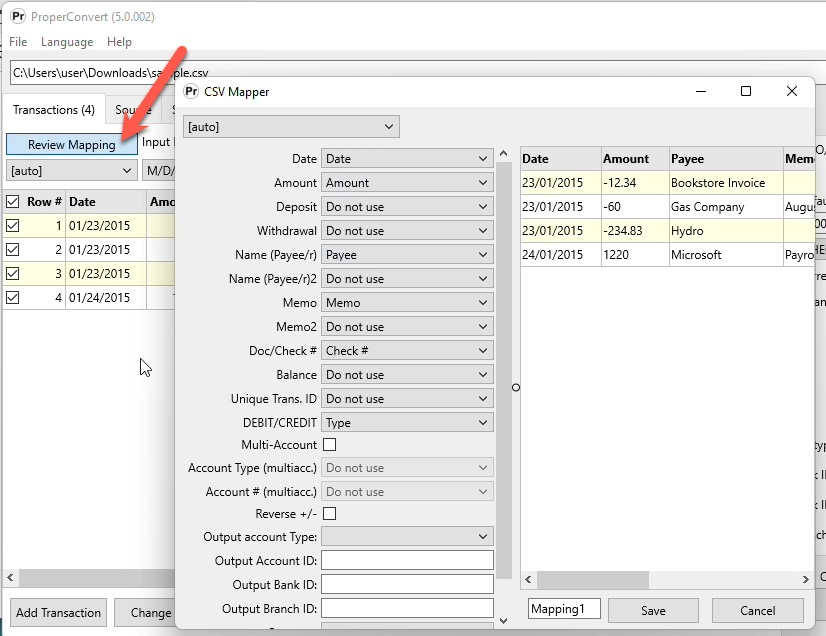

2. ProperSoft

ProperSoft is a desktop-based answer that helps convert monetary transaction information between completely different codecs. It really works offline, giving customers direct management over their information. The main focus is particularly on file format conversion for accounting software program compatibility.

Key options:

1. Converts financial institution and bank card statements from a number of codecs (CSV, Excel, PDF, QFX, QBO, MT940)

2. Integrates with QuickBooks, Quicken, Xero, and Sage

3. Computerized format detection for dates and numbers

4. Customized payee identify guidelines

5. Offline processing

Pricing: Begins at $19.99 monthly for one person, with a free trial accessible and one-time buy choices additionally provided. Staff plan for 3 customers is priced at $49.99/month.

| Execs of ProperSoft | Cons of ProperSoft |

|---|---|

| Works offline with out web dependency | Studying curve for preliminary setup |

| Responsive buyer assist | Some accuracy points with PDF conversions |

| Saves important time in comparison with guide entry | Primary interface that wants updating |

| Helps a variety of file codecs | Restricted automation choices |

| One-time buy choice presents long-term price saving |

Finest for: Particular person customers, small companies, and accounting professionals who require offline file conversion, worth direct management over their information, and like a one-time buy choice for long-term price financial savings.

