Join every day information updates from CleanTechnica on e mail. Or comply with us on Google Information!

Examine exhibits that, in most circumstances, prospects ought to keep low reserves, prioritizing invoice financial savings over backup energy

House battery storage paired with photo voltaic photovoltaic (PV) techniques can scale back utility payments below sure price buildings whereas additionally offering backup energy throughout energy interruptions. For energy interruptions that include some warning (equivalent to these attributable to hurricanes and different pure disasters), prospects are sometimes capable of cost up their battery upfront. However many energy interruptions come with out warning. To protect towards one of these outage, most battery storage techniques come geared up with a “reserve setting” that permits the shopper to keep up some minimal stage of storage capability in reserve. But, this function comes with a tradeoff: the extra storage capability that’s held in reserve, the better the shopper’s skill to experience via unpredictable energy interruptions, however much less capability is then accessible to handle utility payments on a day-to-day foundation.

The brand new Berkeley Lab report, entitled Invoice Financial savings vs. Backup Energy: Evaluating operational tradeoffs for house photo voltaic+storage techniques, exhibits how prospects can method this tradeoff given their specific circumstances. The examine quantifies how utility invoice financial savings and the reliability worth from mitigated energy interruptions range with reserve ranges. The evaluation leverages Berkeley Lab’s PRESTO mannequin, which stochastically simulates energy interruption occasions primarily based on historic patterns in every U.S. county. The examine focuses on ten consultant counties and considers a spread of widespread utility price buildings, in addition to different key elements, together with electrical energy costs, native reliability ranges, and the shopper’s worth of misplaced load (VoLL). The examine will not be a cost-effectiveness analysis, however somewhat examines the slim query of how the worth of battery storage to the host buyer is impacted by the reserve settings. Different necessary methodological particulars and limitations are summarized within the report.

Key findings from the report are highlighted beneath and shall be mentioned in an upcoming webinar on October twenty third at 11:00 am Pacific. Please register for the webinar right here: https://lbnl.zoom.us/webinar/register/WN_xFm0GAPuRHSnoeoGq40tiQ

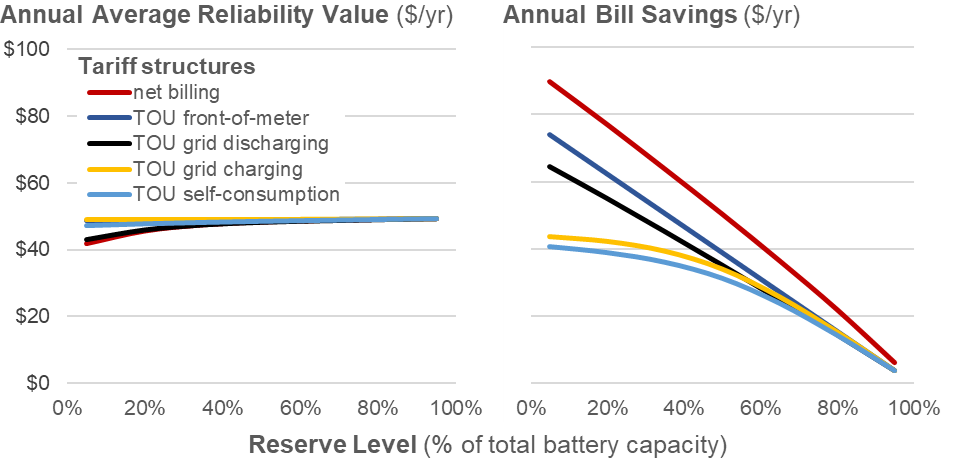

Reliability worth is (surprisingly) insensitive to order stage below most circumstances. The reliability worth of the backup energy supplied by the photo voltaic+storage system will increase with reserve stage, however solely modestly in most circumstances. For instance, as proven within the left-hand panel of Determine 1, the common annual reliability worth for a typical buyer in Memphis rose by simply $1-10/yr when growing reserves from 20% to 80% of the battery’s capability. All different examine areas confirmed comparable traits as nicely, as proven within the report. The overall “flatness” of those traits partly displays the restricted quantity of backup load for the battery to serve throughout a mean yr, given the standard frequency and length of energy interruptions in most places. The examine additionally consists of sensitivities exploring extra frequent energy interruptions, given the various reliability ranges that particular person prospects could expertise inside any given county.

Invoice financial savings drop precipitously with larger reserves. Storage generates invoice financial savings by arbitraging between high and low costs, below both time-of-use (TOU) charges with peak and off-peak costs, or internet billing charges that compensate photo voltaic exports at costs beneath retail charges. As proven within the right-hand panel of Determine 1, the invoice financial savings from storage arbitrage decline considerably with larger reserves, albeit to differing levels relying on the particular tariff construction. For instance, below TOU charges the place grid discharging will not be allowed (the 2 backside strains), the decline in invoice financial savings is kind of gradual for reserve ranges as much as roughly 40%, because the battery would not often discharge beneath that stage. To make certain, the instance proven in Determine 1 is predicated on a pricing differential of simply $0.05/kWh. With a better pricing differential, the invoice financial savings at low reserve ranges could be larger, and the drop in invoice financial savings with growing reserves could be much more pronounced.