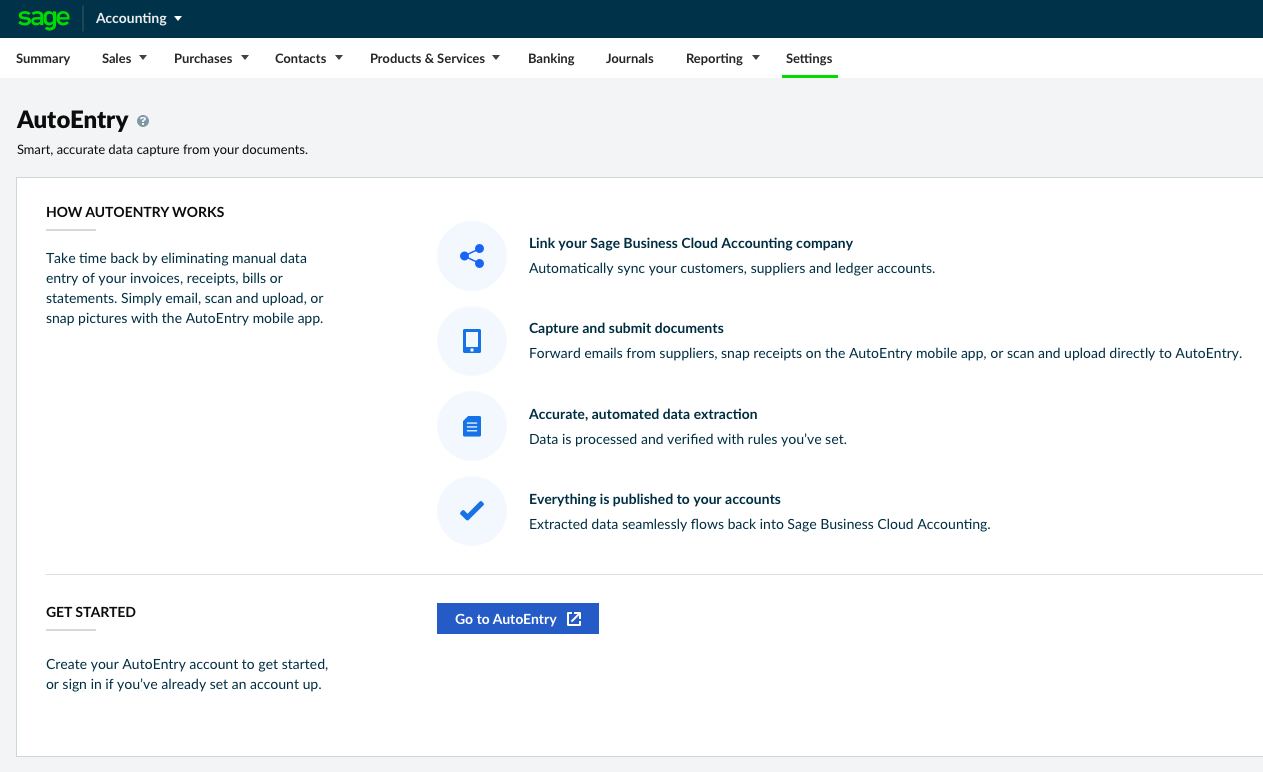

3. AutoEntry by Sage

AutoEntry is an information automation software that helps companies extract data from monetary paperwork and sync it with accounting software program. It is significantly common for its integration with main accounting software program and its skill to cut back guide information entry.

Key options:

1. Extracts information from receipts, invoices, and financial institution statements

2. Cell app for doc scanning

3. Automated information categorization and guidelines

4. Integration with main accounting software program

5. Multi-currency supportLine-item extraction functionality

6. Provider assertion reconciliation

Pricing: Credit score-based pricing, with plans starting from Bronze (50 credit for $12/month) to Sapphire (2500 credit for $450/month). The per-credit price decreases with higher-tier plans. A free trial with 25 credit can be accessible.

| Execs of AutoEntry | Cons of AutoEntry |

|---|---|

| Important time financial savings on information entry | Processing occasions will be inconsistent |

| Excessive accuracy for traditional paperwork | Sync points with accounting software program |

| Simple integration with accounting software program | Studying curve for superior options |

| Good at remembering recurring transactions | Credit expire if not used |

| Useful buyer assist by way of chat | Cell app will be unreliable |

| Cell app for on-the-go scanning | Occasional delays in doc processing |

Finest for: Accounting companies, bookkeepers, and small to medium-sized companies (SMBs) trying to automate monetary doc processing and scale back guide information entry.

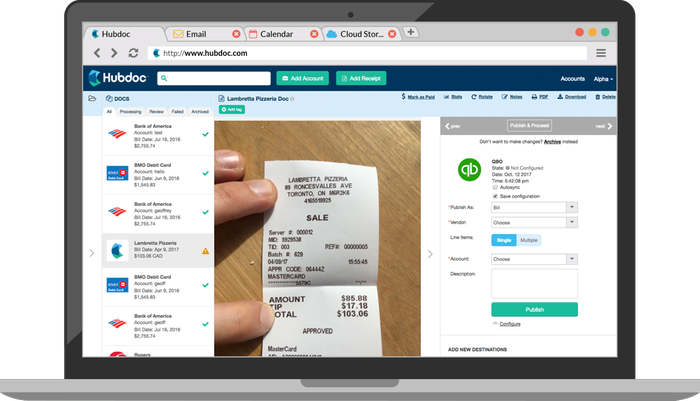

4. Hubdoc from Xero

Hubdoc is a cloud-based doc administration platform that simplifies information seize and group. It imports financial institution statements and different monetary paperwork, routinely extracting key information and syncing it with accounting software program similar to QuickBooks and Xero.

Key options:

1. Cell app for doc scanning

2. Customized electronic mail deal with for forwarding paperwork

3. Computerized information extraction utilizing OCR

4. Integration with main accounting software program

5. Cloud storage and backupDocument group and search

6. Multi-user collaboration

Pricing: A single plan for $12 monthly after a free trial.

| Execs of Hubdoc | Cons of Hubdoc |

|---|---|

| Simple doc add via a number of strategies (electronic mail, cell app, scanner) | OCR accuracy points with advanced paperwork |

| Robust integration with accounting software program like Xero and QuickBooks | Processing delays and sync issues |

| Efficient doc group and storage | Cell app will be unreliable |

| Good for workforce collaboration | Restricted bulk enhancing capabilities |

| Time-saving automated information extraction | Some customers report duplicate doc points |

| Useful for sustaining audit trails |

Finest for: Small to medium-sized companies and accounting companies that primarily use Xero or QuickBooks On-line and wish a easy answer for gathering, storing, and managing monetary paperwork.

5. Nanonets

Nanonets is an AI-powered doc processing platform designed to automate information extraction and workflow automation. Not like DocuClipper, which focuses on pre-built fashions for monetary paperwork, Nanonets permits customers to coach customized deep studying fashions and deal with a greater variety of doc varieties.

Key options:

1. AI-powered OCR and deep studying fashions

2. Customized mannequin coaching and zero-shot studying capabilities

3. Multi-language assist (40+ languages)

4. API integration choices

5. Workflow automation instruments

6. Pre-built templates for widespread paperwork

Pricing: The starter plan presents pay-as-you-go pricing with $0.3/web page after first 500 free pages. Contact the gross sales workforce for the enterprise plans.

| Execs of Nanonets | Cons of Nanonets |

|---|---|

| Reduces guide information entry by as much as 90% | Comparatively costly for low-volume wants |

| Robust buyer assist throughout implementation | Studying curve for advanced use instances |

| Handles advanced doc varieties properly | Some UI/UX enhancements wanted |

| Common platform enhancements | |

| Versatile customization choices | |

| Appropriate for high-volume processing |

Finest for: Medium to giant enterprises processing excessive volumes of various doc varieties and needing extremely customizable extraction capabilities via customized mannequin coaching.