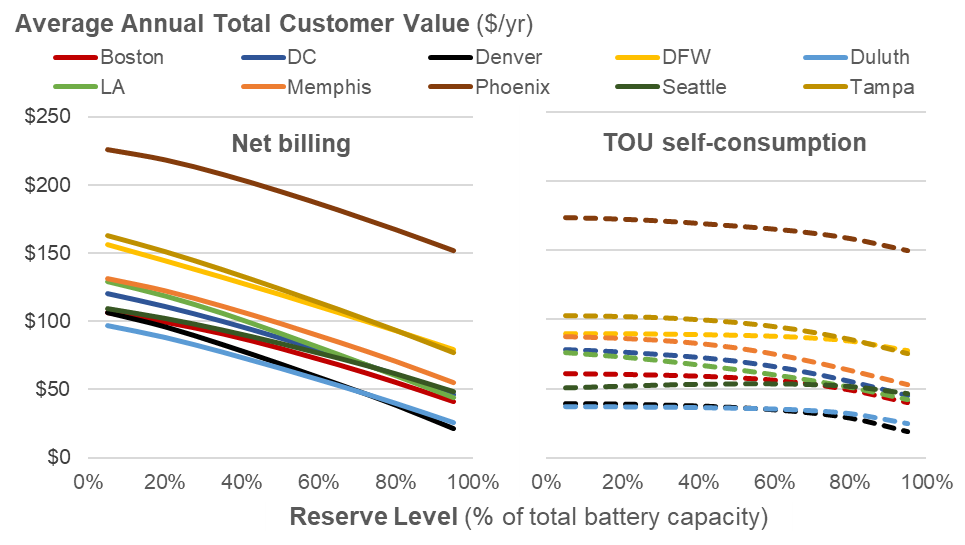

Complete buyer worth tends to be biggest when reserves are set as little as allowed. Given the 2 findings above, whole buyer worth—that’s, the sum of buyer reliability worth and invoice financial savings—tends to say no with larger reserves, similar to the drop in invoice financial savings. Determine 2 exhibits this pattern throughout all ten examine places, for the 2 “bookend” tariff buildings: internet billing and TOU self-consumption. All places present monotonically declining buyer worth as reserves rise. That is true for each tariff buildings, although the decline in whole buyer worth below the TOU self-consumption tariff is significantly much less pronounced, and so prospects on that kind of tariff could also be considerably detached to modifications in reserve stage (at the least as much as some level).

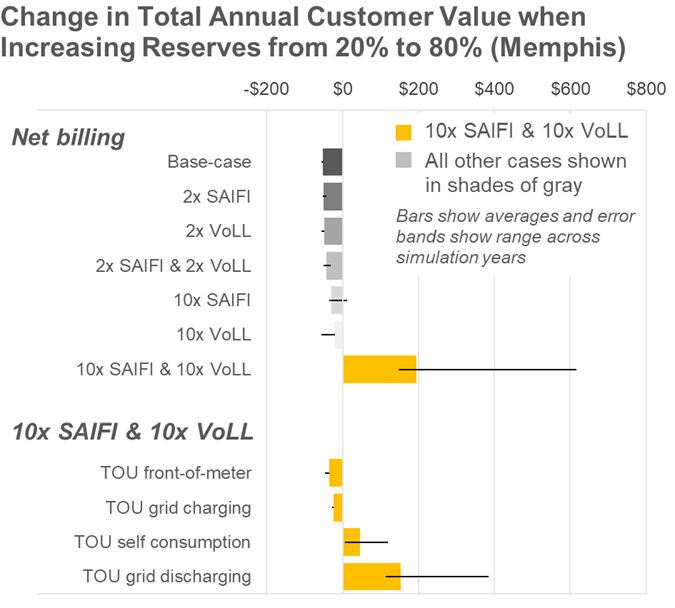

Increased reserve ranges could improve whole buyer worth for purchasers with an exceptionally excessive worth of misplaced load, dwelling in areas with exceptionally frequent energy interruptions. The examine included eventualities the place prospects have a better worth of misplaced load (VoLL) and/or stay in places with extra frequent energy interruptions (SAIFI), in comparison with their county common. Determine 3 exhibits how the overall buyer worth modifications throughout these sensitivities because the reserve stage is elevated from 20% to 80%: that’s, a detrimental worth signifies that whole buyer worth declines with growing reserves, whereas a optimistic worth signifies that whole buyer worth will increase. As proven in Determine 3, solely within the case the place the shopper has ten occasions the base-case VoLL ($50/kWh) and likewise ten occasions the common SAIFI (roughly 10 interruptions per yr, for Memphis) do the outcomes flip, and whole buyer worth rises with reserves. Nevertheless, even that exception is proscribed to specific tariff buildings (internet billing and TOU charges that permit solely grid discharging). Moreover, as proven within the report, bigger value differentials can shift the economics again towards decrease reserve ranges.

The total report offers a wealth of further element and outcomes, together with extra detailed quantitative findings for every location analyzed, in addition to sensitivity instances for battery measurement (i.e., 10 kWh vs. 30 kWh battery), alternate price ranges (together with larger value arbitrage ranges and totally different base costs), and buyer utilization ranges (together with a low consumption and excessive consumption case). Whereas the report typically means that prospects will maximize their worth by sustaining the bottom stage of reserves allowed, the findings additionally present how the particular circumstances of any particular person buyer must be thought-about when making choices about reserve stage settings.

The examine builds on earlier work printed by the Berkeley Lab staff (right here and right here), evaluating the capabilities of photo voltaic+storage in offering backup energy over lengthy multi-day interruptions.

We thank the U.S. Division of Power Photo voltaic Power Applied sciences Workplace for his or her help of this work, in addition to members of the exterior technical advisory group and different exterior reviewers who supplied invaluable steering and suggestions on this evaluation.

Courtesy of Galen Barbose, Will Gorman, and the remainder of the examine’s authors.

The views expressed right here don’t essentially symbolize the views of the U.S. Division of Power or the U.S. Authorities.

Have a tip for CleanTechnica? Need to promote? Need to recommend a visitor for our CleanTech Discuss podcast? Contact us right here.

Newest CleanTechnica.TV Movies

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.

CleanTechnica’s Remark Coverage