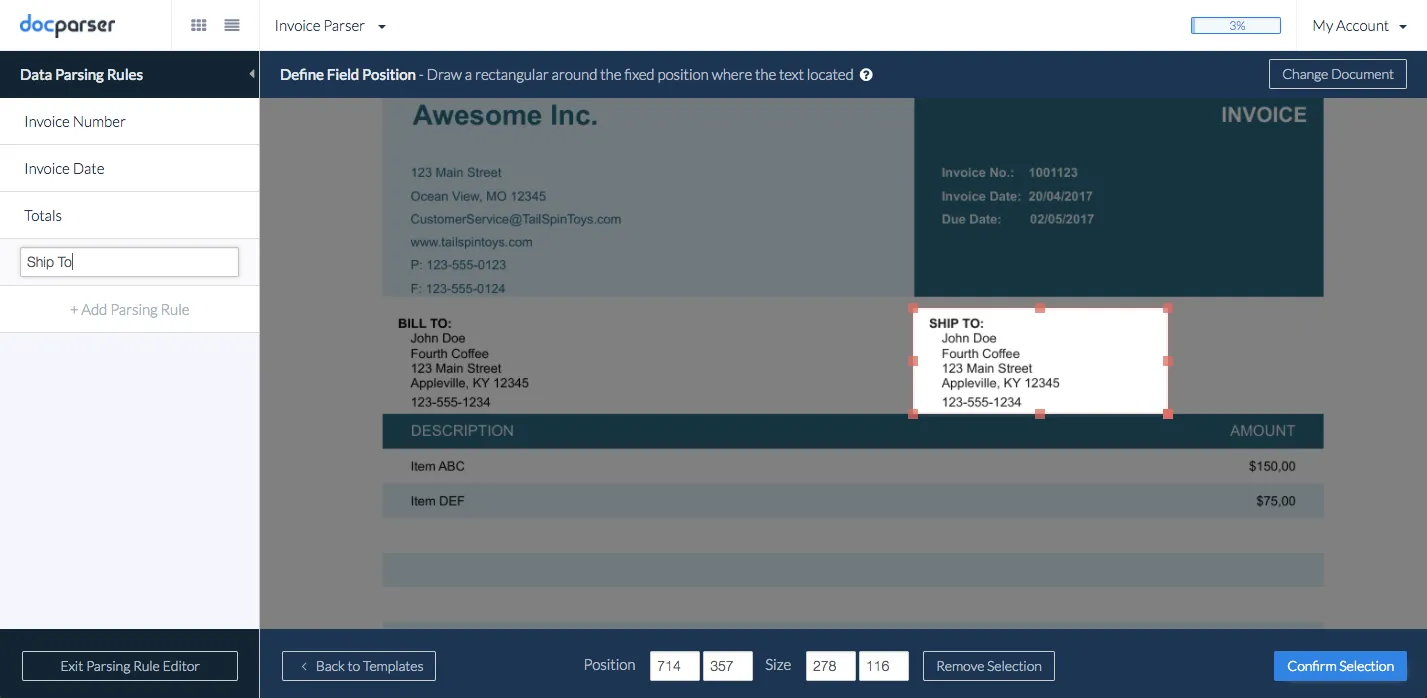

6. Docparser

Docparser is a doc parsing software that makes use of OCR and customized guidelines to extract information from varied doc varieties — financial institution statements, invoices, receipts, and extra. It converts these paperwork into codecs like Excel and CSV, and integrates with accounting platforms similar to QuickBooks, Xero, and Sage, simplifying monetary information administration for companies.

Key options:

1. Customized parsing guidelines utilizing Zonal OCR

2. Helps a number of doc codecs (PDF, Phrase, pictures)

3. Integrations with varied platforms via Zapier and different instruments

4. Desk information extraction capabilities

5. Doc routing performance

Pricing: Docparser presents a credit-based pricing mannequin, with plans beginning at $32.50/month for 1,200 annual parsing credit. For limitless credit, chances are you’ll want to purchase the customized Enterprise plan. A 14-day free trial is obtainable.

| Execs of Docparser | Cons of Docparser |

|---|---|

| Extremely customizable parsing guidelines for particular wants | Important studying curve for establishing parsing guidelines |

| Wide selection of integration choices | Guide rule creation required for every doc sort and format |

| Robust buyer assist | Might be advanced for non-technical customers |

| Correct information extraction when guidelines are correctly configured | Restricted AI/ML capabilities in comparison with extra superior options |

| Handles a number of doc layouts with customized guidelines | Preliminary setup and rule configuration will be time-consuming |

| Presents time-saving automation for doc processing | Credit score-based pricing will be limiting for high-volume processing |

Finest for: Companies that require extremely customizable doc parsing options and have the technical sources to arrange and preserve parsing guidelines.

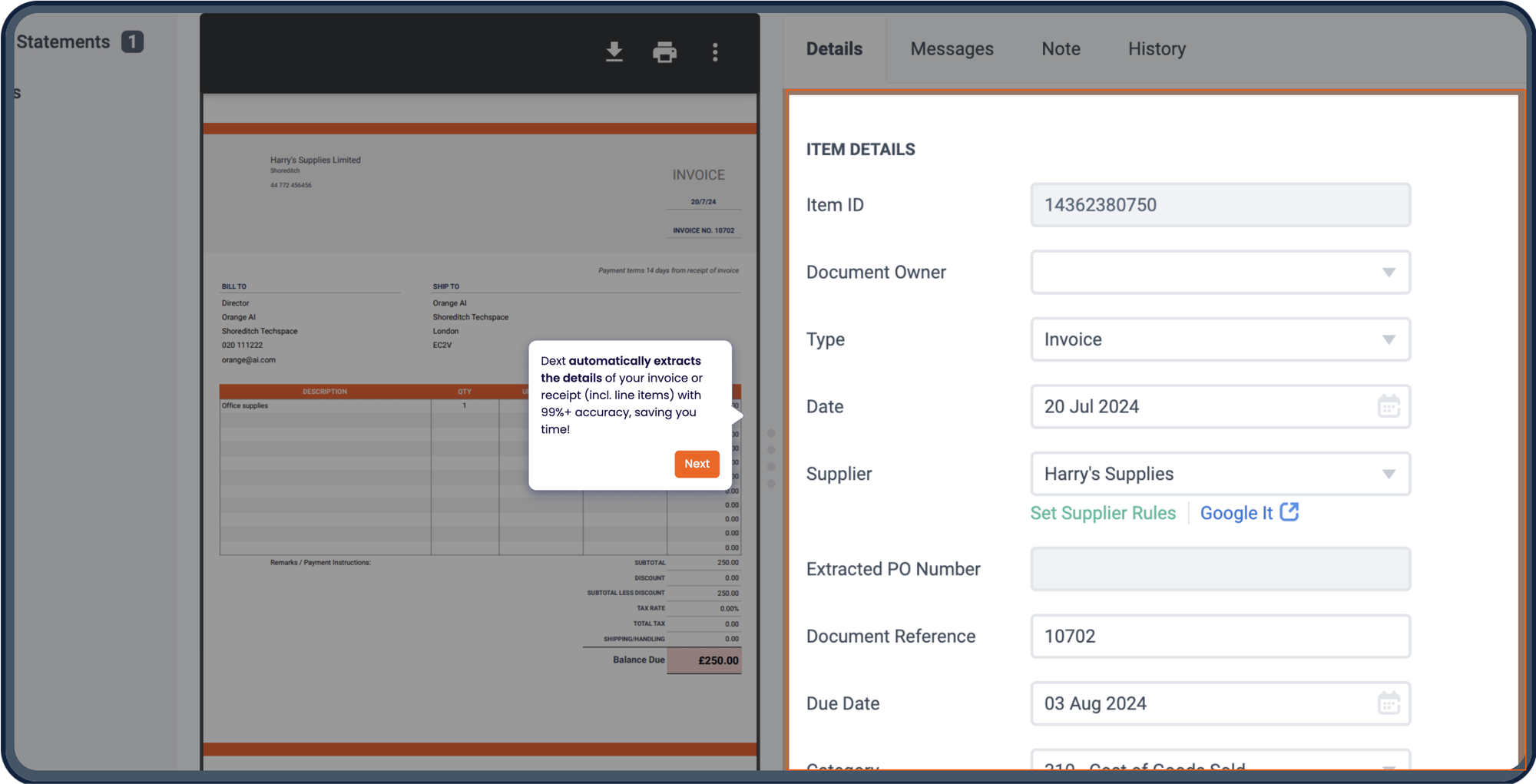

7. Dext Put together

Dext Put together is a cloud-based doc administration answer that automates monetary information assortment and entry. It presents a broader method to doc processing with specific energy in receipt and bill administration.

Key options:

1. A number of seize strategies (cell app, electronic mail, add, financial institution feeds, bill fetch, financial institution statements)

2. Computerized information extraction

3. Integration with main accounting software program (Xero, Sage, QuickBooks, IRIS)

4. Provider guidelines and auto-publishing

5. Expense administration instruments

6. Connects with 11,500+ monetary establishments

Pricing: Dext Put together presents subscription-based pricing beginning at $229.99/month (USD) for 10 purchasers with limitless customers. Pricing might fluctuate by area. A free trial is obtainable.

| Execs of Dext Put together | Cons of Dext Put together |

|---|---|

| Important time financial savings on information entry | Financial institution assertion processing wants enchancment |

| Simple doc submission via a number of channels | Duplicate detection is just not very sturdy |

| Robust accounting software program integration | Cell app requires additional steps |

| Efficient provider guidelines for automation | Multi-page PDF dealing with will be problematic |

| Good receipt matching capabilities | |

| Useful for audit documentation |

Finest for: Companies and accountants who want complete doc processing, particularly these with a robust emphasis on receipt and bill administration.

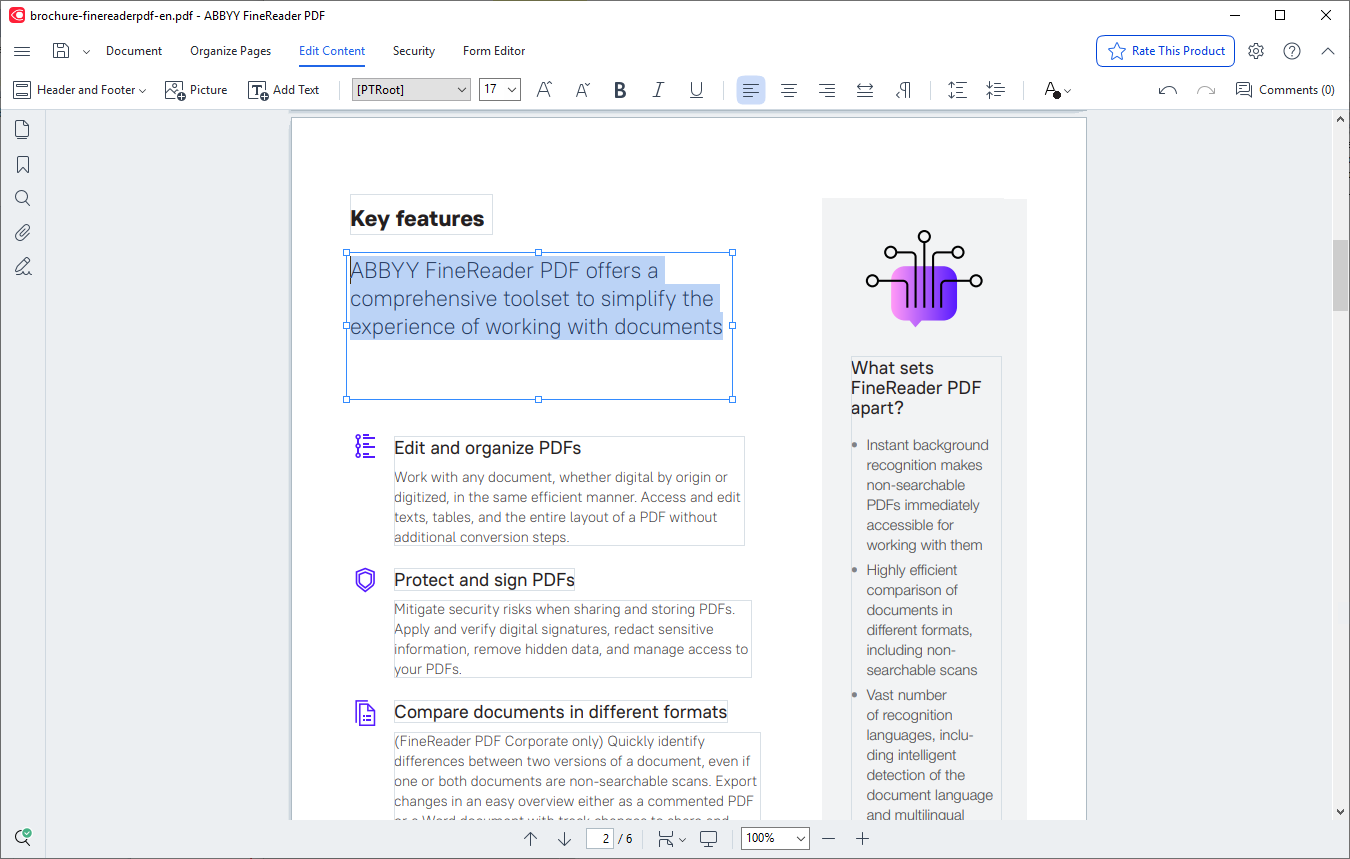

8. ABBYY FineReader PDF

ABBYY FineReader PDF is an OCR and doc processing software program providing a variety of functionalities, from digitization and enhancing to PDF administration and collaboration. It gives broader capabilities for working with varied doc varieties, together with scanned paperwork and pictures.

Key options:

1. Doc digitization and enhancing

2. A number of language assist

3. PDF administration instruments

4. Cell scanning capabilities

5. Cross-platform compatibility

Pricing: FineReader presents a flexible licensing choices together with per workstation, per named person, and concurrent person fashions, accessible in Commonplace and Company editions. For precise costs, contact their gross sales workforce.

| Execs of ABBYY FineReader | Cons of ABBYY FineReader |

|---|---|

| Excessive accuracy in textual content recognition | Not specialised for monetary paperwork |

| Helps a number of languages | OCR points with handwritten textual content |

| Good for poor high quality paperwork | Restricted accounting software program integration |

| Simple doc collaboration | Might be sluggish with giant paperwork |

| Cell scanning choice | Costlier for enterprise use |

| Complete PDF enhancing | Steeper studying curve |

Finest for: Giant companies needing complete doc digitization, OCR, and PDF enhancing capabilities.

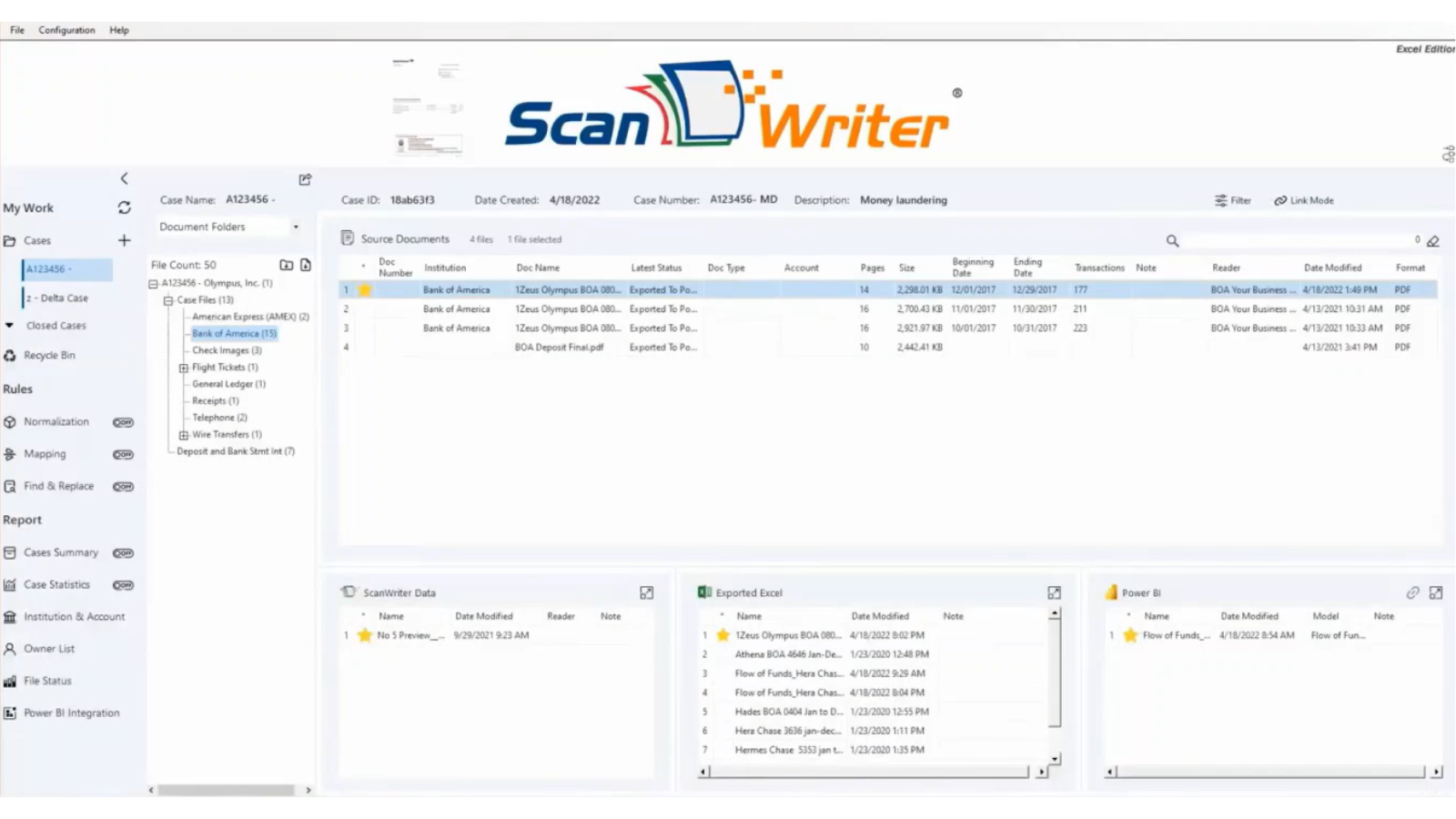

9. ScanWriter

ScanWriter is a desktop-based monetary doc processing software designed particularly for forensic accountants and investigators. It focuses on native processing with a robust emphasis on audit trails and fraud detection.

Key options:

1. Converts financial institution statements, checks, and different monetary paperwork to Excel

2. Constructed-in fraud detection instruments

3. Move of funds visualization

4. Full audit path monitoring

5. Native file storage for safety

6. QuickBooks and Excel integration

Pricing: You will get the Commonplace License for a one-time payment of $5,495, plus an annual upkeep payment of $3,230.

| Execs of ScanWriter | Cons of ScanWriter |

|---|---|

| Excessive accuracy in information seize | Important upfront funding and annual upkeep payment |

| Complete audit path capabilities | Desktop-based limitations |

| Enhanced safety with native file storage | Steep studying curve |

| In depth establishment assist | Some QuickBooks integration points |

| Highly effective information visualization options for evaluation | Processing velocity can fluctuate relying on doc complexity |

| Quick processing of huge volumes of checks | Set up required |

Finest for: Forensic accountants, fraud investigators, authorities companies, and accounting companies dealing with advanced monetary investigations. It’s best fitted to medium to giant organizations as a result of pricing construction.

Why select Nanonets Over DocuClipper?

| Standards (Weightage) | DocuClipper | DocuClipper Rating | Nanonets | Nanonets Rating |

|---|---|---|---|---|

| AI-Powered Studying (5) | Rule-based OCR; guide setup | 0 | Deep studying; automates advanced duties | 5 |

| Handles Different Doc Varieties (5) | Primarily monetary paperwork | 5 | Handles varied doc varieties | 5 |

| Value-Efficient (5) | Sure, for top volumes | 5 | Sure, for top volumes | 5 |

| Handles Unstructured Information (5) | No | 0 | Sure | 5 |

| Handles Textual content-Heavy Paperwork (5) | Sure | 5 | Sure | 5 |

| Requires Guide Intervention (4) | Sure | 0 | Sure, for customized fashions | 0 |

| Combines Information from A number of Sources (3) | Sure, inside paperwork | 3 | Sure, throughout programs | 3 |

| On-Platform Human QA (3) | Sure | 3 | Sure | 3 |

| Indexes & Shops Paperwork (3) | Sure | 3 | Sure | 3 |

| Handwriting Recognition (3) | No | 0 | Sure, restricted accuracy | 3 |

| Workflows & Integrations (2) | Primary | 2 | Superior | 2 |

| Doc Classification/Routing (2) | Sure | 2 | Sure | 2 |

| TOTAL SCORE (45) | 28 | 41 |

Whereas DocuClipper presents strong capabilities for monetary doc processing, Nanonets is a extra versatile and highly effective answer, significantly for companies trying to scale their doc processing operations. The important thing differentiator lies in Nanonets’ AI-driven method versus DocuClipper’s extra conventional OCR-based system.

Smarter know-how, higher outcomes

DocuClipper’s rule-based OCR requires guide setup for every doc sort. Nanonets makes use of AI and deep studying to automate this course of, dealing with unstructured information and completely different layouts with out fixed rule changes. This protects time and reduces guide errors, particularly as your doc quantity grows.

Deal with any doc sort

Whereas DocuClipper focuses on monetary paperwork, Nanonets can deal with any doc sort chances are you’ll get— contracts, claims, buy orders, you identify it. Obtained worldwide paperwork? Nanonets can course of in 40+ languages and even learn handwriting. Your workforce will not want completely different instruments for various doc varieties.

Scale with out the complications

Each instruments deal with the fundamentals properly — combining information, checking high quality, and routing paperwork. However here is the place Nanonets pulls forward: it will get smarter with each doc you course of. No have to replace guidelines or create new templates as your online business grows. The system adapts routinely. Furthermore, its superior workflows, API entry, and customized mannequin coaching capabilities provide help to scale your doc processing with out rising guide effort.

FAQs

Is DocuClipper free to make use of?

No, DocuClipper is a subscription-based software program. Pricing begins at $39/month for the Starter plan, which incorporates 200 pages. A free trial is obtainable, although.

Sure, DocuClipper is a legit OCR software program firm specializing in monetary doc automation. It is utilized by companies of all sizes and integrates with accounting software program like QuickBooks, Xero, and Sage. Nonetheless, should you want extra superior options like AI-powered studying, dealing with of various doc varieties, or higher scalability, exploring options like Nanonets or Docparser is likely to be helpful.

DocuClipper is OCR software program designed to automate information extraction from monetary paperwork, together with financial institution statements, invoices, receipts, checks, bank card statements, and brokerage statements. It converts these paperwork into Excel, CSV, or QBO codecs for straightforward import into accounting platforms. Key options embody financial institution reconciliation, transaction categorization, and circulation of funds evaluation.

What software program converts financial institution statements to Excel?

A number of software program choices automate financial institution assertion conversion to Excel, streamlining monetary information evaluation. Nonetheless, these instruments typically deal with extra than simply conversion; as an illustration, Nanonets can automate financial institution assertion retrieval from electronic mail, cloud, or your financial institution’s system, convert them to Excel, and ship the extracted information to your accounting software program or ERP — all with minimal human intervention.